DRDA, LLC Was Awarded the BBB Pinnacle Award for Excellence in Accounting/Taxes for 2024

By: Eva Jiang, M.B.A., M.S.

We are pleased to announce that DRDA, LLC was named the Pinnacle Winner in the Accounting/Taxes category at the 2024 BBB Awards for Excellence. We appreciate the recognition that the Better Business Bureau has bestowed on DRDA, LLC .

Commitment to Core Values

At DRDA, LLC we value integrity, accountability, and respect. These values are the foundation of how we work with our clients and within our team. We are dedicated to not only providing excellent service but also building sustainable relationships that contribute to long-term success. You can learn more about who we are.

Appreciation and Responsibility

We are grateful to the Better Business Bureau and the Greater Houston community for this recognition. It serves as a reminder of the standards we strive to meet every day. While we celebrate this achievement, we remain focused on continuing to uphold the principles that earned us this honor and are committed to maintaining the trust and confidence of our clients.

Looking Ahead

As we move forward, our aim is to continue innovating and finding ways to better serve our clients and community. We are thankful for the opportunity to make a positive impact and will keep working to live up to the expectations that come with this award.

If you’re interested in learning more about a career at DRDA, LLC visit us here.

- Published in Culture, Team Achievement

Are You Ready to Be the Boss?

By James Barrera

Which are you – Manager, Leader or Both?

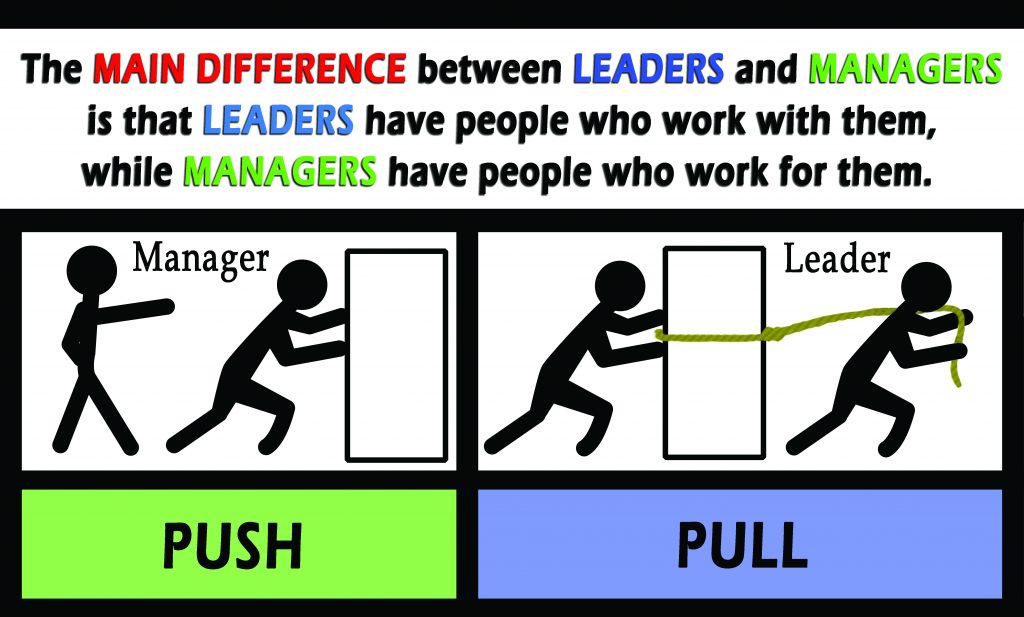

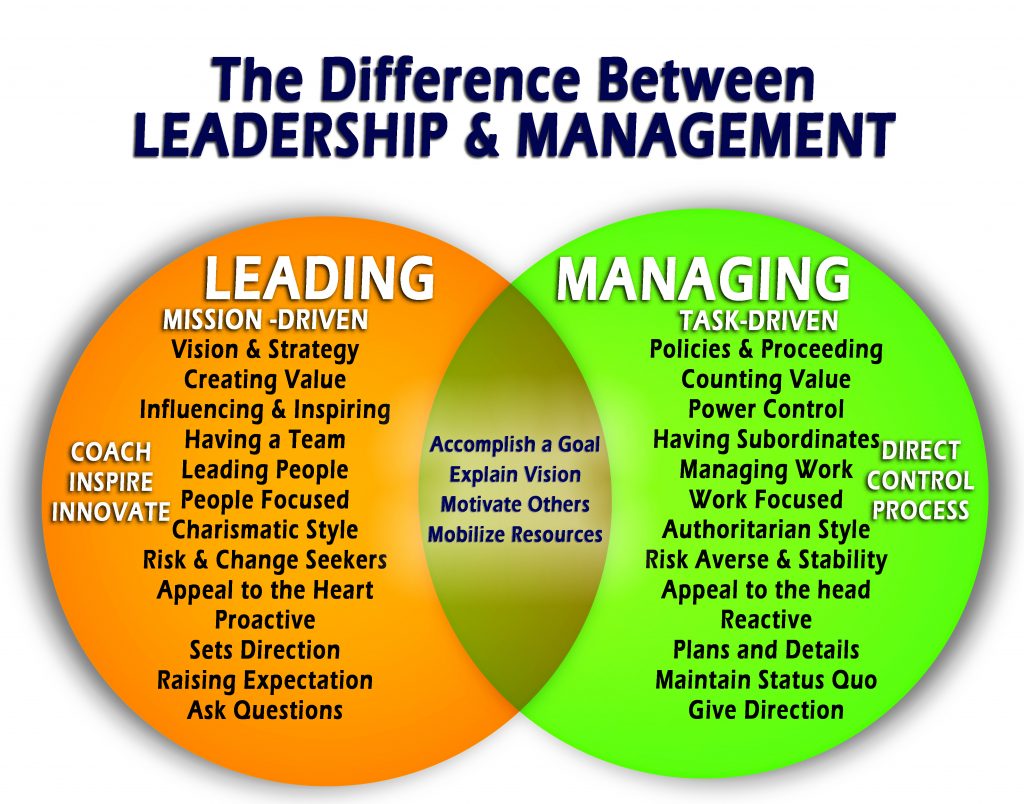

In an ever-increasing competitive workplace, how we show up matters. If you want to get ahead, you must show up as a leader – not only a manager. The difference between leadership vs management is big, and the distinction between the two matters. Not every manager is a leader, and not every leader is a manager, the ability to balance both is a feat many of us aspire to achievement.

A successful business owner needs to be both a strong leader and manager to get their team on board to follow them towards their vision of success. Leadership is about getting people to understand and believe in your vision and to work with you to achieve your goals while managing is more about administering and making sure the day-to-day things are happening as they should.

What Is Management?

Managers make the business world go around. When goals and objectives are set, managers are the implementers. They get things done. Management requires planning, organizing and controlling the various aspects of projects and the related outcomes. Managers are process oriented. They rely on other people, primarily subordinates, to complete tasks and move projects along. Managers delegate set deadlines and evaluate work product. They also course-correct when needed.

What is Leadership?

Management is an essential skill required to perform effectively. It is also a foundational skill that can evolve into leadership. But leadership is a combination of personal qualities that inspire others to follow. A leader is not a power of authority, but a process of social influence which maximizes the efforts of others toward the achievement of a greater good.

What is true leadership? Many times, when you come across the word leader you see the word follower aligned in some way. Leadership is not about attracting others to follow. This conveys a sense of power, authority, and control that might serve well in the short term by getting others to fall into line through conformity, but it doesn’t create the conditions necessary for sustaining change.

Great leaders don’t tell people what to do, but instead drive them to where they need to be. There is no agenda to create a group of followers or disciples. True leaders know that their success is intimately tied to the project and its results. The path to achieve a goal is predicated on how effective the team responds and interacts with each other and the leader. It is a team approach where each person in the organization knows that he or she has an important role to play. Leadership is all about action not position or title.

Some of the best leaders never had a title. What they did have was the tenacity to act on a bold vision for change to improve outcomes and increase performance. These people may be overlooked because they don’t possess the necessary title that is used to describe a leader in a traditional sense. A Leader, from the perspective of society is not a virtue associated by a title, such as manager, director, supervisor, but more by character, presence and action.

The fact that we are surrounded by these people each day both physically and virtually. They are colleagues, mentors, and staff who have all acted to initiate meaningful change in their teams and work environment. These people don’t just talk the talk, but they walk the walk. They lead by example in what might be the most impactful way possible – Leading by Example. These true leaders do not expect others to do what they are not willing to do. The best part is that these unsung heroes do not need a title to make a difference. They also don’t need a title to be a force of change.

If you look on the internet you will find thousands of articles depicting traits and styles of what makes a good leader. For most of us we have identified what traits are important by evaluating our current supervisors and determining what differentiates them from being a good leader. In retrospect we tend to place ourselves in their shoes and begin envisioning how we would do things differently. Our impressions distinguish what attributes we place value on to determine what makes a good leader.

The best leaders work to improve themselves Continuously and do the following on a consistent basis:

Learn

Learning is the work. Great leaders take professional growth seriously as they know there is no perfection in any position, just daily improvement. Leaders make the time to learn and get better daily. They also make their learning visible to inspire others to follow suit. Leaders who love their work are always learning.

Empower

A key element of effective leadership is to empower others to take risks, remove the fear of failure, and grant autonomy to innovate. People that are empowered find greater value in the work they are engaged in. Empowerment leads to respect and trust, which builds powerful relationships where everyone is focused on attaining specified goals.

Adapt

Everything can change in a heartbeat. As such, leaders must embrace a sense of flexibility and openness to change accordingly in certain cases. The ability to adapt to an array of situations, challenges, and pressures are pivotal to accomplish goals. Success in life is intimately intertwined into an organism’s ability to adapt in order to survive. As leaders adapt, they evolve into better leaders.

Delegate

A leader knows the importance of communication and trust. The decisiveness to delegate certain tasks and responsibilities is paramount for team-esteem. It builds confidence in others in their ability as co-leaders of an organization even if they don’t have a fancy title. It also allows leaders to apply more focus to areas of greater importance.

Engage

In the sharing economy there might not be anything more important than information. Leaders understand this fact and develop strategies to authentically engage their clients through multi-dimensional communications, by taking control of public relations, and developing a positive brand presence. Increased engagement results by meeting prospects where they are at, encouraging two-way communications, and becoming the liaison of the brand.

Reflect

It is quite difficult to find a great leader who does not reflect daily on his or her work. Reflection in a digital world can take many forms and results in greater transparency. It is not how one chooses to reflect, but an emphasis to integrate this process consistently that defines a great leader.

Serve

It’s not just what you say, but more importantly what you do. The most effective leaders work constantly to meet the needs of others while building them up in the process. They make it clear that it is not about them. Serving others taps into one’s heart and soul. It is in the moment of service to others that true leaders rise up in esteem, prestige, and industry.

You are in Control

The perception of the term leader is evolving, and it begins with you regardless of your position. As an aspiring leader, setting high standards requires that you develop a strategic and compelling vision for who you want to be and what you want to achieve. It is that vision that will provide you with the drive and perseverance to attain your leadership goals. Herein lies the first key in transforming your world into a better place. Never underestimate the power that you have. You are part of the solution!

Are you interested in learning more about DRDA’s ROBS structure, the BORSA™ Plan? Contact Bryan Uecker by sending an email (bryan.uecker@drdacpa.com) today for a free consultation.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

BORSA and SECURE 2.0 Mandate for Automatic Enrollment

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Key Points:

• Effective for plan years starting after December 31, 2024.

• New 401(k) and 403(b) plans are required to have automatic enrollment.

• The automatic enrollment feature must comply with an eligible automatic enrollment arrangement (EACA).

• Participants must be enrolled automatically:

– Initially at a rate of a minimum of 3% (maximum 10%).

– Increased annually by 1%, reaching at least 10% (maximum 15%).

• Contributions must be invested in a qualified default investment alternative (QDIA).

Exempt Plans:

• SIMPLE 401(k) plans.

• Plans established before December 29, 2022 (date of document signing, not effective date).

• Governmental or church plans.

• Plans by businesses under 3 years old.

• Plans by employers with 10 or fewer employees.

Most BORSA™ plans adopted after December 29, 2022, will qualify for the exemptions based on the company’s age or size. However, consider the following scenarios with recent BORSA™ clients:

Scenario 1:

A couple establishes a new C-Corp and a BORSA™ to acquire two Home Health Care businesses with over 30 employees in 2023. The C-Corp 3-year exemption applies until 2026. Mandatory automatic enrollment begins on January 1, 2027.

Scenario 2:

DRDA takes over an existing ROBS plan in 2023, which lacks a 401(k) feature (a peculiarity of this competitor). The client adds a 401(k) with a safe harbor 3% non-elective contribution and converts the profit-sharing scheme to a cross-tested formula targeting key employees. Although the plan was established in 2015, adding the 401(k) triggers the requirement for automatic enrollment by January 1, 2025.

Scenario 3:

The owner of a 5-year-old business with 8 employees plans to set up a BORSA™ for capital infusion. The business expects to hire 3 or more employees within a year. According to the rule, automatic enrollment becomes mandatory “not earlier than the date that is one year after the close of the first taxable year with respect to which the employer normally employed more than 10 employees.” If this occurs in 2025, automatic enrollment starts on January 1, 2027.

Although many BORSA™ clients start exempt from mandatory EACA rules, growth and time may necessitate compliance in the future.

- Published in ROBS 401(k), ROBS 401k Provider