Discovering Financial Excellence: Why DRDA’s Tailored Solutions Stand Out

By: Eva Jiang, M.B.A., M.S.

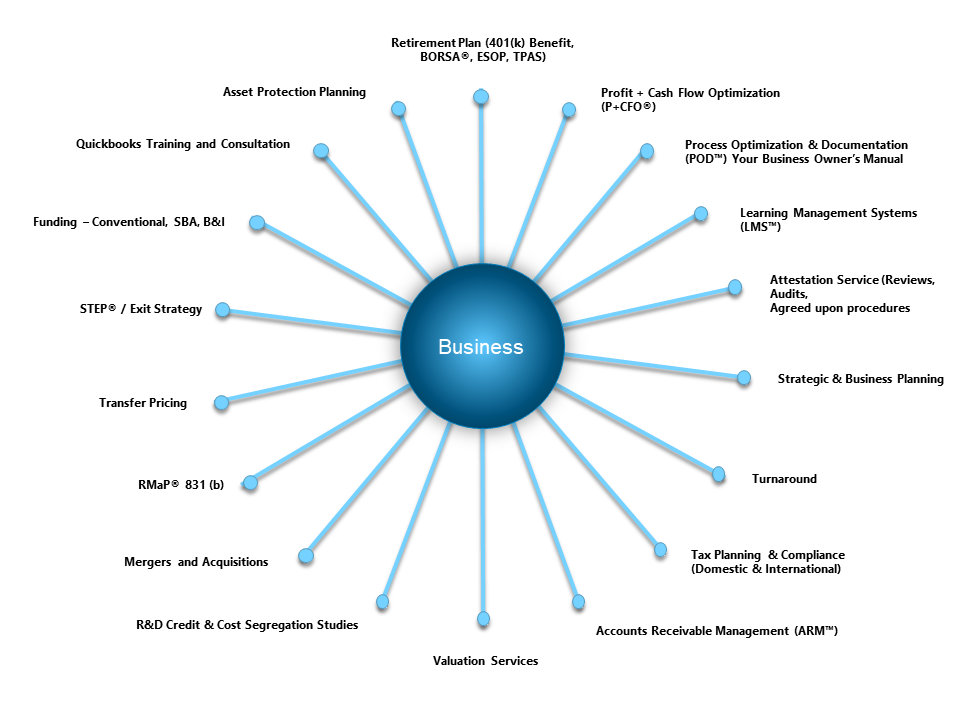

Looking for financial services that exceed expectations? Look no further than DRDA. Our comprehensive range of services encompasses tax planning and compliance, audit, accounting, bookkeeping, QuickBooks, 401(k) plan, Third Party Administration, BORSA® implementation, Operation and Exit, Profit and Cash Flow Optimization (P+CFO®), and Business Value Acceleration.

DRDA Wheel of Services

Because of our commitment to professionalism and uniqueness, we offer several trademarked services, including RMaP, BORSA, STEP, P+CFO, ARM, POD and LMS. At DRDA, we pride ourselves on our ability to make a difference in our clients lives. These trademarked services represent our dedication to providing cutting-edge solutions that are tailored to the needs of each client.

When you choose DRDA, you’re not just getting cookie-cutter solutions. Our team understands that every business is unique, which is why we take the time to truly understand your individual needs. We believe in open communication and collaboration across departments, ensuring that your experience with us is seamless and efficient.

Our tax services cover everything from planning and compliance to resolution, helping you navigate complex tax laws to minimize liabilities and maximize savings.

Our accounting services are tailored to your specific needs, providing accurate and reliable financial reporting. From auditing, assurance and financial statement preparation to budgeting and forecasting, our team helps you understand and trust your business information systems.

Our bookkeeping services ensure that your financial records are organized and up-to-date, allowing you to focus on what you do best – running your business. And if you use QuickBooks, our consultants can optimize your software usage, from setup and customization to training and ongoing support.

In addition to traditional services, our business advisory team offers strategic guidance to drive growth and profitability. Whether you need help with TPAS (Third-Party Administrative Services), retirement plan, BORSA® implementation (ROBS), business planning, performance analysis, or risk management, we’ve got you covered.

At DRDA, we don’t believe in a one-size-fits-all approach. DRDA Business Solutions are tailor-made for your business, saving you time and money while ensuring maximum efficiency and effectiveness.

Of the more than 46,000 CPA firms in the United States, DRDA has been recognized as one of the Top 500 CPA Firms in the United states by Inside Public Accounting, DRDA is ready to serve you. Visit our website at www.drdacpa.com to learn more about how we can help you and your business succeed and thrive.

By: Eva Jiang, M.B.A., M.S.

- Published in P+CFO™, ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business, Tax

Three reasons business owners should consider Cash Balance Plans

By: Bryan Uecker

Over the last half-century, employers shifted most of the retirement plans away from employer-funded pension plans (defined benefit) to employee/employer-funded savings plans such as the 401(k) (defined contribution). Defined contribution plans continue to eclipse defined benefit plans by an ever-widening margin when considering the number of plans and total assets. However, one defined benefit plan is getting some recent attention: the Cash Balance Plan. Here are three reasons why:

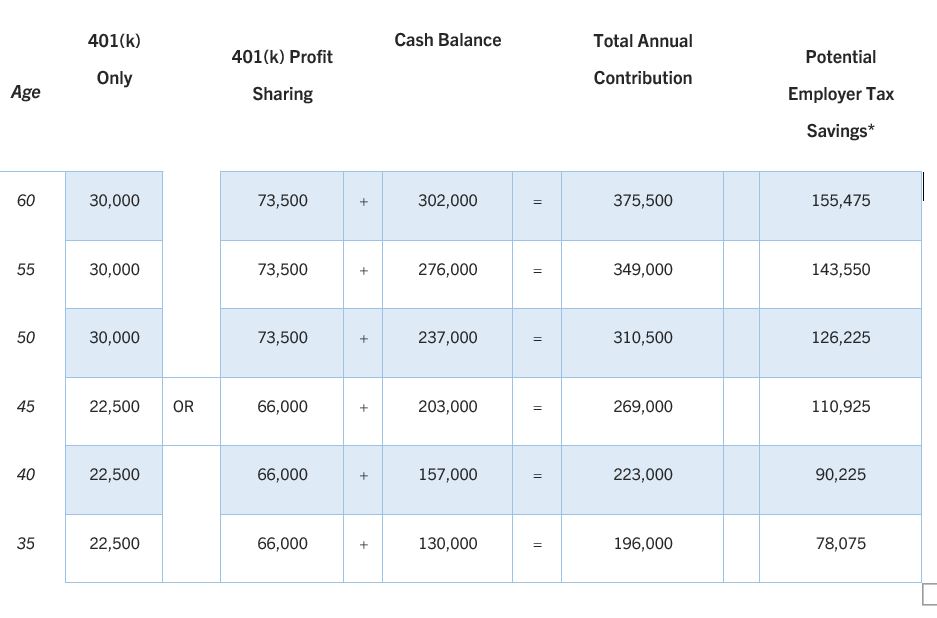

1: Business owners can accumulate more for retirement and reduce current taxes.

The biggest attraction of a cash balance plan is that key employees can typically contribute more – often much more – to the plan. Look at the following table. A 60-year-old owner or key employee could contribute up to $30,000 in 401(k), or up to $73,500 if the 401(k) has a profit-sharing component. Adding the cash balance to the 401(k)-profit sharing plan would allow total employee and employer contributions of up to $375,500.

Moreover, employer contributions are deductible for the business. This means an employer could have saved over $155,000 in taxes on that same 60-year-old.

2023 contribution limits. 401(k) limit includes annual catch-up contributions for participants aged 50 or older. For illustrative purposes only. Actual results may vary depending on the plan design, participant compensation, employee demographics, and projected retirement age.

*Based on assumed combined federal and state tax rate of 45%. Calculation uses “Total Annual Contribution” excluding 401(k) contributions.

2: Easy to understand and portable.

A cash balance plan is a defined benefit plan in which an employer credits a participant’s account with a “pay credit” (a percentage of pay or a flat dollar amount) and an “interest credit” (either a fixed or a variable rate). The lumpsum benefit at retirement equals the “account balance” which is the accumulation of all annual pay and interest credits. To the participant, it looks and feels like an interest-bearing savings account with annual deposits and earnings.

In a traditional defined benefit plan, the “goal” or the “what” that’s being defined is a monthly pension amount payable for life at retirement age. The annual funding needed is based on whatever amount it takes to accumulate enough to pay out the promised benefits on the promised retirement dates. It’s not rocket science, but it takes an actuary to determine the present value of all future benefits and compare it with the plan’s current assets. The actuary must make assumptions about current and future interest rates, mortality, turnover, inflation, salary increases, etc.

In a cash balance plan, the present value of benefits is in the ballpark of the sum of the “account balances”. The annual contribution is in the ballpark of the sum of the “pay credits” for the year. The actuary keeps a tally of how the plan assets fare in reality compared to the “interest credit” for the year and adds plus or minus to the mix.

The cash balance plan is portable. Most defined benefit plans have a default payment of an annuity for life, the default payout for most cash balance plans is a lump sum that can be rolled into an IRA.

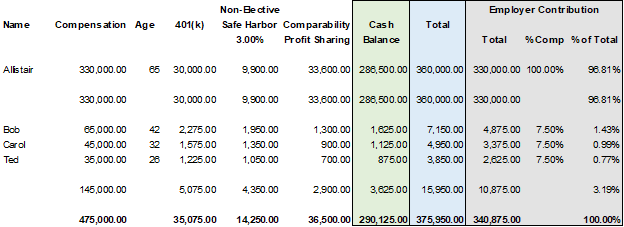

3: Allows for multiple employee groups with different contribution rates.

A cash balance plan works beautifully with a “new-comparability” or “cross-tested” profit sharing plan. Because a cash balance plan can be combined with a profit sharing plan for non-discrimination testing, employers with a cross-tested profit sharing typically requiring an allocation of 5% of compensation to non-highly-compensated employees in order to max-out contributions to key employees, can supercharge the amounts to key employees while sometimes only raising contribution requirements to non-highly-compensated employees by 2.5%.

2023 contribution limits. 401(k) limit includes annual catch-up contributions for participants aged 50 or older. For illustrative purposes only. Actual results may vary depending on the plan design, participant compensation, employee demographics, and projected retirement age.

Please note that for certain plans that are not covered by the PBGC (e.g., owner-only/spouse plans and certain professional services businesses, etc.), employer contribution amounts to a 401(k)/profit sharing plan may be limited to an IRS deduction limit of 6% of total eligible compensation.

In the above scenario, the non-highly compensated employees can defer up to the maximum 401(k) contribution of $22,500. They all receive employer contributions totaling 7.5% of compensation made up of a 3% non-elective safe harbor, a 2% profit sharing, and a 2.5% cash balance. The owner can defer $30,000 in 401(k), including a $7,500 catch-up. In addition, he can receive an employer contribution equal to 100% of compensation made up of a 3% non-elective safe harbor, ~10% profit sharing, and ~87% cash balance.

Frequent questions about cash balance plans.

Aren’t fees to administer cash balance plans expensive? The annual 5500 requires an attachment called Schedule SB which reports the funding adequacy of the defined benefit plan. An enrolled actuary must certify the figures and assumptions on the form. The need for an actuary adds a cost for cash balance plans that isn’t needed for most defined contribution plans. However, because the cash balance plan is usually valued once a year by the actuary and TPA (Third Party Administrator), and the assets are pooled, there is no need for a third-party recordkeeper, and the investment fees are typically lower than 401(k) plans.

Are annual contributions to a cash balance plan mandatory? Except for safe harbor plans, contributions to a defined contribution plan are usually discretionary meaning if the employer chooses not to contribute every year they don’t have to. For the cash balance plan, the actuary will calculate a minimum and maximum funding range every year and the employer must meet at least the minimum funding requirement.

What is the deadline to set up a new cash balance plan? Before 2020, a new cash balance plan had to be adopted by the last day of the plan’s first year. Thanks to the SECURE Act, business owners can adopt a cash balance plan until the entity’s tax filing deadline (including extensions) for the plan’s first year. Because of the time needed to prepare the plan document, calculate the required contribution, and fund the contributions to the trust by the deadline, however, plan on a couple of months lead time.

Can a cash balance plan use a vesting schedule? Yes. Most plans use a “three-year cliff” vesting schedule. 0% vested for years one and two and 100% vested with three years of service.

Why DRDA? DRDA has spent decades developing real world solutions to everyday business issues. As technology, resources and awareness change, our solutions are updated, introduced or replaced to make certain we offer the best solution today. DRDA takes a holistic view of the business owners’ situation including a comprehensive financial and tax strategy – encompassing both personal and business. We offer integrated solutions that save time and money such as bookkeeping, payroll, and retirement plans. This is all in service of creating better futures for our clients. Where do you want to go from here? Let us help you get there.

For an illustration call (281) 488-2022 or email bryan.uecker@drdacpa.com.

- Published in ROBS 401(k)

A robust and efficient payroll system is a vital component of any successful business.

By: Agustin Muniz

A robust and efficient payroll system is a vital component of any successful business, regardless of its size. The significance of utilizing a payroll system cannot be overstated, as it not only ensures accurate and timely payment to employees but also streamlines various critical aspects of human resources and financial management. Here are some compelling reasons why businesses should prioritize the implementation of a reliable payroll system:

- Accuracy and Compliance: Payroll systems automate the payroll process, reducing the risk of human errors in calculations. By accurately computing wages, taxes, and deductions, businesses can avoid costly mistakes and maintain compliance with ever-changing labor laws and tax regulations.

- Time and Cost Savings: Manual payroll processing can be time-consuming, diverting valuable resources away from core business activities. A dedicated payroll system automates repetitive tasks, saving time and allowing HR and finance teams to focus on strategic initiatives and employee development.

- Enhanced Data Security: Employee payroll data is sensitive and must be safeguarded. Payroll systems incorporate robust security measures, protecting confidential information from unauthorized access and potential breaches, thus mitigating the risk of data theft and legal ramifications.

- Employee Satisfaction and Retention: A timely and accurate payroll process boosts employee morale and satisfaction. By ensuring employees are paid accurately and on time, businesses create a positive work environment and foster higher levels of employee loyalty and retention.

- Improved Reporting and Analytics: Payroll systems provide comprehensive reporting capabilities that enable businesses to gain insights into labor costs, tax liabilities, and other financial metrics. Such data-driven insights empower businesses to make informed decisions and devise effective strategies for growth and profitability.

- Seamless Integration: Many modern payroll systems can seamlessly integrate with other HR and financial software, streamlining data flow and eliminating data silos. This integration enhances overall operational efficiency and data accuracy throughout the organization.

- Scalability and Flexibility: A good payroll system can adapt to the evolving needs of a growing business. As the organization expands, the payroll system can accommodate new hires, additional benefits, and complexities without disrupting the payroll process.

In conclusion, implementing a reliable payroll system is not merely an option for businesses but a necessity. The advantages it offers, such as accuracy, cost savings, data security, employee satisfaction, and operational efficiency, make it an indispensable tool in today’s competitive business landscape. By investing in a robust payroll system, businesses can streamline their operations, reduce administrative burdens, and focus on their core competencies, ultimately driving growth and success in the long run.

By: Agustin Muniz

- Published in ROBS 401(k)

What is ERISA and how does it benefit your business?

By: Agustin Muniz

The Employee Retirement Income Security Act (ERISA) is a significant federal law that sets standards for employee benefit plans offered by private employers. Enacted in 1974, ERISA aims to protect the rights and interests of employees who participate in retirement plans, health insurance programs, and other welfare benefit plans. ERISA was enacted to establish minimum standards for employee benefit plans to safeguard the financial security and welfare of employees. It applies to private-sector employers that offer employee benefit plans, including pension plans, 401(k) plans, health insurance plans, and other welfare benefit plans. ERISA does not cover government plans, church plans, or plans maintained outside the United States for non-resident aliens.

One of the central aspects of ERISA is the imposition of fiduciary standards on those who manage and control employee benefit plans. Fiduciaries, such as plan administrators, trustees, and investment managers, are legally obligated to act in the best interests of the plan participants and beneficiaries. They must exercise prudence, loyalty, and diligence in managing the plan and its assets. ERISA mandates various reporting and disclosure requirements to ensure transparency and accountability in employee benefit plans. Employers are required to provide plan participants with essential information, including plan features, funding mechanisms, investment options, and potential risks. This includes distributing Summary Plan Descriptions (SPDs), Summary Annual Reports (SARs), and other disclosures to participants. ERISA includes provisions that protect employees’ rights to their accrued benefits. The law establishes rules for vesting, which determines when employees become entitled to receive their full pension benefits. Additionally, ERISA created the Pension Benefit Guaranty Corporation (PBGC), a federal agency that provides a safety net by insuring certain pension benefits in case of plan termination.

ERISA provides mechanisms for enforcing compliance and addressing fiduciary breaches or plan violations. The law grants authority to the Department of Labor (DOL) to oversee and enforce ERISA provisions. Participants and beneficiaries also have the right to bring lawsuits to enforce their benefits and seek remedies for fiduciary breaches or other violations of ERISA.

ERISA has had a profound impact on employee benefit plans and the retirement landscape in the United States. It has helped establish standards of conduct for fiduciaries, promote transparency in plan administration, and provide avenues for legal recourse in case of misconduct. ERISA has also facilitated the growth of retirement savings plans like 401(k) plans, providing individuals with tax advantages and investment opportunities to build their retirement nest eggs. The Employee Retirement Income Security Act (ERISA) serves as a crucial framework for regulating private-sector employee benefit plans, ensuring the protection of employees’ rights and interests. By establishing fiduciary responsibilities, reporting requirements, and benefit security measures, ERISA promotes transparency, accountability, and the long-term financial security of plan participants. Understanding the key provisions of ERISA is essential for both employers and employees to navigate the complex landscape of employee benefits effectively.

For more information on ERISA and how DRDA, LLC can help please click here.

- Published in ROBS 401(k), Uncategorized

Introducing expanded services and New Team Members!

By: Agustin Muniz

We wanted to take a moment to share some exciting news with you regarding our services and new team members. As part of our ongoing commitment to build sustainable value for your business and to secure a promising future for you, your family, and your employees, we have expanded our offerings to include not only tax planning and bookkeeping, but payroll, and employee benefits – all designed to meet your needs while saving you time and money. It is our pleasure to welcome Bryan Uecker and Carrie Wright as members of the team that will support you and your business.

Bryan Uecker QPA, QPEC, AIF, AIFA

BORSA Manager & Retirement Plans

Bryan, a 30-year veteran of employee benefits, will be heading up BORSA and Retirement Plan design and compliance. With his expertise and experience, he brings a wealth of knowledge and a new perspective to our organization. As you know, the BORSA plan is a fantastic way to fund your business. But that is only the first stage! Bryan will be working with you to maximize the value of your plan through additional tax savings and allocation strategies.

*Click image to view profile

Carrie Wright EA

Tax Senior

Carrie is a seasoned tax practitioner and federally- credentialed Enrolled Agent tasked with finding the best result with your tax filings. She is at your service for any questions you may have regarding your business and saving taxes. She is eager to learn more about your organization and how we can support your growth and success.

*Click image to view profile

We genuinely appreciate your continued trust in DRDA, LLC as we strive to proactively improve your future, not just account for the past.

If you would like to take a look at our payroll and bookkeeping services to see how it could streamline your business processes, please reach out for a quote (or click the button below).

- Published in ROBS 401(k), Uncategorized

Using Rollovers for Business Start-ups (ROBS) such as DRDA’s, LLC BORSA™ Plan

Click here to register for the Webinar

To finance a business isn’t new, but it is unfamiliar to many. As a result, there are a lot of myths swirling around about the use of ROBS structures that may be stopping would-be entrepreneurs from chasing their dreams. BORSA Plans involve using money from an eligible retirement account to finance the purchase of a business or franchise. To summarize, a corporation is formed, and that corporation then sponsors a 401(k) plan. Funds are rolled from an existing retirement account into the new 401(k) without triggering a taxable distribution. This new 401(k) purchases (or invests in) shares of the corporation, which can then purchase a business or franchise. In essence, a BORSA™ Plan allows you to invest in your own business where you have control rather than investing in the market where you have no control. Here’s the truth behind the most common ROBS myths:

- It’s not tax avoidance.

Using a BORSA™ Plan isn’t a way to evade taxes by any means. The Employee Retirement Income Security Act of 1974 (ERISA) was set up explicitly to encourage investment in small businesses – businesses that pay taxes.

- BORSA™ Plan is an investment, not a loan.

With a BORSA™ Plan, you’re investing in your new business or franchise, not taking on debt. This means you won’t have to make monthly loan payments or incur interest.

- You can use a BORSA Plan to diversify your nest egg.

You don’t have to take every penny from your existing retirement fund for a BORSA™ Plan to work. Many people only use a portion of their retirement assets, and this arrangement can be used in conjunction with a small business loan or other financing option. So, you can diversify your investments.

- Getting funded using a BORSA™ Plan can take as little as four weeks.

Depending on the state in which you’re filing, and how fast you’re able to file the necessary paperwork, funding can take as little as a few weeks. Most are completed in less than 30 days.

- BORSA Plans are not the same as Self-directed IRAs.

While it’s possible to finance a business with both self-directed IRAs and a BORSA™ Plan, there are some major differences between the two. If you use an SDIRA, the owner may not work for the business or take a salary. The investment amount is also potentially liable for the unrelated business income tax (UBIT), which can get very expensive. With the BORSA™ Plan, the 401(k) owner must work for the new business, and UBIT doesn’t apply.

- A BORSA™ Plan can be used to fund start-ups.

A BORSA™ Plan is a great option to finance not only start-ups, but also purchases of existing businesses and franchises. To some, the BORSA process can appear to have complex rules and regulations. But if you have a qualified retirement plan with a balance that’s sufficient for your start-up needs and work with an experienced company to support its formation, it can be a great option to start or re-capitalize your business debt-free.

- Published in ROBS 401(k), Uncategorized

Lost Your Job Due to The Pandemic? Start, Purchase or Fund your own business today.

Lost your job due to the pandemic? You’re not alone.

Research shows that, as of July 2021, unemployment rates have not yet recovered (5.4% vs. 3.5% pre-pandemic). There’s no better time to get started investing in your own business with DRDA’s BORSA™ plan.

Avoiding Early Withdrawal Taxes & Penalties

Normally, if you withdraw money from your 401(k) before the age of 59½, you are liable to pay income taxes and a 10% early withdrawal penalty on your money. The Business Owners Retirement Savings Account will allow you to take control of your 401(k), IRA, or other qualified funds and use them to start, purchase, or fund a business tax or penalty free.

What types of funds are eligible?

Not only does the BORSA™ Plan work with a traditional 401(k), DRDA can also assist you with rolling over the following into a business:

- 401(a)

- 403(b)

- 457

- IRAs ( with exceptions for Roth or Non-spousal inherited IRAs)

- Pension

- Profit Sharing

- ESOP

- Annuities

- Thrift Savings Plans

I’m ready to start my business! How does this process work?

- Form a new C Corporation

- The new C Corp. will establish a 401(k) Profit Sharing plan

- Existing retirement funds will be rolled over into the new 401(k) plan

- Participants in the 401(k) plan will invest in stock of the newly formed C Corp.

This process typically takes around 30 days from the initial engagement, to the time you will receive your funds in hand.

Have more questions, comments, or are you ready to get started?

If you’re ready to get started or have any additional questions, please register for our FREE webinar (September 8th, 1pm CST & September 9th, 5pm CST) below:

- Published in Business Lending, ROBS 401(k), ROBS 401k Provider, Uncategorized

Finance Your New Business During the Pandemic

BORSA, finance your new business during the pandemic

How can you make BORSA work for you? Now may be a great time to explore ROBS, or the Rollover Business Startup Solution and what it can do for you during the pandemic.

Key Points

- Start a new business or franchise

- Legally pay yourself a salary

- Abide by IRS and ERISA guidelines

What is the BORSA Plan?

The BORSA (Business Owners Retirement Savings Account) is DRDA’s, LLC Solution otherwise known as ROBS (Rollover Business Startup Solution), an IRS and ERISA approved structure that allows investors to use their retirement funds for a new business or franchise that they will be personally involved in. It is the primary way a retirement plan holder can have personal involvement in a business utilizing their retirement funds, without triggering IRC prohibited transaction rules.

Setting up a BORSA Plan requires planning but can be accomplished in relatively few steps.

- Set up a C Corporation – The process begins by establishing the new corporation, using the proper legal structure to support the establishment and operation of the company’s qualified retirement plan.

- Rollover your funds – Transfer your funds from an old IRA or 401(k) plan into a new 401(k) plan that the stock of the start-up C corp. business sponsors or adopts.

- Start earning a salary – You must be an employee of your new business and provide a legitimate service. Your compensation must come from your business.

How Do BORSA and Pandemic Relate?

While there’s a pandemic, millions are losing their jobs and joining the ranks of the unemployed. More than ever, many are trying to rely on themselves and not some corporate entity that must make difficult decisions to comply with federal and state mandates affecting individual earning, security, and livelihood. Using BORSA can be an ideal way to start the business of your dreams with money you already have.

BORSA can help you fund a new business or franchise with retirement funds, and that means you’re starting on your way to owning and fulfilling your goals. When COVID-19 hit, no one could have anticipated it would bring the unprecedented upheaval of everyday life that it has.

How Does BORSA Work?

The BORSA Plan allows an investor to create a C Corporation, and the C Corp’s profits are taxed separately from the owner as it is owned by shareholders. Next, funds are transferred from an old IRA or 401(k) plan. Then, as an employee providing a legitimate service, you are able to earn a salary at the business you’ve created.

There are very specific IRS and ERISA rules that have to be followed, and for this reason guidance is recommended. DRDA, LLC can help you get started. When it’s time for your new company’s stock to get valuated by the IRS, DRDA, LLC will help value the stock of the new or existing company.

BORSA Benefits

More than almost anything else, Americans are looking to make certain they can make it through the pandemic, civil unrest, and the whole of the current situations currently embroiling the nation. For those who have lost their jobs and have been unable to find replacement work, tapping into their retirement funds have been one source of income to help. But what happens when the funds have been depleted?

More than just taking funds out, though, BORSA can help you open a franchise or start a new business you can own yourself. Your money is helping you and your family first. The primary benefit of using the BORSA Plan is that you can employ it to use your retirement funds to invest in a business you will be personally involved in. You can do this without paying tax on the retirement funds you wish to use as a distribution.

Additionally, investing in yourself within your retirement portfolio is an excellent way to diversify. Your investments in traditional assets such as stocks and bonds, and alternative assets such as cryptocurrency, exist separately, and you can fund your own business as well. This may protect investment portfolios as a whole during times of unrest and market volatility,

During the COVID-19 and now the Delta Variant financial crisis, it’s important to know where your money is and what it’s doing. While investing in the market and traditional assets can bring you financial success, it’s very volatile at this time. Alternative assets like real estate can help diversify your portfolio. And using the BORSA Plan to fund your dreams can help you even more.

If you are interested in receiving more information on the BORSA™ plan, DRDA, LLC will be hosting a webinar on September 8th and 9th, 2021.

Click Here to sign up and access this FREE webinar.

- Published in Business Lending, ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business, Uncategorized

Using 401(k)/IRA Funds to Start or Buy a Business

Using Rollovers for Business Start-ups (ROBS) such as DRDA’s, LLC BORSA™ Plan

to finance a business isn’t new, but it is unfamiliar to many. As a result, there are a lot of myths swirling around about the use of ROBS structures that may be stopping would-be entrepreneurs from chasing their dreams.

BORSA Plans involve using money from an eligible retirement account to finance the purchase of a business or franchise. To summarize, a corporation is formed, and that corporation then sponsors a 401(k) plan. Funds are rolled from an existing retirement account into the new 401(k) without triggering a taxable distribution. This new 401(k) purchases (or invests in) shares of the corporation, which can then purchase a business or franchise.

In essence, a BORSA™ Plan allows you to invest in your own business where you have control rather than investing in the market where you have no control. Here’s the truth behind the most common ROBS myths:

- It’s not tax avoidance.

Using a BORSA™ Plan isn’t a way to evade taxes by any means. The Employee Retirement Income Security Act of 1974 (ERISA) was set up explicitly to encourage investment in small businesses – businesses that pay taxes. - BORSA™ Plan is an investment, not a loan.

With a BORSA™ Plan, you’re investing in your new business or franchise, not taking on debt. This means you won’t have to make monthly loan payments or incur interest. - You can use a BORSA Plan to diversify your nest egg.

You don’t have to take every penny from your existing retirement fund for a BORSA™ Plan to work. Many people only use a portion of their retirement assets, and this arrangement can be used in conjunction with a small business loan or other financing option. So, you can diversify your investments. - Getting funded using a BORSA™ Plan can take as little as four weeks.

Depending on the state in which you’re filing, and how fast you’re able to file the necessary paperwork, funding can take as little as a few weeks. Most are completed in less than 30 days. - BORSA Plans are not the same as Self-directed IRAs.

While it’s possible to finance a business with both self-directed IRAs and a BORSA™ Plan, there are some major differences between the two. If you use an SDIRA, the owner may not work for the business or take a salary. The investment amount is also potentially liable for the unrelated business income tax (UBIT), which can get very expensive. With the BORSA™ Plan, the 401(k) owner must work for the new business, and UBIT doesn’t apply. - A BORSA™ Plan can be used to fund start-ups.

A BORSA™ Plan is a great option to finance not only start-ups, but also purchases of existing businesses and franchises.

To some, the BORSA process can appear to have complex rules and regulations. But if you have a qualified retirement plan with a balance that’s sufficient for your start-up needs and work with an experienced company to support its formation, it can be a great option to start or re-capitalize your business debt-free.

Are you interested in learning more about DRDA’s, LLC ROBS structure, the BORSA™ Plan? Give our experienced team a call today 281-488-2022 for a free consultation

- Published in ROBS 401(k), Small Business, Starting a Business, Tax, Uncategorized

Your BORSA Plan and the CARES Act

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was enacted to address the

financial difficulties that have resulted from the COVID‐19 pandemic. Included in this law were provisions that

provide special coronavirus related distributions (CRD) for qualifying plan participants. Below is a brief summary of the new CRDs available and new loan provisions to qualifying participants.

Coronavirus Related Distribution:

Qualifying participants can request a distribution of up to $100,000 from the retirement plan without incurring a

10% early distribution penalty. There is no age requirement and you can take coronavirus‐related distributions

whether actively employed or not. You can request the entire amount in a one lump sum, or multiple payments, but all must be taken by no later than December 30, 2020.

There is a federal tax withholding requirement of 10%, but you may choose to waive it completely or withhold a

different amount at the time of distribution. The amount of distribution is subject to federal tax, but you will be able to spread the taxes owed on the distribution over three years.

You may repay the entire amount distributed to you within three years. This opportunity allows you to repay

some or all of the distribution to any qualified plan or IRA that accepts rollovers as a way to minimize your income

tax liability. This is different than a loan in that there is no interest and no periodic payment requirement, and the

ability to repay does not require an election at the time of distribution. Repayment can be in a single lump sum or

via installments of different amounts at different times, but the repayment window only runs for three years from

the date you first receive the distribution.

It is important to emphasize that this new CRDs only apply to individual plan participants that meet certain requirements. If you should choose to utilize either of these provisions, you must certify that you meet one or more of the conditions listed below.

You have experienced adverse financial consequences as a result of:

• having been diagnosed with SARS‐CoV‐2 or COVID‐19 by a test approved by the Centers for Disease Control and

Prevention,

• a spouse or other dependent (as defined in section 152 of the internal revenue code) being diagnosed with

SARS‐CoV‐2 or COVID‐19 by a test approved by the Centers for Disease Control and Prevention,

• being quarantined,

• being furloughed,

• being laid off or having work hours reduced,

• being unable to work due to a lack of childcare,

• being an owner of a business who has had to close the business or reduce hours worked in the business due to

the COVID‐19 virus.

Increase of Maximum Loan Amount

Under current rules the maximum loan amount available is the lesser of 50% of vested account balance or $50,000

reduced by the highest outstanding loan amount in the previous 12 months. The new rule increases the maximum

loan amount to the lesser of 100% of vested account balance or $100,000 reduced by the highest outstanding loan

in the previous 12 months. This provision has been incorporated into our plan but will expire on September 23, 2020.

The loan must still meet all other requirements and limitations set forth under the plan.

Loan Payment Suspension

Qualifying participants who currently have loans outstanding or who take new loans can suspend their loan

payments for the remainder of 2020. It is important to know that interest will continue to accrue on any loan where

payments are suspended.

Re‐Amortization of Loans with a Final Payment Date that is Later than 12/31/2020:

If a loan is suspended under

this provision, the loan will be re‐amortized to include the accrued interest and extend the loan duration for 12

months beyond the original final loan payment date. This re‐amortization will result in a new loan payment amount.

Payments, using this new payment amount, will begin as of the first payment due date in 2021.

Example: Loan with an original first payment date of 3/15/2018 with a final payment date of 3/15/2021. Payment

is suspended as of 4/15/2020 for the remainder of 2020. New payment is calculated by including the accrued

interest for the period 4/15/2020 through 12/31/2020 and by extending the final payment date to 3/15/2022.

Payments resume on 1/15/2021, using the new payment amount.

Re‐Amortization of Loans with a Final Payment Date of prior to 12/31/2020:

If a loan is suspended under this

provision, the loan will be re‐amortized to include the accrued interest and extend the loan duration for 12 months

beyond the original final loan payment date. This re‐amortization will result in a new loan payment amount.

Payments, using this new payment amount, will begin 12 months after the date of the suspension.

Example: Loan with an original first payment date of 9/30/2017 with a final payment date of 9/30/2020. Payment

is suspended as of 4/15/2020 for the remainder of 2020. New payment is calculated by including the accrued

interest for the period 4/15/2020 through 3/31/2021 and by extending the final payment date to 9/30/2021.

Payments resume on 4/15/2021, using the new payment amount.

Please note that this document was prepared based on our best interpretation of the law. Additional guidance from regulators is likely. This guidance may result in the information presented in this document being inaccurate.

If we receive information that is conflicting with what we have stated here we will send that information to you and post it on our website www.drdacpa.com. In the interim, please call us if you have any questions or if we may be of any assistance.

- Published in Business Lending, ROBS 401(k), ROBS 401k Provider, Small Business