By: Agustin Muniz

The Employee Retirement Income Security Act (ERISA) is a significant federal law that sets standards for employee benefit plans offered by private employers. Enacted in 1974, ERISA aims to protect the rights and interests of employees who participate in retirement plans, health insurance programs, and other welfare benefit plans. ERISA was enacted to establish minimum standards for employee benefit plans to safeguard the financial security and welfare of employees. It applies to private-sector employers that offer employee benefit plans, including pension plans, 401(k) plans, health insurance plans, and other welfare benefit plans. ERISA does not cover government plans, church plans, or plans maintained outside the United States for non-resident aliens.

One of the central aspects of ERISA is the imposition of fiduciary standards on those who manage and control employee benefit plans. Fiduciaries, such as plan administrators, trustees, and investment managers, are legally obligated to act in the best interests of the plan participants and beneficiaries. They must exercise prudence, loyalty, and diligence in managing the plan and its assets. ERISA mandates various reporting and disclosure requirements to ensure transparency and accountability in employee benefit plans. Employers are required to provide plan participants with essential information, including plan features, funding mechanisms, investment options, and potential risks. This includes distributing Summary Plan Descriptions (SPDs), Summary Annual Reports (SARs), and other disclosures to participants. ERISA includes provisions that protect employees’ rights to their accrued benefits. The law establishes rules for vesting, which determines when employees become entitled to receive their full pension benefits. Additionally, ERISA created the Pension Benefit Guaranty Corporation (PBGC), a federal agency that provides a safety net by insuring certain pension benefits in case of plan termination.

ERISA provides mechanisms for enforcing compliance and addressing fiduciary breaches or plan violations. The law grants authority to the Department of Labor (DOL) to oversee and enforce ERISA provisions. Participants and beneficiaries also have the right to bring lawsuits to enforce their benefits and seek remedies for fiduciary breaches or other violations of ERISA.

ERISA has had a profound impact on employee benefit plans and the retirement landscape in the United States. It has helped establish standards of conduct for fiduciaries, promote transparency in plan administration, and provide avenues for legal recourse in case of misconduct. ERISA has also facilitated the growth of retirement savings plans like 401(k) plans, providing individuals with tax advantages and investment opportunities to build their retirement nest eggs. The Employee Retirement Income Security Act (ERISA) serves as a crucial framework for regulating private-sector employee benefit plans, ensuring the protection of employees’ rights and interests. By establishing fiduciary responsibilities, reporting requirements, and benefit security measures, ERISA promotes transparency, accountability, and the long-term financial security of plan participants. Understanding the key provisions of ERISA is essential for both employers and employees to navigate the complex landscape of employee benefits effectively.

For more information on ERISA and how DRDA can help please click here.

By: Agustin Muniz

We wanted to take a moment to share some exciting news with you regarding our services and new team members. As part of our ongoing commitment to build sustainable value for your business and to secure a promising future for you, your family, and your employees, we have expanded our offerings to include not only tax planning and bookkeeping, but payroll, and employee benefits – all designed to meet your needs while saving you time and money. It is our pleasure to welcome Bryan Uecker and Carrie Wright as members of the team that will support you and your business.

Bryan Uecker QPA, QPEC, AIF, AIFA

BORSA Manager & Retirement Plans

Bryan, a 30-year veteran of employee benefits, will be heading up BORSA and Retirement Plan design and compliance. With his expertise and experience, he brings a wealth of knowledge and a new perspective to our organization. As you know, the BORSA plan is a fantastic way to fund your business. But that is only the first stage! Bryan will be working with you to maximize the value of your plan through additional tax savings and allocation strategies.

*Click image to view profile

Carrie Wright EA

Tax Senior

Carrie is a seasoned tax practitioner and federally- credentialed Enrolled Agent tasked with finding the best result with your tax filings. She is at your service for any questions you may have regarding your business and saving taxes. She is eager to learn more about your organization and how we can support your growth and success.

*Click image to view profile

We genuinely appreciate your continued trust in DRDA as we strive to proactively improve your future, not just account for the past.

If you would like to take a look at our payroll and bookkeeping services to see how it could streamline your business processes, please reach out for a quote (or click the button below).

Click here to register for the Webinar

To finance a business isn’t new, but it is unfamiliar to many. As a result, there are a lot of myths swirling around about the use of ROBS structures that may be stopping would-be entrepreneurs from chasing their dreams. BORSA Plans involve using money from an eligible retirement account to finance the purchase of a business or franchise. To summarize, a corporation is formed, and that corporation then sponsors a 401(k) plan. Funds are rolled from an existing retirement account into the new 401(k) without triggering a taxable distribution. This new 401(k) purchases (or invests in) shares of the corporation, which can then purchase a business or franchise. In essence, a BORSA™ Plan allows you to invest in your own business where you have control rather than investing in the market where you have no control. Here’s the truth behind the most common ROBS myths:

- It’s not tax avoidance.

Using a BORSA™ Plan isn’t a way to evade taxes by any means. The Employee Retirement Income Security Act of 1974 (ERISA) was set up explicitly to encourage investment in small businesses – businesses that pay taxes.

- BORSA™ Plan is an investment, not a loan.

With a BORSA™ Plan, you’re investing in your new business or franchise, not taking on debt. This means you won’t have to make monthly loan payments or incur interest.

- You can use a BORSA Plan to diversify your nest egg.

You don’t have to take every penny from your existing retirement fund for a BORSA™ Plan to work. Many people only use a portion of their retirement assets, and this arrangement can be used in conjunction with a small business loan or other financing option. So, you can diversify your investments.

- Getting funded using a BORSA™ Plan can take as little as four weeks.

Depending on the state in which you’re filing, and how fast you’re able to file the necessary paperwork, funding can take as little as a few weeks. Most are completed in less than 30 days.

- BORSA Plans are not the same as Self-directed IRAs.

While it’s possible to finance a business with both self-directed IRAs and a BORSA™ Plan, there are some major differences between the two. If you use an SDIRA, the owner may not work for the business or take a salary. The investment amount is also potentially liable for the unrelated business income tax (UBIT), which can get very expensive. With the BORSA™ Plan, the 401(k) owner must work for the new business, and UBIT doesn’t apply.

- A BORSA™ Plan can be used to fund start-ups.

A BORSA™ Plan is a great option to finance not only start-ups, but also purchases of existing businesses and franchises. To some, the BORSA process can appear to have complex rules and regulations. But if you have a qualified retirement plan with a balance that’s sufficient for your start-up needs and work with an experienced company to support its formation, it can be a great option to start or re-capitalize your business debt-free.

Lost your job due to the pandemic? You’re not alone.

Research shows that, as of July 2021, unemployment rates have not yet recovered (5.4% vs. 3.5% pre-pandemic). There’s no better time to get started investing in your own business with DRDA’s BORSA™ plan.

Avoiding Early Withdrawal Taxes & Penalties

Normally, if you withdraw money from your 401(k) before the age of 59½, you are liable to pay income taxes and a 10% early withdrawal penalty on your money. The Business Owners Retirement Savings Account will allow you to take control of your 401(k), IRA, or other qualified funds and use them to start, purchase, or fund a business tax or penalty free.

What types of funds are eligible?

Not only does the BORSA™ Plan work with a traditional 401(k), DRDA can also assist you with rolling over the following into a business:

- 401(a)

- 403(b)

- 457

- IRAs ( with exceptions for Roth or Non-spousal inherited IRAs)

- Pension

- Profit Sharing

- ESOP

- Annuities

- Thrift Savings Plans

I’m ready to start my business! How does this process work?

- Form a new C Corporation

- The new C Corp. will establish a 401(k) Profit Sharing plan

- Existing retirement funds will be rolled over into the new 401(k) plan

- Participants in the 401(k) plan will invest in stock of the newly formed C Corp.

This process typically takes around 30 days from the initial engagement, to the time you will receive your funds in hand.

Have more questions, comments, or are you ready to get started?

If you’re ready to get started or have any additional questions, please register for our FREE webinar (September 8th, 1pm CST & September 9th, 5pm CST) below:

BORSA, finance your new business during the pandemic

How can you make BORSA work for you? Now may be a great time to explore ROBS, or the Rollover Business Startup Solution and what it can do for you during the pandemic.

Key Points

- Start a new business or franchise

- Legally pay yourself a salary

- Abide by IRS and ERISA guidelines

What is the BORSA Plan?

The BORSA (Business Owners Retirement Savings Account) is DRDA’s Solution otherwise known as ROBS (Rollover Business Startup Solution), an IRS and ERISA approved structure that allows investors to use their retirement funds for a new business or franchise that they will be personally involved in. It is the primary way a retirement plan holder can have personal involvement in a business utilizing their retirement funds, without triggering IRC prohibited transaction rules.

Setting up a BORSA Plan requires planning but can be accomplished in relatively few steps.

- Set up a C Corporation – The process begins by establishing the new corporation, using the proper legal structure to support the establishment and operation of the company’s qualified retirement plan.

- Rollover your funds – Transfer your funds from an old IRA or 401(k) plan into a new 401(k) plan that the stock of the start-up C corp. business sponsors or adopts.

- Start earning a salary – You must be an employee of your new business and provide a legitimate service. Your compensation must come from your business.

How Do BORSA and Pandemic Relate?

While there’s a pandemic, millions are losing their jobs and joining the ranks of the unemployed. More than ever, many are trying to rely on themselves and not some corporate entity that must make difficult decisions to comply with federal and state mandates affecting individual earning, security, and livelihood. Using BORSA can be an ideal way to start the business of your dreams with money you already have.

BORSA can help you fund a new business or franchise with retirement funds, and that means you’re starting on your way to owning and fulfilling your goals. When COVID-19 hit, no one could have anticipated it would bring the unprecedented upheaval of everyday life that it has.

How Does BORSA Work?

The BORSA Plan allows an investor to create a C Corporation, and the C Corp’s profits are taxed separately from the owner as it is owned by shareholders. Next, funds are transferred from an old IRA or 401(k) plan. Then, as an employee providing a legitimate service, you are able to earn a salary at the business you’ve created.

There are very specific IRS and ERISA rules that have to be followed, and for this reason guidance is recommended. DRDA can help you get started. When it’s time for your new company’s stock to get valuated by the IRS, DRDA will help value the stock of the new or existing company.

BORSA Benefits

More than almost anything else, Americans are looking to make certain they can make it through the pandemic, civil unrest, and the whole of the current situations currently embroiling the nation. For those who have lost their jobs and have been unable to find replacement work, tapping into their retirement funds have been one source of income to help. But what happens when the funds have been depleted?

More than just taking funds out, though, BORSA can help you open a franchise or start a new business you can own yourself. Your money is helping you and your family first. The primary benefit of using the BORSA Plan is that you can employ it to use your retirement funds to invest in a business you will be personally involved in. You can do this without paying tax on the retirement funds you wish to use as a distribution.

Additionally, investing in yourself within your retirement portfolio is an excellent way to diversify. Your investments in traditional assets such as stocks and bonds, and alternative assets such as cryptocurrency, exist separately, and you can fund your own business as well. This may protect investment portfolios as a whole during times of unrest and market volatility,

During the COVID-19 and now the Delta Variant financial crisis, it’s important to know where your money is and what it’s doing. While investing in the market and traditional assets can bring you financial success, it’s very volatile at this time. Alternative assets like real estate can help diversify your portfolio. And using the BORSA Plan to fund your dreams can help you even more.

If you are interested in receiving more information on the BORSA™ plan, DRDA will be hosting a webinar on September 8th and 9th, 2021.

Click Here to sign up and access this FREE webinar.

Using Rollovers for Business Start-ups (ROBS) such as DRDA’s BORSA™ Plan

to finance a business isn’t new, but it is unfamiliar to many. As a result, there are a lot of myths swirling around about the use of ROBS structures that may be stopping would-be entrepreneurs from chasing their dreams.

BORSA Plans involve using money from an eligible retirement account to finance the purchase of a business or franchise. To summarize, a corporation is formed, and that corporation then sponsors a 401(k) plan. Funds are rolled from an existing retirement account into the new 401(k) without triggering a taxable distribution. This new 401(k) purchases (or invests in) shares of the corporation, which can then purchase a business or franchise.

In essence, a BORSA™ Plan allows you to invest in your own business where you have control rather than investing in the market where you have no control. Here’s the truth behind the most common ROBS myths:

- It’s not tax avoidance.

Using a BORSA™ Plan isn’t a way to evade taxes by any means. The Employee Retirement Income Security Act of 1974 (ERISA) was set up explicitly to encourage investment in small businesses – businesses that pay taxes. - BORSA™ Plan is an investment, not a loan.

With a BORSA™ Plan, you’re investing in your new business or franchise, not taking on debt. This means you won’t have to make monthly loan payments or incur interest. - You can use a BORSA Plan to diversify your nest egg.

You don’t have to take every penny from your existing retirement fund for a BORSA™ Plan to work. Many people only use a portion of their retirement assets, and this arrangement can be used in conjunction with a small business loan or other financing option. So, you can diversify your investments. - Getting funded using a BORSA™ Plan can take as little as four weeks.

Depending on the state in which you’re filing, and how fast you’re able to file the necessary paperwork, funding can take as little as a few weeks. Most are completed in less than 30 days. - BORSA Plans are not the same as Self-directed IRAs.

While it’s possible to finance a business with both self-directed IRAs and a BORSA™ Plan, there are some major differences between the two. If you use an SDIRA, the owner may not work for the business or take a salary. The investment amount is also potentially liable for the unrelated business income tax (UBIT), which can get very expensive. With the BORSA™ Plan, the 401(k) owner must work for the new business, and UBIT doesn’t apply. - A BORSA™ Plan can be used to fund start-ups.

A BORSA™ Plan is a great option to finance not only start-ups, but also purchases of existing businesses and franchises.

To some, the BORSA process can appear to have complex rules and regulations. But if you have a qualified retirement plan with a balance that’s sufficient for your start-up needs and work with an experienced company to support its formation, it can be a great option to start or re-capitalize your business debt-free.

Are you interested in learning more about DRDA’s ROBS structure, the BORSA™ Plan? Give our experienced team a call today 281-488-2022 for a free consultation

We have been keeping you updated through blog posts, webinars, and resources on our website on PPP, EIDL, PPP2, and the loan forgiveness process. Today we are happy to bring you information on further relief for restaurant and bar owners with the $28.6B that the American Rescue Plan Act of 2021 sets aside for this purpose. This relief is in the form of grants, not loans.

While this program being administered by the SBA Office of Disaster Assistance has not launched yet, but we anticipate them doing so soon. Like PPP, there will be updates and we are committed to bringing the information to you as soon as it is available.

Out best advice at this time is to educate yourselves on this program and start to gather the documents that are suggested will be required for application and keep your eye on our website.

On Saturday, March 6th, the Senate passed legislation that gives restaurants $28.6 billion in federal relief. That number accounts for a small piece of the new $1.9 trillion stimulus pie officially called the American Rescue Plan Act of 2021 – which changed slightly since it was originally introduced by the Biden administration in January.

The bill was then passed once again in the House on Wednesday, March 10th, ahead of the Democrat’s original March 14th deadline. On Thursday, March 11th, President Biden signed the package into action.

Here’s what’s in it for restaurants owners and workers:

Eligibility For All Restaurants & Bars

Restaurant relief is available to any restaurant, food stand, food truck, food cart, caterer, saloon, inn, tavern, bar, lounge, brewpub, tasting room, taproom, or facility with an alcohol license.

Continued Unemployment Benefits

Unemployed individuals (including but not limited to restaurant workers) will continue to receive a weekly $300 supplemental bonus on top of regular unemployment payments through September 6th.

How Much Relief Can A Restaurant Receive?

Restaurant groups can apply for a maximum grant of $10 million, individual restaurants can apply for a maximum grant of $5 million.

How Grants Will Be Calculated

Grant eligibility is calculated by what the bill calls “pandemic-related revenue loss” or the difference between a particular restaurant’s 2020 sales and their 2019 revenue, minus whatever amount of PPP loans a restaurant may have already received in prior rounds of federal relief. Essentially, the stimulus package’s goal is to try to make up for lost funds due to the pandemic, while taking into account which restaurants have already seen federal aid.

If a business wasn’t open in 2019, the grant administrator looks at the restaurant costs incurred “minus the gross receipts received.”

The American Rescue Plan’s restaurant relief money pot reserves $5 billion of grants for restaurants with revenues of less than $500.000 in 2019, which theoretically is targeted towards small, independently-owned businesses. That’s a little less than a fifth of the entire relief package.

What Restaurant Relief Can Cover

Grants can cover anything from mortgage and rent, payroll and employee benefit costs, PPE, sick leave for employees, food costs, as well as operational expenses like utilities and maintenance. In essence, mostly anything the grant administrator is down with.

Restaurants who receive grants can use their federal aid money for expenses dating back to the start of the pandemic (February 15th, 2020) all the way through December 31st, 2021. If things get worse in the coming months, grant funds may be eligible for longer use.

How Is This Actually Going To Happen?

The federal government is required to let restaurants know about the new aid opportunities. There will be a phone hotline, websites, and outreach in the 10 languages most commonly spoken in the U.S.

If you’re a restaurant owner and you want to learn more about applying for a restaurant relief grant, the Independent Restaurant Coalition is working with the White House and the Small Business Administration to help make the application process run efficiently.

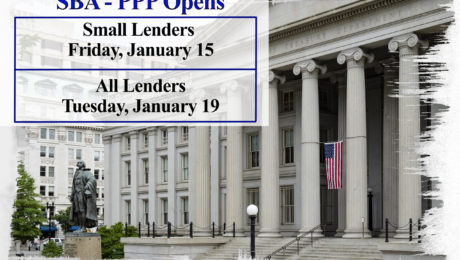

Lenders with $1 Billion or Less in Assets Will be Able to Submit First and Second Draw PPP Applications on Friday – Continuing Dedicated Access for Community-Based Lenders

WASHINGTON – The U.S. Small Business Administration, in consultation with the U.S. Treasury Department, will re-open the Paycheck Protection Program (PPP) loan portal to PPP-eligible lenders with $1 billion or less in assets for First and Second Draw applications on Friday, January 15, 2021 at 9 am ET. The portal will fully open on Tuesday, January 19, 2021 to all participating PPP lenders to submit First and Second Draw loan applications to SBA.

Earlier in the week, SBA granted dedicated PPP access to Community Financial Institutions (CFIs) which include Community Development Financial Institutions (CDFIs), Minority Depository Institutions (MDIs), Certified Development Companies (CDCs), and Microloan Intermediaries as part of the agency’s ongoing efforts to reach underserved and minority small businesses.

On Friday, SBA will continue its emphasis on reaching smaller lenders and businesses by opening to approximately 5,000 more lenders, including community banks, credit unions, and farm credit institutions. Moreover, the agency also plans to have dedicated service hours for these smaller lenders after the portal fully re-opens next week.

“A second round of PPP could not have come at a better time, and the SBA is making every effort to ensure small businesses have the emergency financial support they need to continuing weathering this time of uncertainty,” said SBA Administrator Jovita Carranza. “SBA has worked expeditiously to ensure our policies and systems are re-launched so that this vital small business aid helps communities hardest hit by the pandemic. I strongly encourage America’s entrepreneurs needing financial assistance to apply for a First or Second Draw PPP loan.”

“We are pleased to have opened PPP loans to CDFIs, MDIs, CDCs, and Microloan Intermediaries. The PPP is already providing America’s small businesses hardest hit by the pandemic with vital economic relief,” said Secretary of the Treasury Steven T. Mnuchin. “As the Program re-opens for all First and Second Draw borrowers next week, the PPP will allow small businesses to keep workers on payroll and connected to their health insurance.”

First Draw PPP Loans are for those borrowers who have not received a PPP loan before August 8, 2020. The first round of the PPP, which ran from March to August 2020, was a historic success helping 5.2 million small businesses keep 51 million American workers employed.

Second Draw PPP Loans are for eligible small businesses with 300 employees or less, that previously received a First Draw PPP Loan and will use or have used the full amount only for authorized uses, and that can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020. The maximum amount of a Second Draw PPP loan is $2 million.

Updated PPP Lender forms, guidance, and resources are available at www.sba.gov/ppp and www.treasury.gov/cares.

The legislation, the Consolidated Appropriations Act, 2021, adds $300 to extended weekly unemployment benefits, and provides more than $300 billion in aid for small businesses. It also ensures tax deductibility for business expenses paid with forgiven Paycheck Protection Program (PPP) loans, provides fresh PPP funding, makes Sec. 501(c)(6) not-for-profit organizations eligible for loans for the first time, and offers businesses facing severe revenue reductions the opportunity to apply for a second loan.

The COVID-19 relief package is tied to a $1.4 trillion resolution to fund the government through September 2021. The Senate approved the bill with a 92-6 vote at about 11:45 p.m. Dec. 21, just a couple of hours after the House approved it 359-53.

Key provisions in the bill include:

$325 billion in aid for small businesses struggling after nine months of pandemic-induced economic hardships. The bill provides more than $284 billion to the U.S. Small Business Association (SBA) for first and second PPP forgivable small business loans and allocates $20 billion to provide Economic Injury Disaster Loan (EIDL) Grants to businesses in low-income communities. In addition, shuttered live venues, independent movie theaters, and cultural institutions will have access to $15 billion in dedicated funding while $12 billion will be set aside to help business in low-income and minority communities.

$166 billion for economic impact payments of $600 for individuals making up to $75,000 per year and $1,200 for married couples making up to $150,000 per year, as well as a $600 payment for each child dependent.

$120 billion to provide workers receiving unemployment benefits a $300 per week supplement from Dec. 26 until March 14, 2021. This bill also extends the Pandemic Unemployment Assistance (PUA) program, with expanded coverage to the self-employed, gig workers, and others in nontraditional employment, and the Pandemic Emergency Unemployment Compensation (PEUC) program, which provides additional weeks of federally funded unemployment benefits to individuals who exhaust their regular state benefits.

$25 billion in emergency rental aid and an extension of the national eviction moratorium through Jan. 31, 2021.

$45 billion in transportation funding, including $16 billion for airlines, $14 billion for transit systems, $10 billion for state highways, $2 billion each for airports and intercity buses, and $1 billion for Amtrak.

$82 billion in funding for colleges and schools, including support for HVAC repair and replacement to mitigate virus transmission, and $10 billion in child care assistance.

$22 billion for health-related expenses incurred by state, local, Tribal, and territorial governments.

$13 billion for emergency food assistance, including a 15% increase for six months in Supplemental Nutrition Assistance Program benefits.

$7 billion for broadband expansion.

The bill includes the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTR) which extends and expands upon the Employee Retention Credit (ERC) provided by the CARES Act.

Beginning on January 1, 2021 and through June 30, 2021, TCDTR extends and expands the following

CARES Act provisions:

- Increases the ERC rate from 50% to 70% of qualified wages (Sec. 207(a)(2)(b)).

- Expands eligibility for the credit by reducing the required year-over-year gross receipts decline from 50% to 20% and provides a safe harbor allowing employers to use prior quarter gross receipts to determine eligibility (Sec. 207(d)(2)(B)).

- Increases the limit on per- employee creditable wages from $10,000 for the year to $10,000 for each quarter (Sec. 207(a)(2)(c)).

- Increases the 100- employee delineation for determining the relevant qualified wage base to employers with 500 or fewer employees (Sec. 207(e)(1)).

- Allows certain public instrumentalities to claim the credit (Sec. 207(d)(3)).

- Removes the 30-day wage limitation, allowing employers to, for example, claim the credit for bonus pay to essential workers.

- Allows businesses with 500 or fewer employees to advance the credit at any point during the quarter based on wages paid in the same quarter in a previous year (Sec. 207(e)(1)).

- Provides rules to allow new employers who were not in existence for all or part of 2019 to be able to claim the credit (Sec. 207(d)(1)(B)); and

- Provides for a small business public awareness campaign regarding availability of the credit to be conducted by the Secretary of the Treasury in coordination with the Administrator of the Small Business Administration (Sec. 207(i)).

- Retroactive provisions. Retroactively effective March 12, 2020, TCDTR:

- provides clarification for the determination of gross receipts for certain tax-exempt organization (Sec. 206(a)).

- reaffirms prior IRS guidance that group health plan expenses can be considered qualified wages even when no wages are paid to an employee (Sec. 206(b); and

- provides that employers who receive a Paycheck Protection Program (PPP) loan may still qualify for the ERC for wages that are not paid for with forgiven PPP proceeds (Sec. 206(c)).

- Disaster relief. Section 303 provides a tax credit for 40% of ages (up to $6,000 per employee) paid by a disaster-affected employer to a qualified employee. The credit applies to wages paid without regard to whether services associated with those wages were performed. Certain tax-exempt entities are provided the option to claim the credit against payroll taxes.

Breaking down the PPP provisions

The return of the PPP is of particular interest to accountants, who played a significant role in helping millions of small businesses acquire $525 billion in forgivable loans during the five months the program was accepting applications, according to SBA reporting. The new round of PPP, or PPP2 as some are calling it, contains many similarities to the first round of the PPP but also has several important differences. The following is a high-level view of the PPP provisions.

Who is eligible to apply

PPP2 loans will be available to first-time qualified borrowers and, for the first time, to businesses that previously received a PPP loan. Specifically, previous PPP recipients may apply for another loan of up to $2 million, provided they:

- Have 300 or fewer employees.

- Have used or will use the full amount of their first PPP loan.

- Can show a 25% gross revenue decline in any 2020 quarter compared with the same quarter in 2019.

PPP2 also makes the forgivable loans available to Sec. 501(c)(6) business leagues, such as chambers of commerce, visitors’ bureaus, etc., and “destination marketing organizations” (as defined in the act), provided they have 300 or fewer employees and do not receive more than 15% of receipts from lobbying. The lobbying activities must comprise no more than 15% of the organization’s total activities and have cost no more than $1 million during the most recent tax year that ended prior to Feb. 15, 2020.

PPP2 will also permit first-time borrowers from the following groups:

- Businesses with 500 or fewer employees that are eligible for other SBA 7(a) loans.

- Sole proprietors, independent contractors, and eligible self-employed individuals.

- Not-for-profits, including churches.

- Accommodation and food services operations (those with North American Industry Classification System (NAICS) codes starting with 72) with fewer than 300 employees per physical location.

The bill allows borrowers that returned all or part of a previous PPP loan to reapply for the maximum amount available to them.

PPP loan terms

As with PPP1, the costs eligible for loan forgiveness in PPP2 include payroll, rent, covered mortgage interest, and utilities. PPP2 also makes the following potentially forgivable:

- Covered worker protection and facility modification expenditures, including personal protective equipment, to comply with COVID-19 federal health and safety guidelines.

- Expenditures to suppliers that are essential at the time of purchase to the recipient’s current operations.

- Covered operating costs such as software and cloud computing services and accounting needs.

To be eligible for full loan forgiveness, PPP borrowers will have to spend no less than 60% of the funds on payroll over a covered period of either eight or 24 weeks — the same parameters PPP1 had when it stopped accepting applications in August.

PPP borrowers may receive a loan amount of up to 2.5 times their average monthly payroll costs in the year prior to the loan or the calendar year, the same as with PPP1, but the maximum loan amount has been cut from $10 million in the first round to the previously mentioned $2 million maximum. PPP borrowers with NAICS codes starting with 72 (hotels and restaurants) can get up to 3.5 times their average monthly payroll costs, again subject to a $2 million maximum.

Simplified application and other terms of note

The new COVID-19 relief bill also:

- Creates a simplified forgiveness application process for loans of $150,000 or less. Specifically, a borrower shall receive forgiveness if a borrower signs and submits to the lender a certification that is not more than one page in length, includes a description of the number of employees the borrower was able to retain because of the loan, the estimated total amount of the loan spent on payroll costs, and the total loan amount. The SBA must create the simplified application form within 24 days of the bill’s enactment and may not require additional materials unless necessary to substantiate revenue loss requirements or satisfy relevant statutory or regulatory requirements. Borrowers are required to retain relevant records related to employment for four years and other records for three years, as the SBA may review and audit these loans to check for fraud.

- Repeals the requirement that PPP borrowers deduct the amount of any EIDL advance from their PPP forgiveness amount.

- Includes set-asides to support first- and second-time PPP borrowers with 10 or fewer employees, first-time PPP borrowers that have recently been made eligible, and for loans made by community lenders.

- Tax deductibility for PPP expenses

**Other notes and considerations

The COVID-19 relief bill clarifies that “no deduction shall be denied, no tax attribute shall be reduced, and no basis increase shall be denied, by reason of the exclusion from gross income provided” by Section 1106 of the CARES Act (which has been redesignated as Section 7A of the Small Business Act). This provision applies to loans under both the original PPP and subsequent PPP loans.

While the CARES Act excluded PPP loan forgiveness from gross income, it did not specifically address whether the expenses used to achieve that loan forgiveness would continue to be deductible, even though they would otherwise be deductible. In April, the IRS issued Notice 2020-32, which stated that no deduction would be allowed under the Internal Revenue Code for an expense that is otherwise deductible if the payment of the expense results in forgiveness of a PPP loan because the income associated with the forgiveness is excluded from gross income for purposes of the Code under CARES Act Section 1106(i).

In November, the IRS then expanded on this position by issuing Rev. Rul. 2020-27, which held that a taxpayer computing taxable income on the basis of a calendar year could not deduct eligible expenses in its 2020 tax year if, at the end of the tax year, the taxpayer had a reasonable expectation of reimbursement in the form of loan forgiveness on the basis of eligible expenses paid or incurred during the covered period.

President Donald Trump signed on Sunday evening a $900 billion pandemic relief bill into law that includes enhanced unemployment benefits and direct cash payments. The measure is the second-largest federal stimulus package after the $2 trillion CARES Act that Congress approved in March.

Lawmakers passed the bill last Monday, just in time to get something done before the end of December, when several aid programs in the CARES Act were set to expire, including key pandemic jobless assistance measures and eviction protections.

Here’s some of the major points:

Stimulus checks

The package sends direct stimulus payments of $600 to individuals, half the amount provided in the first round of checks, which went out in the spring. Eligible families will receive an additional $600 per child — which is $100 more than Congress gave families in the first round of relief last spring. Eligible children are 16 and under on the 2019 Tax Return. If a child was born in 2020, they are not eligible since they are not documented in the 2019 Tax Return.

The payments start phasing out for individuals with adjusted gross incomes of more than $75,000, and those making more than $99,000 will not receive anything. The income thresholds are doubled for couples. The amounts will be based on 2019 incomes. Those who filed their 2019 tax returns will receive their money automatically, as well as Social Security recipients and those who uploaded their bank account information using the IRS’s online portal to receive their first payments.

Undocumented immigrants who do not have Social Security numbers remain ineligible for the payments. But in a change from the first round, their spouses and children are now eligible as long as they have Social Security numbers.

Unemployment benefits

Eligible Unemployed will receive a $300 weekly federal enhancement in benefits through March 14. The amount is half of the earlier federal boost, which ran out at the end of July. Also, the package extends by 11 weeks two other pandemic unemployment programs that were created in the CARES Act in March and were set to expire at year’s end.

- The Pandemic Unemployment Assistance program: initially expanded jobless benefits to gig workers, freelancers, independent contractors, the self-employed and certain people affected by the coronavirus for up to 39 weeks.

- The Pandemic Emergency Unemployment Compensation program: provided an additional 13 weeks of payments to those who exhaust their regular state benefits.

Both programs will now close to new applicants on March 14th but continue through April 5th for existing claimants who have not yet reached the maximum number of weeks.

Also, the measure provides a federally funded $100 per week additional benefit to those who have at least $5,000 in annual self-employment income but are disqualified from receiving Pandemic Unemployment Assistance because they are eligible for regular state unemployment benefits; In addition, the package gives states the authority to waive overpayments in cases where the claimant is not at fault.

The package also continues full federal financing of extended benefits through mid-March, providing up to 20 additional weeks of payments depending on a state’s unemployment rate. Typically, states and the federal government split the tab. Fewer than two dozen states now offer extended benefits because of the improving economy.

Payment Protection Program & Small business loans

The package reopens the Paycheck Protection Program so that some of the hardest-hit small businesses can apply for a second loan. The program stopped taking applications for the first round of loans in August.

The second loans will be limited to those with fewer than 300 employees that have seen drops of at least 25% of their revenue during the first, second or third quarter of 2020. It also reduces the amount a borrower can receive from $10 million to $2 million, gives businesses more flexibility on how they spend the money and simplifies the forgiveness process for loans under $150,000. It carves out $12 billion for minority-owned businesses. It also expands eligibility to more nonprofits as well as local newspapers, TV and radio broadcasters.

Grants for theaters and other live venues

The package creates a $15 billion grant program for live venues, theaters and museum operators that have lost at least 25% of their revenues. The initial grant can total up to $10 million per eligible business. A second grant, worth half the amount of the first, may also be available. The money will be for specified expenses such as payroll costs, rent, utilities and personal protective equipment.

During the first 14 days of the program’s implementation, grants will be awarded to those who have faced 90% revenue losses. Then, those who have experienced at least 70% revenue losses will be eligible during the next two weeks. After the first month of the program, any other eligible businesses can receive grants.

Funding for schools and child care

It provides $82 billion in aid for K-12 schools and colleges. An additional $10 billion is included to support child care providers that have struggled because of the pandemic.

Rental assistance

It extends until January 31 the eviction protection set to expire at the end of the year. It also provides $25 billion in rental assistance for individuals who lost their sources of income during the pandemic.

Federal nutrition assistance

The package raises SNAP benefits by 15% for six months but does not expand eligibility. This is more generous than the original bipartisan agreement from earlier in December, which called for a four-month increase.

It also expands the Pandemic-EBT program to families with children under age 6 who receive food stamps, deeming them “enrolled” in child care and eligible for benefits. The program now provides money to low-income families with school-age children in lieu of the free and reduced-price meals they would have received in school.

The package sends $400 million to food banks and food pantries through The Emergency Food Assistance Program.It also provides $175 million for nutrition services for seniors, such as Meals on Wheels, and $13 million for the Commodity Supplemental Food Program, which serves more than 700,000 older Americans monthly.

Vaccine and hospital funding

It provides $20 billion for the purchase of vaccines so they can be available at no charge for those who need it, as well as another $8 billion for vaccine distribution. It also gives states $20 billion to assist with testing. And it adds $3 billion to the $175 billion fund for hospitals and health care providers for reimbursement of health care-related expenses or lost revenue resulting from the pandemic. The original agreement would have given them another $35 billion.

Payroll tax repayment Employers who are deferring their workers’ payroll taxes under President Trump’s executive action from August now have until the end of 2021 to increase their employees’ withholding to pay back the taxes owed. Originally, the deferred amount

Revisions to Loan Forgiveness and Loan Review Procedures were issued on Thursday, October 8. In these revisions made by the Small Business Administration (SBA) and the Treasury Department, recipients of Paycheck Protection Program (PPP) loans of $50,000 or less will be able to apply for forgiveness using a simplified application. The new application, Form 3508S, is one and a half pages long and requires the borrower to verify that the amount that is being requested for forgiveness is in accordance with PPP requirements. Documentation consists of payroll and non-payroll costs such as mortgage interest payments, rent, or utility costs.

Looking at the instructions to Form 3508S, it is clear that for borrowers who fall into this category of having PPP loans of $50,000 or less will not receive automatic forgiveness. The good news is that the standard application for forgiveness (Form 3508) is long, confusing, and time-consuming, however, the new form completely removes this. This simplified application incorporates a new interim final rule (IFR) providing new guidance concerning forgiveness and loan review processes. Specifically, a borrowers of a PPP loan of $50,000 or less is no longer required to reduce the amount eligible for forgiveness if the borrower:

- Reduces the salary or hourly wage of an employee (who earned less than $100,000 in 2019) during the “covered period” following the borrowing relative to the first quarter of 2020, or

- Reduces full-time equivalent employees (FTEs) during the covered period relative to a base period.

Meaning, that borrowers are exempt from the PPP requirement that FTE employee numbers pre-pandemic must remain the same during the covered period as well as not reducing employee wages. The CARES Act (Section 1106) gave the authority to the SBA Administrator as well as the Treasury Department to create such exemption.

Aside from those very important exemptions, the application process is largely the same. Borrowers must still compute the amount that they are eligible for forgiveness, but now borrowers do not have to show their math. However, that math should stay readily available in case the SBA requests it at any time.

The SBA is currently processing these forgiveness claims. Borrowers that seek forgiveness must submit a form and accompanying documents within 10 months from the end of their covered period. The lender will then have 60 days to determine whether the loan was forgiven.

There have been 5.2 million approved PPP loans, 3.57 million of which were for $50,000 or less. These loans accounted for $62 billion of the allotted $525 billion in PPP loans. This new forgiveness application can help millions of borrowers.

For those who are not eligible to use the Form 3508S and, instead, have to use Form 3508, a set of step-by-step instructions which is linked here.

For use of any of the forms mentioned here, please see below:

Submitted by: Kendra May

After meeting every day for more than a week, Nancy Pelosi (House Speaker, D-California), Chuck Schumer (Senate Minority Leader, D-New York), Steven Mnuchin (Treasury Secretary), and Mark Meadows (White House Chief of Staff) are trying to find a compromise between the

Democrats’ $3 trillion proposal and the Republicans’ $1 trillion package. While negotiations are still going on, the framework for the next stimulus package called the March to Common Ground has been released. The March to Common Ground includes proposals and key compromises from both parties. The Proposals are being led by Representative Josh Gottheimer (D-New Jersey) and Representative Tom Reed (R-New York) and are being supported by 50 lawmakers—25 Democrats and 25 Republicans.

THE MARCH TO COMMON GROUND

The United States Treasury has already claimed they would accept a $1.5 trillion deal, however the Democrats may have to make more compromises for the deal to go through. As of right now, all eyes are on the Democrats to see if there will be a successful compromise. The framework for the March to Common Ground includes:

- $1,200 second stimulus checks and $500 per child and dependent adults

- $450-$600 weekly unemployment benefits

- $500 billion to state and local governments

- $290 billion for Paycheck Protection Program and other small business programs

- $100 billion for virus testing and tracing and public health

- $25 billion for mortgage and rental assistance

- $145 billion for schools and child care

- $25 billion for broadband, agriculture, Postal Service and Census

- $11 billion for WIC and SNAP assistance

- $400 million for 2020 elections

- Student loan forbearance through December 31, 2020

- Worker and Liability Protections

PAYCHECK PROTECTION PROGRAM

The Paycheck Protection Program (PPP) was created to help small businesses during the COVID-19 pandemic. It is a loan program designed to provide a direct incentive for small businesses to keep their workers on the payroll to reduce unemployment. Most small businesses who took out a PPP loan earlier in the year have exhausted the resources, and for many, the company and their employees are hanging in the balance.

A major component of the March to Common Ground relief framework includes $290 billion for the PPP and other small business programs. $240 billion of this fund is allotted for the PPP which will allow small businesses to take out a second PPP loan and will allow for a simplified forgiveness process. In addition, $50 billion has been allotted for the Targeted Employee

Retention Tax Credit (ERTC).

ANOTHER DELAY TO THE BILL

On Tuesday, September 22, House of Representative leaders abruptly delayed plans for a floor vote on a stopgap funding measure that is needed to avoid a partial government shutdown. Even with the stopgap funding measure passed in the House, it still needs to be approved by the Senate and President Trump to ensure the government does not have a shutdown in eight days. Continual hiccups of this nature will slow down congressional leaders and their approval of the March to Common Ground as well as other bills.

Submitted by:

Kendra May

- 1

- 2