Court Halts Enforcement of Corporate Transparency Act: What Businesses Need to Know

By Chris Bernier

The Corporate Transparency Act (CTA), enacted under the stated intent to promote transparency and combat financial crimes, has faced a significant roadblock in the second ruling against the Act. A federal court in Texas on December 3, 2024 issued an injunction halting the enforcement of its reporting requirements nationwide. Here’s what this means for business owners and how you can stay prepared for potential changes.

What is the CTA?

The CTA requires businesses to report detailed beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN). The law aims to curb financial misconduct, including money laundering and tax evasion, by increasing accountability but many have felt it is overreaching and intrusive of business owners privacy. Businesses that fail to comply could face severe penalties.

What Changed?

A recent court ruling has temporarily enjoined the enforcement of these requirements, citing concerns about the CTA’s constitutionality. The court highlighted potential violations of privacy and Fourth Amendment rights, creating uncertainty for the future of the law. While the injunction is in place, businesses are no longer required to file ownership reports.

What This Means for You

• Temporary Suspension: If your business was preparing to comply, there is no immediate need to file reports.

• Ongoing Uncertainty: This injunction is subject to appeal, and the reporting requirements may be reinstated if the ruling is overturned.

• Preparation is Key: Staying informed and organized will help you adapt quickly to any changes.

Stay Ahead of the Curve

While the future of the CTA remains uncertain, proactive planning is essential. Reach out to us today to discuss any changes that affect your business and ensure you’re ready for whatever comes next.

Want to Learn More? Contact Us!

DRDA is committed to helping businesses navigate complex regulations with ease. Contact us for personalized advice and support.

- Published in Small Business, Starting a Business, Tax

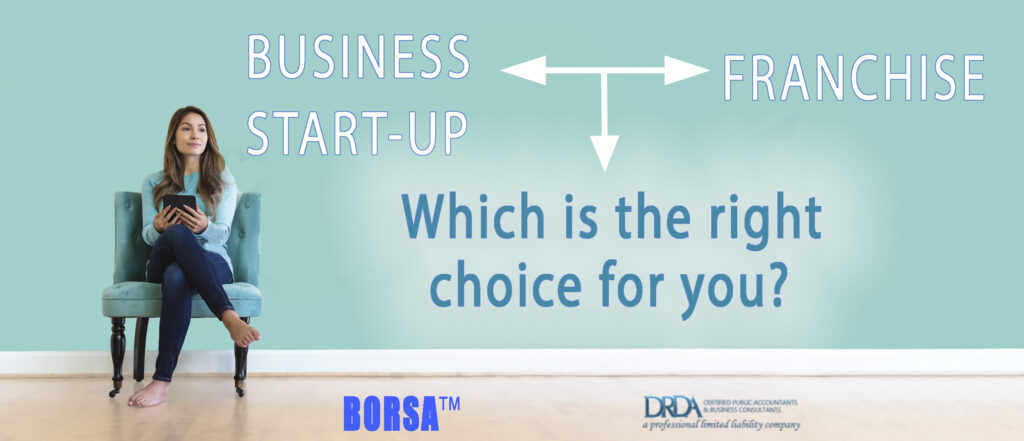

Franchise Or Business Start-Up?

Which is the right fit for you?

Options and Opportunity

The ability to work for yourself, being in control and making the big decisions appeals to many people. You may just be starting your profession and dreaming of starting your own business, or you may have had a long and successful career and are longing for something more – additional money, greater flexibility or the chance to focus on doing something you enjoy.

Taking a risk and following your dream by becoming a business owner is an aspiration shared by many Americans. The first step in determining whether starting your own business or investing your time and money into a proven franchise is more your style is to begin with a self-assessment of your strengths, weaknesses, interests, skills and work/life aspirations. Do you work well in a more structured environment, or do you require freedom to create and innovate? Are you risk-averse and like having a support system, or are you more daring and hope to blaze a trail for others to follow one day?

Countless first-time entrepreneurs have the burden of whether to start a business from scratch or buy a franchise. The allure of being your own boss can be tempting; franchises and startups each pose their own challenges and benefits. Evaluating each option can help you get closer to realizing what the right venture is for you.

What Is a Franchise?

A franchise is a type of license that an individual or group (franchisee) acquires to allow them to have access to a business’s (franchisor) proprietary knowledge, processes, and trademarks in order to allow the party to sell a product or provide a service under the business’s Brand. In exchange for gaining the franchise, the franchisee usually pays the franchisor an initial start-up and annual licensing (royalty) fees.

How Franchises Work

When a business wants to increase its market share or increase its geographical reach at a low cost, it may create a franchise for its product and brand name. A franchise is a joint venture between a franchisor and a franchisee. The franchisor is the original or existing business that sells the right to use its name and idea. The franchisee is the individual who buys into the original company by purchasing the right to sell the franchisor’s goods or services under the existing business model and trademark.

Franchises are a very popular method for people to start a business, especially for those who wish to operate in a highly competitive industry like the fast-food industry. One of the biggest advantages of purchasing a franchise is that you have access to an established company’s brand name, meaning that you do not need to spend further resources to get your name and product out to customers.

Franchise Basics and Regulations

Franchise contracts are complex and vary for each franchisor. Typically, a franchise contract agreement includes three categories of payment that must be made to the franchisor by the franchisee.

- The franchisee must purchase the controlled rights, or trademark, from the franchisor business in the form of an upfront fee.

- The franchisor often receives payment for training, equipment, or business advisory services from the franchisee.

- The franchisor receives ongoing royalties or a percentage of the business’s sales.

It is important to note that a franchise contract is temporary, like a lease or rental of a business, and does not signify business ownership by the franchisee. Depending on the franchise contract, franchise agreements typically last from 5 to 30 years, with penalties or consequences if a franchisee violates or prematurely terminates the contract.

In the U.S., franchises are regulated by law at the state level. However, there is one federal regulation established in 1979 by the Federal Trade Commission (FTC). The Franchise Rule is a legal disclosure given to a prospective purchaser of a franchise from the franchisor that outlines all the relevant information in order to fully inform the prospective purchaser of any risks, benefits, or limits of such an investment.

Such information specifically stipulates full disclosure of fees and expenses, any litigation history, a list of suppliers or approved business vendors, even estimated financial performance expectations, and more. This law has gone through various iterations and has previously been known as the Uniform Franchise Offering Circular (UFOC) before it was renamed in 2007 as the current Franchise Disclosure Document.

Brand awareness

Building a brand is no small feat and can be quite expensive and time-consuming. When you sign on with a popular franchise, the work has been done for you. We all know some of the more popular brand franchises out there, and we’ve become accustomed to a certain set of standards from these businesses. Customers will seek out establishments for their familiarity and consistency that comes from patronizing these businesses over many years.

Additionally, if you are part of a nationally recognized brand, you automatically have the power of that franchise’s marketing and advertising dollars to support you. This can inevitably result in a faster time to market and quicker ROI. However, brand awareness comes with a price tag. Buying into one of these better-proven franchises can be expensive and require more startup costs than building your own business.

Site selection

Site selection is critical for many businesses. Most franchisors pre-approve sites for outlets. This may increase the likelihood that your location will attract customers. The franchisor, however, may not approve the site you want. If there’s a specific location where you want your business to be and it doesn’t match the franchise opportunities in that area, then you will have to find a location or territory that will be acceptable to both of you.

In addition, franchisors may impose design or appearance standards to ensure customers receive the same experience in each outlet. If you are passionate about creating a unique look and feel for your business, you may have a hard time following the guidelines set forth by the franchisor.

Training and support services

Perhaps one of the biggest advantages to buying a franchise is the training and ongoing support you receive from a franchisor. They can help with managing the day-to-day business, from hiring and training employees to overseeing the finances. Franchisors can help you learn to run a business rather than doing it on your own, which can lead to mistakes that affect your business’s bottom line – whether through the cost of time, money or both.

Costs, fees and contracts

Depending on the system, startup costs for a franchise can be steep. Many franchise owners find it necessary to secure financing to purchase their business. In addition, most franchisors require franchisees to pay ongoing royalty and/or advertising fees. The fees are attributed to training, support and marketing, of which a certain percentage of your profits will be allocated to the franchisor. Finally, when you buy a franchise, you sign an agreement that locks you in for a specified amount of time, anywhere from 5 to 30 years. Breaking a franchise agreement can be difficult and costly.

Financing

Owning any new business, start-up costs can be high and require infusions of capital if they encounter hardship. A business needs a good business plan, healthy cash flow, and solid financing to succeed. Most franchisees will have to apply for a business loan at some point, such as a loan backed by the SBA (Small Business Administration). But bank loans and SBA loans are still not easy to get even for franchise businesses, and the application and approval process can be prohibitively long for a lot of franchisees in need of quick capital. Some franchisors offer their own financing programs, but the practice is far from widespread, so you can’t necessarily depend on funding from your franchise brand.

For these reasons, many prospective business owners are turning to alternative funding for better financing options. DRDA BORSA™ Plan, a self-directed 401(k) plan which allows an individual access to their qualifying retirement funds TAX and PENALTY FREE to be used as equity for a business start-up, acquisition, or as capital for an existing business. The Plan offers a much faster time to funding than traditional bank loans, often receiving funds in your account within 30 days of initiating the plan. The Funds then can be used as a down payment for an SBA loan.

Autonomy

Buying into a franchise system requires you to run your business as dictated by the franchisor with little leeway for business decisions, including the look and feel, purchasing equipment and overall operating procedures. You may control your franchise unit’s culture and who you hire and fire, but you still must follow a prescribed set of guidelines.

To maintain uniformity and ensure future success within a franchise system, franchisors can be very diligent about enforcing policies and procedures. The franchise system they created is their most valuable asset. If following and adhering to a prescribed set of operating instructions to run your business is not something you are envisioning, then franchising may not be the path for you.

Purchasing power

Having brand-name backing allows you to benefit from the collective buying power of the franchise when it comes to purchasing equipment and supplies. This can be critical for finding the right supplier and negotiating deals. Franchisors can also help you with determining what equipment you need, the right size and the supplies you’ll need.

At the same time, a franchisor’s requirement for you to purchase equipment and inventory only from approved suppliers will limit what you can purchase as well as your ability to purchase something at a discounted price from another dealer.

Challenges & Advantages

There are many advantages to investing in a franchise, as there are advantages in starting your own business. Widely recognized benefits to buying a franchise include a ready-made business operation. A franchise comes with a built-in business formula including products, services, even employee uniforms and well-established brand recognition. Depending on the franchise, the franchisor company may offer support in training and financial planning, or even with approved suppliers. Whether this is a formula for success is no guarantee.

Business owners, by definition, may not have any ongoing costs to an investor in the form of a percentage of sales or revenue, but they do have to expense their marketing, training, processes, and systems in place. Thich can equate to the same percentage range of 4% to 8% royalty fees required by the franchisee. Other equivalents would be location control or creativity with an owned business. Territories are defined by the Franchisor and approved based on area and region of similar brands within the geographical distance. The business owner must conduct market research and competitive analysis in order to establish a consensus of where to locate, and how to promote their brand. Other factors that affect all businesses, such as poor location or management, are also possibilities.

Franchise or Startup

As a franchisee, you will be signing a long-term contract with your franchisor and creating a relationship through which you will need each other to succeed. It’s critical you do your research and ensure your core values and goals align with those of the franchisor.

If you don’t want to carry on somebody else’s idea for a business, with a host of regulations, procedures, systems in place and rules you must follow as part of your agreement, you can start your own. While founding your own company has plenty of potential rewards, both monetary and personal, it is also at greater risk. When you start your own business, you are on your own, and much is unknown. Will the product sell? Will customers like it? Will I make enough money to survive?

If you choose to build your own business, then you won’t be as constrained by the franchisor/franchisee relationship, but you also will not receive the support you may need down the road. If your business is going to survive, you alone will have to make that happen. To turn your dream into a reality, you can expect to work long, hard hours with no support or expert training. If you try this on your own without any experience, the deck is stacked against you. If this sounds like too big a burden to bear, the franchise route may be a better choice.

People purchase a franchise because the model often works. It offers careful entrepreneurs a stable, tested model for running a successful business. It also requires them to operate on someone else’s business model. For those with a big idea and a solid understanding of how to run a business, launching your own startup presents an opportunity for personal and financial freedom.

So, startup or franchise? As you can tell the decision is very dependent on the professional and personal experience you want to gain through this next venture. There are merits and perils with each, but at the end of the day, only you can make the right choice for yourself.

Are you interested in learning more about DRDA’s ROBS structure, the BORSA™ Plan? Give Bryan Uecker a call today at 281-954-6004 for a free consultation.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Tax

Discovering Financial Excellence: Why DRDA’s Tailored Solutions Stand Out

By: Eva Jiang, M.B.A., M.S.

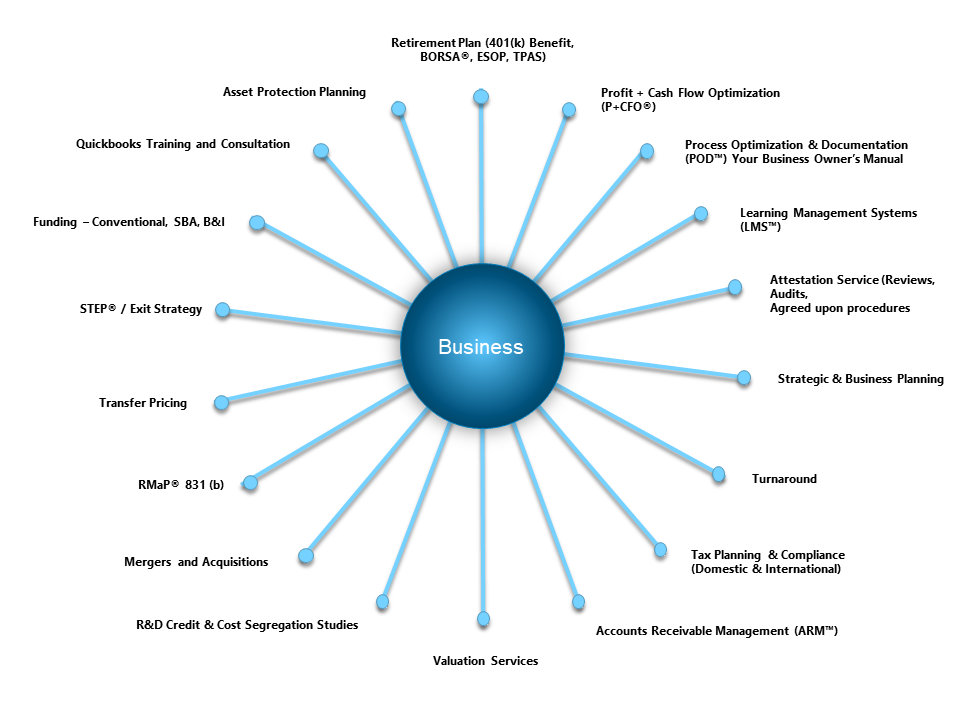

Looking for financial services that exceed expectations? Look no further than DRDA. Our comprehensive range of services encompasses tax planning and compliance, audit, accounting, bookkeeping, QuickBooks, 401(k) plan, Third Party Administration, BORSA® implementation, Operation and Exit, Profit and Cash Flow Optimization (P+CFO®), and Business Value Acceleration.

DRDA Wheel of Services

Because of our commitment to professionalism and uniqueness, we offer several trademarked services, including RMaP, BORSA, STEP, P+CFO, ARM, POD and LMS. At DRDA, we pride ourselves on our ability to make a difference in our clients lives. These trademarked services represent our dedication to providing cutting-edge solutions that are tailored to the needs of each client.

When you choose DRDA, you’re not just getting cookie-cutter solutions. Our team understands that every business is unique, which is why we take the time to truly understand your individual needs. We believe in open communication and collaboration across departments, ensuring that your experience with us is seamless and efficient.

Our tax services cover everything from planning and compliance to resolution, helping you navigate complex tax laws to minimize liabilities and maximize savings.

Our accounting services are tailored to your specific needs, providing accurate and reliable financial reporting. From auditing, assurance and financial statement preparation to budgeting and forecasting, our team helps you understand and trust your business information systems.

Our bookkeeping services ensure that your financial records are organized and up-to-date, allowing you to focus on what you do best – running your business. And if you use QuickBooks, our consultants can optimize your software usage, from setup and customization to training and ongoing support.

In addition to traditional services, our business advisory team offers strategic guidance to drive growth and profitability. Whether you need help with TPAS (Third-Party Administrative Services), retirement plan, BORSA® implementation (ROBS), business planning, performance analysis, or risk management, we’ve got you covered.

At DRDA, we don’t believe in a one-size-fits-all approach. DRDA Business Solutions are tailor-made for your business, saving you time and money while ensuring maximum efficiency and effectiveness.

Of the more than 46,000 CPA firms in the United States, DRDA has been recognized as one of the Top 500 CPA Firms in the United states by Inside Public Accounting, DRDA is ready to serve you. Visit our website at www.drdacpa.com to learn more about how we can help you and your business succeed and thrive.

By: Eva Jiang, M.B.A., M.S.

- Published in P+CFO™, ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business, Tax

Using 401(k)/IRA Funds to Start or Buy a Business

Using Rollovers for Business Start-ups (ROBS) such as DRDA’s, LLC BORSA™ Plan

to finance a business isn’t new, but it is unfamiliar to many. As a result, there are a lot of myths swirling around about the use of ROBS structures that may be stopping would-be entrepreneurs from chasing their dreams.

BORSA Plans involve using money from an eligible retirement account to finance the purchase of a business or franchise. To summarize, a corporation is formed, and that corporation then sponsors a 401(k) plan. Funds are rolled from an existing retirement account into the new 401(k) without triggering a taxable distribution. This new 401(k) purchases (or invests in) shares of the corporation, which can then purchase a business or franchise.

In essence, a BORSA™ Plan allows you to invest in your own business where you have control rather than investing in the market where you have no control. Here’s the truth behind the most common ROBS myths:

- It’s not tax avoidance.

Using a BORSA™ Plan isn’t a way to evade taxes by any means. The Employee Retirement Income Security Act of 1974 (ERISA) was set up explicitly to encourage investment in small businesses – businesses that pay taxes. - BORSA™ Plan is an investment, not a loan.

With a BORSA™ Plan, you’re investing in your new business or franchise, not taking on debt. This means you won’t have to make monthly loan payments or incur interest. - You can use a BORSA Plan to diversify your nest egg.

You don’t have to take every penny from your existing retirement fund for a BORSA™ Plan to work. Many people only use a portion of their retirement assets, and this arrangement can be used in conjunction with a small business loan or other financing option. So, you can diversify your investments. - Getting funded using a BORSA™ Plan can take as little as four weeks.

Depending on the state in which you’re filing, and how fast you’re able to file the necessary paperwork, funding can take as little as a few weeks. Most are completed in less than 30 days. - BORSA Plans are not the same as Self-directed IRAs.

While it’s possible to finance a business with both self-directed IRAs and a BORSA™ Plan, there are some major differences between the two. If you use an SDIRA, the owner may not work for the business or take a salary. The investment amount is also potentially liable for the unrelated business income tax (UBIT), which can get very expensive. With the BORSA™ Plan, the 401(k) owner must work for the new business, and UBIT doesn’t apply. - A BORSA™ Plan can be used to fund start-ups.

A BORSA™ Plan is a great option to finance not only start-ups, but also purchases of existing businesses and franchises.

To some, the BORSA process can appear to have complex rules and regulations. But if you have a qualified retirement plan with a balance that’s sufficient for your start-up needs and work with an experienced company to support its formation, it can be a great option to start or re-capitalize your business debt-free.

Are you interested in learning more about DRDA’s, LLC ROBS structure, the BORSA™ Plan? Give our experienced team a call today 281-488-2022 for a free consultation

- Published in ROBS 401(k), Small Business, Starting a Business, Tax, Uncategorized

Payroll Protection Program (PPP) to relaunch Monday April 27, 2020

DRDA continues to provide you information as quickly as we can related to any tax law changes, as well as financial aid and loan opportunities as a result of the COVID-19 crisis. As you can imagine, this is a rapidly changing environment and we will continue to disseminate information as it is made available to us.

On March 27th 2020, President Trump enacted the Coronavirus Aid, Relief, and Economic Security (CARES) Act to Help small businesses keep workers employed through a program known as the Paycheck Protection Program (PPP). Which allowed banks to issue SBA 100% federally guaranteed loans to small businesses that can attest to suffering economic hardship as a result of the COVID-19 crisis. Importantly, these PPP loans may be forgiven if borrowers maintain their payrolls during the crisis or restore their payroll afterward.

Yesterday April 23, 2020 Congress approved an additional $310 billion in Funding to replenish the PPP Program which has run out of money. Congress had allotted an initial $349 billion in the last relief bill, a $2.2 trillion package enacted on March 27, only to see the funds run dry shortly afterward due to the rush of businesses seeking to tap the benefits.

Banks will start processing application Monday April 27, 2020. We anticipate the money to move very quickly. We suggest to those applying for the PPP, to do so as soon as possible, and be ready to submit their applications immediately as the program becomes available.

Here is a link to a small business guide published yesterday by the U.S Chamber of Commerce. Please take the time to read this memo, and if you believe your business qualifies (if you need help in that determination, please let us know), then you need to contact your banker to start the process. Please keep in mind, these loans are moving very fast and they are being created as a “first come, first served” priority list for applicants. This will typically be a bank process, not an accounting process, so submitting a loan application through your bank will be of the utmost importance.

The last twelve (12) months payroll information will be needed. It is our understanding at this time, that payroll will include wages, employer paid payroll taxes, health insurance premiums and retirement expense (i.e. 401(k) match).

As stated previously, for the PPP loan to be forgiven your business will have to prove that it retained and continued to pay employees. The rules are still evolving regarding the employee retention provision but understand that employee retention is paramount to having this loan forgiven.

The administration’s PPP program guidelines can be found at www.treasury.gov, and the U.S. Small Business Administration’s search tool to find a bank that offers PPP loans can be found at www.sba.gov/paycheckprotection/find.

We hope that you are well, and please stay safe. Please don’t hesitate to contact us with any questions you may have.

- Published in Business Lending, Small Business, Tax

Everything You Need to Know About Coronavirus Federal Small Business Stimulus Aid Programs

A breakdown of all the federal programs and aid for small business coronavirus assistance.

Three separate packages approved by Congress and signed by President Trump over the past weeks combined offer a variety of assistance to businesses. Here’s a breakdown of what’s in those packages and how your business can take advantage of these relief efforts.

Coronavirus Preparedness and Response Supplemental Appropriations Act

What is it?

Signed into law on March 6, The Coronavirus Preparedness and Response Supplemental Appropriations Act provides $8.3 billion in emergency funding for federal agencies to respond to the coronavirus outbreak, enabling the U.S. Small Business Administration to offer $7 billion in disaster assistance loans to small businesses impacted by COVID-19.

What does it mean for small business?

The SBA is offering designated states and territories low-interest federal disaster loans to small businesses suffering substantial economic harm as a result of the coronavirus.

These loans may be used by small businesses to pay fixed debts, payroll, accounts payable and additional bills that can’t be paid because of COVID-19’s impact. The interest rate is 3.75% for small businesses without other available means of credit. The interest rate for non-profits is 2.75%. Businesses with credit available elsewhere are not eligible.

The SBA loans come with long-term repayments, up to a maximum of 30 years, in an effort to keep payments affordable. Loan terms are determined on a case-by-case basis, according to individual borrower’s ability to repay.

The SBA has amended its disaster loan criteria to help borrowers still paying back SBA loans from previous disasters. By making this change, deferments through December 31, 2020, will be automatic. Hence, borrowers of home and business disaster loans do not have to contact SBA to request deferment.

Where can I learn more?

SBA Coronavirus Small Business Loan Page

Coronavirus (COVID-19): Small Business Guidance & Loan Resources

Families First Coronavirus Response Act

What is it?

Signed into law on March 18, the Families First Coronavirus Response Act (FFCRA or Act) contains eight divisions designed to provide assistance to covered employees and households with eligible children affected by COVID-19. Key components of the Act include:

- Mandatory emergency paid sick leave for covered employees who, as a result of COVID-19, are quarantined, symptomatic or caring for a symptomatic individual, or caring for a child whose school has been closed.

- An expansion of unemployment benefits.

- Modifications to the USDA nutrition and food assistance programs.

- New requirements for coronavirus diagnostic testing.

- A temporary increase in the Medicaid federal medical assistance percentage (FMAP).

What does it mean for small business?

The FFCRA affects small businesses in two key ways:

- Paid sick and family leave. The law requires all private businesses with fewer than 500 employees to provide emergency paid sick or family leave for employees affected by the coronavirus outbreak.

- Employer tax credits. The law provides employers

with fewer than 500 employees with refundable payroll tax credits to cover the

cost of providing the paid sick leave and the paid FMLA leave to their

employees. Specifically, the law states that:

- Employers will receive 100% tax credit against their payroll tax liability up to the capped amount of benefits they must pay.

- Health insurance costs are also included in the credit.

- Self-employed individuals receive an equivalent credit.

- If an employer is owed more than the capped amount and a refund is owed, the IRS will send the refund as quickly as possible.

- Reimbursement will be quick and easy to obtain.

Where can I learn more?

- The full text of the Act can be found at Congress.gov.

- For additional information regarding the mandatory emergency paid sick leave, see this detailed guide provided by the U.S. Department of Labor.

Coronavirus Aid, Relief, and Economic Security Act (CARES Act)

What is it?

The CARES Act, which is expected to be passed by both houses of Congress and signed by the President in the near future, has a number of components aimed at helping small businesses survive and recover from losses suffered during the coronavirus outbreak. Key components of the CARES Act include a loan program from the SBA, changes to unemployment benefits and changes to business tax filing requirements.

What does it mean for small business?

Anticipated key components of the CARES Act include:

- Small Business Paycheck Protection Program: A new lending program that allows businesses to borrow enough to cover monthly payroll costs for businesses for up to 2.5 months. If used for payroll, mortgage interest or other qualified expenses, these loans will be forgiven as long as the employer continues to employ its workers or rehires them when they reopen for business.

- Business tax provisions: Employers can defer payment of the employer share payroll taxes.

- Payments for individuals: It is anticipated those who make less than $75,000 a year will receive direct payments of $1,200 per individual ($2,400 joint return) plus $500 per child. This will phase out for incomes above $75,000 ($150,000 joint filings).

- Unemployment assistance: If your business is closed because of coronavirus and your employees cannot work from home, or your employees are unable to work due to illness or the need to take care of someone who is ill with the virus, they can collect unemployment.

Where can I learn more?

Small Business Administration’s COVID-19 page

More info on IRS tax changes can be found here.

More information on filing for unemployment assistance can be found at the U.S. Department of Labor, though you or your employees will need to file through your state’s unemployment program.

- Published in Business Lending, Small Business, Tax

Caronavirus Update: IRS extends Tax Filing deadline to July 15

Late in the evening on Friday, March 20, 2020, the Treasury Department and the IRS issued Notice 2020-18, restating and expanding relief provided in Notice 2020-17. Notice 2020-18 provides guidance on how Affected Taxpayers can defer tax filings AND tax payments due to the coronavirus (COVID-19). The term “person” includes an individual, a trust, estate, partnership, association, company or corporation, as provided in section 7701(a)(1) of the Code. For an Affected Taxpayer, the due date for filing Federal income tax returns and making Federal income tax payments due April 15, 2020, is automatically postponed to July 15, 2020. Affected Taxpayers do not have to file Forms 4868 or 7004. Another significant change is there is no limitation on the amount of the payment that may be postponed. As you may recall the previous release limited the amount of payment deferral to $1,000,000 for individuals and $10,000,000 for corporations.

The relief provided in this section III is available solely with respect to Federal income tax payments (including payments of tax on self-employment income) and Federal income tax returns due on April 15, 2020, in respect of an Affected Taxpayer’s 2019 taxable year, and Federal estimated income tax payments (including payments of tax on self-employment income) due on April 15, 2020, for an Affected Taxpayer’s 2020 taxable year.

IMPORTANT NOTE – This does not provide deferral or relief for Affected Taxpayer’s second quarter 2020 estimated tax payment normally due June 15, 2020.

IMPORTANT NOTE – Many states and local municipalities are simultaneously providing, or have already provided, their own relief.

As always we appreciate the opportunity to serve you. If you have any questions or if we may be of any assistance to you please do not hesitate to contact us directly.

- Published in Tax

Coronavirus Tax Relief

Treasury has released insight on the deferral of the payment of any tax due on April 15, 2020. The due date for making Federal income (and individual SE Tax Payments) due April 15, 2020 will be postponed to July 15, 2020. C Corporations and consolidated groups can defer up to $10,000,000 in tax. For all other taxpayers the deferral is up to $1,000,000. This is also good for estimated tax payments due April 15, 2020.

Yesterday afternoon the United States Treasury issued Notice 2020-17 Relief for Taxpayers Affected by Ongoing Disease 2019 Pandemic. Notice 2020-17 provides some payment relief to US taxpayers. This notice provides insight on the deferral of the payment of any tax due on April 15, 2020. The due date for making Federal income (and individual SE Tax Payments) due April 15, 2020 will be postponed to July 15, 2020. C Corporations and consolidated groups can defer up to $10,000,000 in tax. For all other taxpayers (i.e. individuals, trusts, etc.) the deferral is up to $1,000,000. This is also good for estimated tax payments due April 15, 2020. This is a deferral of time to pay, NOT and extension of time to file. All taxpayers will have to file or extend their returns as normal.

While we know many of you may want to push back the payment of taxes until July 15, you may prefer to complete at least a draft of your return so you know what liability lies ahead. Your DRDA team will continue to work towards the completion, or extension, of your tax return as if this change had not been made. Many of you will want to “get the tax filing process off your plate” and complete the process as usual and file and pay what is due by April 15. The financial impact of filing and paying by April 15 is generally minimal as the funds for the tax payment are likely already sitting in cash and will earn very little, given today’s interest rate environment, between April 15 and July 15. We also know some of you will not want to send a payment until absolutely the latest date possible. In these cases, we will finalize and then extend the return so that that payment can be made in July. Our goal is to provide flexibility and service to you while managing our workflow in the most normalized manner possible. The growing fear is the bubble of work that may be looming in June and July if everyone delays the preparation of their returns. As such we encourage you to get your information to us if you have not already done so. We definitely live in interesting times and want to serve you well as we work through all of this.

- Published in Tax

Coronavirus and Your Tax Filing and Compliance

Beneath the headlines of an outbreak, fatalities in the thousands and infecting tens of thousands worldwide sits other news: panic buying at grocery stores, whipsawing on Wall Street, and the specter of unprecedented disruption to everyday lives and business — all with less than five weeks to go before Tax Day.

–

So, how is DRDA, LLC planning on dealing with coronavirus just as the season heats up?

“We are taking a proactive approach to dealing with this issue,” said Doug Dickey, CPA, CEPA, Principle Partner of DRDA, LLC. “Like any other Hazard Preparedness or Disaster and Emergency Planning, we are committed to having a system in place to ensure the safety and security of our staff and clients with minimal disruption to our services.”

Being prepared to prevent, respond to, and recover rapidly from public health threats can save lives and protect the health and safety of the public. Though some people feel it is impossible to be prepared for unexpected events, the truth is that taking preparedness actions helps anyone deal with hazards of all types more effectively when they do occur.

The IRS is taking a wait-and-see approach: “Our internal working group will continue to closely watch this and promptly respond to any emerging situations to protect our employees and taxpayers interacting with the agency,” the agency said in a statement. “Normal IRS operations are continuing, and we are seeing a strong, smooth filing season for the nation.”

More than likely the IRS is developing contingency plans, as they did with the government shutdown. Historically they have developed a hierarchy of essential and non-essential services. Our belief is that return filing and the collection of tax due will be at the top of their essential service list.

Taking it seriously

“DRDA, LLC has had remote employees and work from home employees for years. We are ensuring that everyone on our Team is set to work from home if needed,” said Doug Dickey, CPA, CEPA. “

“Different” might be one word to describe the potential disruption. Living on the Texas Gulf Coast we think ahead in detail for weather or power outages. A new and largely unknown virus is a new and different disruption. Since there is very little known of COVID-19, it is being treated as a disaster or an event that would require a business to invoke their Emergency Plan. It is imperative to be prepared with a contingency plan for any natural or systemic challenge.

In the event of a citywide mandate for public safety which would require the staff to stay home; we will continue to serve you by enabling our staff with home workstations, along with constant communication with the entire firm and our clients. Our computer and phone systems have been in the cloud and VOIP for years. There is no difference in access from home or office.

Digital exchange

Tax prep also often depends on face-to-face conferences with clients with little more than the width of a desk between us.

Most preparers complete hundreds of individual returns per year and have face-to-face meetings with about ten percent of the clients. The trend in our industry for the more substantial firms has been leading to digital productivity and remote access. As stated previously DRDA, LLC has been digitally in the cloud for years so the impact to our business will be minimal. Almost everything we do can be conducted remotely via phone, video conferencing, email, fax, secure portals and remote electronic signatures.

We encourage our clients who normally come in for an interview or drop off, pick up or mail their documents to upload their information through the secure client portal if you can. With less interviews, and traditional mailing routes, there would be less contact and increased safety for all. We are all human and human safety and well-being is always our first concern.

Technology will help

We have encouraged clients to use the portal and upload their documents since the beginning of Tax Season (click here to access our secure portal). We believe in these times, if more clients utilize this approach, it will foster a safer and better document delivery and acknowledgment process for everyone. We are currently enhancing our website with even more detailed information about how to use the portal if you choose this option (click here for help with our secure portal).

To make certain we can continue to serve you, DRDA, LLC has incorporated applications from the cloud, with two-factor authentication. In the event of a virus emergency, the firm’s e-workflow would involve alerts to clients in case of quarantine; instructions to use the firm’s encrypted portal; staff scheduling and payroll; monitoring of each stage of work; shipment to the client for e-signature and electronic payment; and e-filing.

Rest assured we are working diligently to ensure a seamless transition in the event of an emergency happening. Our primary endeavor is the safety and security of our staff, clients and community while serving you.

If you have any questions or concerns, please do not hesitate to contact us directly.

- Published in Tax, Uncategorized

Is There Good Tax News on the Horizon for Workers?

In Congress’ haste to push tax reform through in late 2017 they unfairly (some say) eliminated the deduction for employee business expenses through 2025. The suspension of this deduction negatively affected taxpayers across many different occupations – first responders, school teachers, military personnel, transportation workers, construction workers and others.

Well, there may be good news on the horizon for these taxpayers. As first reported by Alan Viard of TheHill.com there has been legislation introduced in Congress by Democratic Senator Bob Casey (S.2718) and Democratic Representative Conor Lamb (H.R. 2103) to bring back the employee business expense deduction. This would bring individual tax reform more in line with corporate and small business/self-employed reform that was passed by Congress as part of the Tax Cuts and Jobs Act of 2017 (TCJA).

TCJA did a good job of bringing much needed reform to our corporate tax structure. It did a fair job of reforming the part of the tax code that applies to small businesses and the self-employed. However, it fell short of what was needed for individual tax reform. I use the following analogy to describe the recent effort at tax reform — corporate tax reform was a stand-up triple, small business and self-employed tax reform was a stand-up double and individuals made it to first base, but they got there by being hit by the pitch. Congress had a once in a generation opportunity to make meaningful change to our tax code and they fell short when considering the effect on individuals.

In his article in The Hill, Alan Viard does a good job describing the inequity caused by the elimination of the deduction for employee business expenses. Businesses can rightly deduct the costs associated with generating revenue. Why can individuals no longer do the same thing? As Viard points out, this violates a very fundamental rule of fair tax policy. Fair tax policy should always be applied consistently and in this case it is not. An individual should be able to deduct the costs they incur to earn their wages. (See Viard’s full article at The Hill)

Effective and fair tax reform seemed within reach as Congress worked diligently on TCJA during 2017. The consensus among most experts was that Congress would pass a meaningful, generational reform package in 2018 once their work was completed. However, as often happens, political expediency got in the way of Congress finishing their job.

Congress was successful in effecting much needed and meaningful tax reform for corporate and small businesses with passage of TCJA. They need to finish the job for individual workers. They have another opportunity to correct their mistake and apply consistent and fair tax policy across all classes of taxpayers. It looks like they may be getting started on that effort. DRDA CPA’s will continue to monitor this important piece of legislation and keep you informed of its progress.

You may contact Senator Bob Casey at Senator Casey and Representative Conor Lamb at Rep. Lamb to weigh in on this important pending legislation. You may contact the author, Larry Lonero, E.A, at larry@DRDACPA.com and DRDA CPA’s at (281) 488-2022 or www.DRDACPA.com.

- Published in Tax