Maximizing Retirement Potential: Exploring SECURE 2.0 Roth Match and Non-Elective Contributions

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

The retirement landscape is evolving with the introduction of the SECURE Act 2.0, bringing forth pivotal changes in retirement savings options. Among these enhancements are the broadened horizons of Roth contributions and the introduction of Roth Match and Non-Elective Contributions. In this article, we’ll delve into these progressive strides, elucidating how they can empower individuals to forge a more resilient financial future.

Understanding SECURE 2.0 Roth Match and Non-Elective Contributions:

In addition to the conventional practice of designating salary deferrals as Roth contributions, participants will soon wield the ability to label any employer contribution – whether match or non-elective profit sharing – as Roth. Despite this adjustment, employers will still claim a deduction for the employer contribution. At year-end, participants will receive a 1099R delineating the contribution as a taxable Roth conversion.

Benefits of SECURE 2.0 Roth Contributions:

1. Tax-Free Growth: Roth contributions offer the invaluable benefit of tax-free growth, enabling investment earnings within Roth accounts to accumulate tax-free over time. This translates into considerable tax savings during retirement, as withdrawals from Roth accounts typically remain tax-free.

2. Diversification of Retirement Income: Integrating Roth contributions into retirement savings furnishes individuals with enhanced flexibility in crafting retirement income strategies. By striking a balance between traditional and Roth accounts, retirees can adeptly manage their tax obligations and optimize their retirement income streams.

3. Exemption from RMD Rules: Roth IRA and Roth 401(k) accounts are exempt from the Required Minimum Distribution (RMD) rules, making them an ideal vehicle for wealth transfer to heirs.

Despite the promising prospects, a few obstacles must be addressed before plans can seamlessly adopt this provision. Payroll and recordkeeping systems are currently racing to develop the capabilities to accommodate these new Roth sources, and employers will need to amend their plan documents accordingly.

Conclusion:

SECURE 2.0 Roth Match and Non-Elective Contributions herald a significant leap forward in retirement savings options, offering individuals heightened flexibility, tax efficiency, and savings potential. By embracing these innovative features, both employers and employees can take proactive strides toward fortifying their financial futures. With meticulous planning, informed decision-making, and strategic implementation, SECURE 2.0 Roth contributions can chart the course for a more prosperous retirement journey.

- Published in ROBS 401(k)

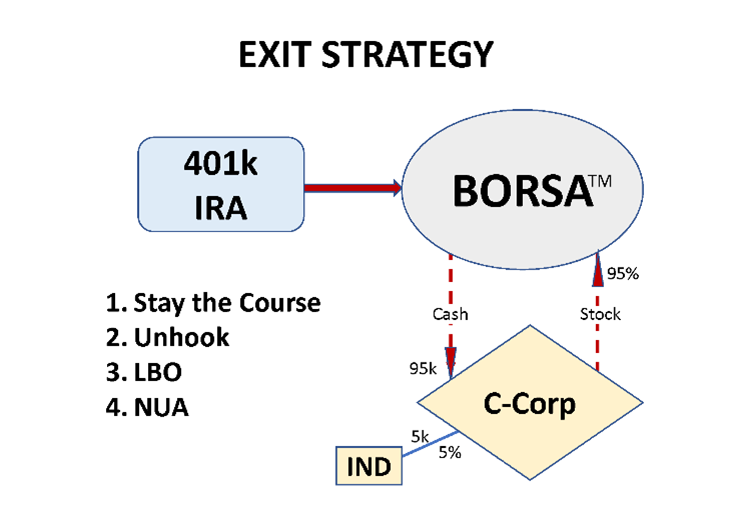

BORSA/ ROBS Exit Strategies

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

When you enter into any structure, it’s wise to know how to exit it as well. There are essentially four avenues for clients to exit the BORSA structure, each depending on where they aim for the value growth to accumulate.

First, there’s the “Stay the Course” approach, where business owners utilize their retirement savings accounts to invest in their enterprises. By funneling existing retirement funds into the business and reinvesting the accumulated value back into the retirement account, individuals expedite their wealth accumulation, often outstripping stock market investments. For those inclined towards this method, the exit strategy is clear: maintain the current trajectory and stay the course. Funds are introduced into the BORSA plan, invested in the C corporation, utilized to operate and expand the company, and upon selling the company, the proceeds are reinvested into the BORSA plan. Subsequently, the company can be liquidated, the retirement plan closed, and the funds rolled back into an IRA, effectively restoring the initial financial structure. At this point, individuals are poised to enjoy their retirement with a substantial deferred income nest egg.

Alternatively, some individuals view the BORSA as a mere launching pad, using their retirement funds for an initial capital infusion but aiming to replenish the money in their retirement accounts swiftly and grow the business’s value personally outside the plan. We refer to this strategy as the “Unhook“. This entails a nuanced approach—let’s say the company generates $100,000 in profit in the first year. After paying 21% corporate income tax, $79,000 of after-tax profits remain. These profits can be distributed as dividends, with the plan receiving 95% of the dividends and individual shareholders subject to individual taxation on the remaining 5%. Alternatively, employing the Unhook strategy, the $79,000 could be utilized to repurchase some of the company stock owned by the BORSA. When a company buys back shares from shareholders, it’s termed treasury stock, reducing the number of shares outstanding and enhancing the value per share of the remaining outstanding shares. Over time, this method allows the C Corporation to repurchase all stock from the retirement plan, effectively restoring their original retirement account balances and reclaiming complete ownership of the company individually. At this juncture, the option within the retirement plan can be to terminate it or transition into a standard 401(k) plan. The business no longer has the 401(k) as a shareholder and is no longer required to be a C Corporation. Converting to an S Corporation or other structure is now an option. This encompasses the Unhook strategy.

In cases where rapid company growth is anticipated, leveraging a buyout may prove advantageous. By borrowing from banks at the corporate level, funds can be used to repurchase stock from the retirement plan at current valuations. Subsequent profits can then be allocated towards repaying the bank, preserving the frozen stock value from the date of the transaction. This constitutes the third exit option: the Leveraged Buyout.

Finally, the fourth option involves utilizing the Net Unrealized Appreciation (NUA) Strategy. Typically, an entrepreneur who has engaged in the ROBS business financing strategy, built a successful and profitable enterprise, and now wishes to exit the strategy aims to defer or reduce taxation on their company shares. If the company stock is valued at more than what an entrepreneur wants to pay to buy it back, there are provisions in the Internal Revenue Code (IRS) permitting tax deferral and capital gains tax treatment when employing certain exit methods from a ROBS Plan. The primary method used is the Net Unrealized Appreciation (NUA) transaction.

When it comes to the NUA transaction, several conditions must be met. These include the ROBS participant being at least 59.5 years old, all other defined contribution accounts (sponsored by the employer) are also distributed, employer securities are distributed in-kind and in the same tax year, among others. Once these conditions are met, a ROBS participant exit can be initiated. The participant will owe only ordinary income tax in the year of distribution on the original rollover value of the shares, as of the date of the original ROBS transaction. Long-term capital gains tax will be due when the shares are ultimately sold.

In the end, the chosen strategy depends on whether individuals seek to maximize value growth within their retirement accounts, maintain a symbiotic relationship between business investment and retirement funds, or capitalize on rapid company expansion through strategic leveraging. Each approach offers distinct advantages tailored to varying financial objectives.

DRDA is the only ROBS/BORSA provider that is uniquely qualified to help navigate the right strategy for you. If you would like to discuss which option is best for you, please call Bryan Uecker at (281) 954-6004 or email bryan.uecker@drdacpa.com.

- Published in ROBS 401(k)

Using Your 401(k) or IRA to Start a Real Estate Business: A Quick Guide

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Thinking about using your retirement savings to enter the real estate market? Here’s a concise guide on how to leverage your 401(k) or IRA for a real estate operating or property management company.

Why Real Estate?

Real estate is a compelling investment due to its potential for passive income and long-term appreciation. It also provides financial benefits like diversification and tax advantages, including depreciation and deductions.

Can You Use Retirement Funds for Real Estate?

Direct investment in real estate through a traditional 401(k) is not permitted. While self-directed IRAs allow real estate investments, they come with complexities and fees. Direct withdrawals from retirement accounts incur taxes and penalties, reducing your investment capital.

Enter the BORSA: A Tax-Advantaged Solution

BORSA (Business Owners Retirement Savings Account) also called ROBS: (Rollovers for Business Startups) offer a way to use retirement funds without taxes or penalties. Here’s how the BORSA works:

- Start a C Corporation: BORSA requires a C Corp to issue Qualified Employer Securities (QES).

- Start a 401(k): The new C Corp adopts a 401(k) plan.

- Roll Over Funds: Move your retirement funds into the new C Corporation’s 401(k) plan.

- Invest in Real Estate: Use the funds to purchase stock in the C Corp, which then finances your real estate business.

What You Can Start with BORSA

Real Estate Operating Companies (REOCs): Manage and invest in commercial or residential properties.

Property Management Companies: Handle property maintenance and tenant relations for other property owners.

Pros and Cons

Pros:

Diverse Investment: Real estate offers potential for high returns and diversification.

Debt-Free Funding: Avoids debt service and loan complexities.

Cons:

Market Risks: Real estate is affected by local market conditions and economic cycles.

Liquidity Risk: Selling properties can be time-consuming and challenging.

Next Steps

If you’re interested in using BORSA for real estate, consider consulting with a specialist. DRDA can assist with setting up your BORSA, ensuring compliance, and guiding you every step of the way.

- Published in ROBS 401(k)

Understanding the Differences Between DOL and IRS Requirements for Qualified Retirement Plans

By: Bryan Uecker

Navigating the regulatory landscape of qualified retirement plans can be complex for plan sponsors and administrators. The Department of Labor (DOL) and the Internal Revenue Service (IRS) play pivotal roles in overseeing these plans, but they have distinct requirements and regulations. Understanding the differences between the two can help plan sponsors ensure compliance and effectively manage their retirement plans.

DOL Requirements:

The DOL primarily focuses on enforcing the Employee Retirement Income Security Act (ERISA), which sets standards for the operation and administration of retirement plans. Some key DOL requirements for qualified plans include:

1. Reporting and Disclosure: The DOL mandates that plan sponsors provide participants with various disclosures, such as the Summary Plan Description (SPD) and Summary of Material Modifications (SMM). These documents inform participants about their rights, benefits, and obligations under the plan.

2. Fiduciary Responsibilities: Plan fiduciaries have a duty to act prudently and solely in the interest of plan participants and beneficiaries. The DOL oversees fiduciary conduct, ensuring that fiduciaries fulfill their obligations and avoid conflicts of interest.

3. Vesting and Participation: The DOL sets rules regarding vesting schedules and eligibility criteria for plan participation. These regulations aim to protect participants’ rights to their accrued benefits and ensure equitable access to retirement savings opportunities.

IRS Requirements:

While the DOL focuses on ERISA compliance, the IRS administers the tax laws related to qualified retirement plans. Key IRS requirements for these plans include:

1. Plan Qualification: To receive favorable tax treatment, retirement plans must meet specific qualification requirements outlined in the Internal Revenue Code (IRC). These requirements cover various aspects of plan design, such as contribution limits, distribution rules, and nondiscrimination testing.

2. Plan Documentation: The IRS requires plan sponsors to maintain up-to-date plan documents that reflect the terms and conditions of the retirement plan. These documents must comply with IRS regulations and be available for review by plan participants and government agencies.

3. Tax Reporting: Plan sponsors are responsible for filing annual tax returns and informational forms with the IRS, reporting contributions, distributions, and other plan-related activities. Compliance with IRS reporting requirements ensures that the plan maintains its tax-qualified status.

Comparison:

While both the DOL and IRS regulate qualified retirement plans, they have distinct areas of focus and enforcement authority. The DOL emphasizes participant protection, fiduciary oversight, and transparency through disclosure requirements. In contrast, the IRS focuses on tax qualification, plan documentation, and compliance with tax laws to maintain the plan’s favorable tax status.

Conclusion:

Understanding the differences between DOL and IRS requirements is essential for plan sponsors and administrators tasked with managing qualified retirement plans. By adhering to both sets of regulations, sponsors can ensure compliance, protect participants’ interests, and maintain the tax-qualified status of their plans. Staying informed about evolving regulations from both agencies is key to successfully navigating the complex landscape of retirement plan administration.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Selling Your BORSA Business

By: Bryan Uecker

When a seller has a BORSA™ (Business Owners Retirement Savings Account), also known as ROBS, and is considering selling their business, the decision between an asset sale and a stock sale involves additional considerations due to the BORSA/ROBS structure. Here’s a comparison of the two approaches in this context:

Asset Sale

1. Definition: In an asset sale, the buyer acquires specific assets and liabilities of the business rather than the entity itself. This includes tangible assets (like equipment and inventory) and intangible assets (like trademarks and customer lists).

2. Tax Implications: For the Seller: The business entity may face double taxation. First, the entity is taxed on the gain from the sale of assets at the corporate tax rate. Then, any remaining sale proceeds are distributed to shareholders according to their ownership percentage and taxed accordingly. For the Buyer: The buyer benefits from a step-up in the basis of the acquired assets, which allows for depreciation or amortization based on the purchase price, potentially reducing future tax liabilities.

3. Complexity: Asset sales require detailed purchase price allocation among various assets and involve complex tax considerations.

4. Liability: The buyer assumes only the liabilities specifically agreed upon in the sale. This reduces the risk of inheriting unknown or contingent liabilities.

5. BORSA/ROBS Considerations: The C-Corp will have to estimate its federal and state tax bill, pay the estimated taxes, pay its final expenses, dissolve, and lastly, any remaining cash gets distributed to the stockholders according to ownership percentage. So, if the 401(k) owns 95% of the company, 95% will go to the 401 (k). The double taxation kicks in when the seller eventually takes retirement distributions taxed as ordinary income. The 5% going to the individual is taxed using capital gains rates.

Stock Sale

1. Definition: In a stock sale, the buyer acquires the company’s shares, gaining ownership of the entire entity, including all its assets and liabilities.

2. Tax Implications: Selling stock can be advantageous for the seller. 95% goes to the 401(k) plan with no tax due until the seller takes retirement distributions. The personal stock portion will be taxed using capital gains treatment, potentially resulting in a lower tax rate on the proceeds. For the Buyer, the buyer assumes the company’s existing tax basis in its assets and takes on all of the business’s liabilities, which may include unknown or contingent liabilities.

3. Complexity: Stock sales tend to be less complex from a transactional standpoint than asset sales, as the focus is on transferring ownership rather than valuing and transferring individual assets.

4. Liability: The buyer inherits all the company’s liabilities, known or unknown, which can be a significant risk factor.

5. BORSA/ROBS Considerations: If the seller’s BORSA plan holds stock in the company, the plan will sell its shares for cash as part of the stock sale. The account can then be rolled into an IRA or other retirement plan vehicle and won’t be taxed until withdrawn. The portion owned outside the plan will be taxed using capital gains rates.

Conclusion

The BORSA™/ROBS structure affects both asset and stock sales of a business. The choice between the two will depend on various factors, including tax considerations, liability issues, licensing issues, and the specific goals of both the seller and the buyer. DRDA is uniquely positioned to help you navigate these complex transactions and ensure compliance with tax, Department of Labor, banking and regulatory requirements so you keep more of what you have earned from growing your business.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business

Comparing Self-Directed IRAs vs. BORSA/ROBS

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Self-directed IRAs and BORSA/ROBS (Rollovers for Business Start-ups) offer distinct approaches to investing in businesses:

Business Involvement

BORSA/ROBS: Requires active participation in business operations, including receiving a salary if deemed reasonable. Structured through a C corporation, which is the sponsor of the retirement plan.

Self-directed IRAs: Passive investment vehicles where IRA owners cannot engage in business management or take salaries. Doing so could violate IRS rules on prohibited transactions.

Tax Considerations

BORSA/ROBS: Subject to regular corporate taxes; UBIT (Unrelated Business Income Tax) does not apply since the C corporation is taxable.

Self-directed IRAs: Income from business activities may trigger UBIT if unrelated to the IRA’s tax-exempt purpose.

Loan Guarantees

BORSA/ROBS: Allows funds to be used as a down payment for business loans, including SBA loans.

Self-directed IRAs: Cannot guarantee loans, maintaining separation between IRA assets and personal liabilities.

Ownership Flexibility

BORSA/ROBS: Enables up to 100% ownership of the business, providing full control.

Self-directed IRAs: Direct ownership risks violating IRA rules if exceeding certain ownership thresholds, jeopardizing tax benefits.

Conclusion: Self-directed IRAs are ideal for passive investors seeking hands-off involvement, while ROBS empowers owners with direct control and tax advantages through a C corporation setup.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Unlocking Success: Navigating the ROBS Journey!

A Persuasive Essay on the Benefits of the ROBS Strategy

By: Eva Jiang, M.B.A., M.S.

Recently, DRDA hosted an enlightening webinar titled “Unlocking Success: Navigating the ROBS Journey,” aiming to demystify the ROBS (Rollover as Business Start-up) strategy for aspiring entrepreneurs. This essay argues that the ROBS strategy offers a unique and advantageous pathway for individuals to leverage their retirement funds to start or buy a business without incurring taxes or penalties. The webinar provided an in-depth exploration of the ROBS strategy, addressing common concerns and illustrating its potential benefits.

Setting the Stage for Success

The webinar began with the foundational steps necessary to ensure a distraction-free environment, emphasizing the importance of focused attention when dealing with complex financial strategies. Attendees were encouraged to silence their phones and find a quiet place, setting the stage for a productive session. The introduction of the Q&A chat box underscored the interactive nature of the webinar, allowing participants to engage directly with the experts, thereby enhancing their understanding of the ROBS strategy.

Expert Insights and Comprehensive Understanding

The session featured two distinguished speakers: Doug Dickey, a Partner at DRDA with credentials such as CPA, CVGA, and CEPA, and Bryan Uecker, the Retirement Plan Manager with qualifications including QPA, QPFC, AIF, and AIFA. Their combined expertise provided a thorough and reliable foundation for understanding the ROBS strategy. This high level of expertise is crucial for individuals considering using their retirement funds to invest in a business, as it ensures that they receive accurate and comprehensive information.

The Mechanics of the ROBS Strategy

Doug and Bryan explained the ROBS strategy in detail, highlighting its core components: forming a C Corporation, establishing a 401(k) Profit Sharing Plan, and rolling over retirement funds into this plan to invest in a new business. This approach allows individuals to use their retirement funds without incurring the taxes and penalties typically associated with early withdrawals. The ROBS strategy thus provides a viable and advantageous option for entrepreneurs who lack sufficient liquid capital but possess substantial retirement savings.

Addressing Common Concerns

A significant portion of the webinar was dedicated to addressing common concerns and questions from the attendees. These included:

Compliance with IRS Regulations: Ensuring compliance with IRS regulations is a primary concern for anyone considering the ROBS strategy. The speakers provided detailed guidance on meeting all necessary requirements, emphasizing the importance of adherence to avoid legal complications.

Eligible Retirement Funds: The types of retirement funds that qualify for ROBS were clarified, providing attendees with a clear understanding of their eligibility.

Tax Benefits: The tax advantages of operating under a C Corporation structure were highlighted, showing how the ROBS strategy can lead to significant tax savings.

Exit Strategy Costs: Insights into the expected costs of an exit strategy were shared, helping attendees plan for the future and understand the long-term financial implications of their investment.

The Value of Personalized Consultation

As the webinar concluded, DRDA offered attendees an exclusive opportunity for a complimentary one-hour consultation. This personalized advice is invaluable for individuals seeking to tailor the ROBS strategy to their specific circumstances. Such consultations can address unique challenges and provide customized solutions, further enhancing the appeal of the ROBS strategy.

Stay Connected

For those with additional questions, the speakers provided direct contact details. Bryan’s email and phone number were shared, along with a link to schedule a consultation. “We’re here to help you on your journey,” Doug assured, his sincerity resonating through the screen.

Bryan Uecker: bryan.uecker@drdacpa.com | 281-954-6004

Schedule a Consultation: Complimentary One-Hour Consultation

Final Thoughts

As the webinar concluded, there was a sense of accomplishment and excitement. The attendees had gained valuable insights into the ROBS journey, feeling more empowered to take the next steps in their entrepreneurial endeavors. The DRDA team was grateful for the opportunity to share their expertise and looked forward to continuing to support these aspiring business owners.

Thank you to all who joined us. Stay tuned for more from DRDA as we continue to help unlock success in entrepreneurial journeys.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Franchise Or Business Start-Up?

Which is the right fit for you?

Options and Opportunity

The ability to work for yourself, being in control and making the big decisions appeals to many people. You may just be starting your profession and dreaming of starting your own business, or you may have had a long and successful career and are longing for something more – additional money, greater flexibility or the chance to focus on doing something you enjoy.

Taking a risk and following your dream by becoming a business owner is an aspiration shared by many Americans. The first step in determining whether starting your own business or investing your time and money into a proven franchise is more your style is to begin with a self-assessment of your strengths, weaknesses, interests, skills and work/life aspirations. Do you work well in a more structured environment, or do you require freedom to create and innovate? Are you risk-averse and like having a support system, or are you more daring and hope to blaze a trail for others to follow one day?

Countless first-time entrepreneurs have the burden of whether to start a business from scratch or buy a franchise. The allure of being your own boss can be tempting; franchises and startups each pose their own challenges and benefits. Evaluating each option can help you get closer to realizing what the right venture is for you.

What Is a Franchise?

A franchise is a type of license that an individual or group (franchisee) acquires to allow them to have access to a business’s (franchisor) proprietary knowledge, processes, and trademarks in order to allow the party to sell a product or provide a service under the business’s Brand. In exchange for gaining the franchise, the franchisee usually pays the franchisor an initial start-up and annual licensing (royalty) fees.

How Franchises Work

When a business wants to increase its market share or increase its geographical reach at a low cost, it may create a franchise for its product and brand name. A franchise is a joint venture between a franchisor and a franchisee. The franchisor is the original or existing business that sells the right to use its name and idea. The franchisee is the individual who buys into the original company by purchasing the right to sell the franchisor’s goods or services under the existing business model and trademark.

Franchises are a very popular method for people to start a business, especially for those who wish to operate in a highly competitive industry like the fast-food industry. One of the biggest advantages of purchasing a franchise is that you have access to an established company’s brand name, meaning that you do not need to spend further resources to get your name and product out to customers.

Franchise Basics and Regulations

Franchise contracts are complex and vary for each franchisor. Typically, a franchise contract agreement includes three categories of payment that must be made to the franchisor by the franchisee.

- The franchisee must purchase the controlled rights, or trademark, from the franchisor business in the form of an upfront fee.

- The franchisor often receives payment for training, equipment, or business advisory services from the franchisee.

- The franchisor receives ongoing royalties or a percentage of the business’s sales.

It is important to note that a franchise contract is temporary, like a lease or rental of a business, and does not signify business ownership by the franchisee. Depending on the franchise contract, franchise agreements typically last from 5 to 30 years, with penalties or consequences if a franchisee violates or prematurely terminates the contract.

In the U.S., franchises are regulated by law at the state level. However, there is one federal regulation established in 1979 by the Federal Trade Commission (FTC). The Franchise Rule is a legal disclosure given to a prospective purchaser of a franchise from the franchisor that outlines all the relevant information in order to fully inform the prospective purchaser of any risks, benefits, or limits of such an investment.

Such information specifically stipulates full disclosure of fees and expenses, any litigation history, a list of suppliers or approved business vendors, even estimated financial performance expectations, and more. This law has gone through various iterations and has previously been known as the Uniform Franchise Offering Circular (UFOC) before it was renamed in 2007 as the current Franchise Disclosure Document.

Brand awareness

Building a brand is no small feat and can be quite expensive and time-consuming. When you sign on with a popular franchise, the work has been done for you. We all know some of the more popular brand franchises out there, and we’ve become accustomed to a certain set of standards from these businesses. Customers will seek out establishments for their familiarity and consistency that comes from patronizing these businesses over many years.

Additionally, if you are part of a nationally recognized brand, you automatically have the power of that franchise’s marketing and advertising dollars to support you. This can inevitably result in a faster time to market and quicker ROI. However, brand awareness comes with a price tag. Buying into one of these better-proven franchises can be expensive and require more startup costs than building your own business.

Site selection

Site selection is critical for many businesses. Most franchisors pre-approve sites for outlets. This may increase the likelihood that your location will attract customers. The franchisor, however, may not approve the site you want. If there’s a specific location where you want your business to be and it doesn’t match the franchise opportunities in that area, then you will have to find a location or territory that will be acceptable to both of you.

In addition, franchisors may impose design or appearance standards to ensure customers receive the same experience in each outlet. If you are passionate about creating a unique look and feel for your business, you may have a hard time following the guidelines set forth by the franchisor.

Training and support services

Perhaps one of the biggest advantages to buying a franchise is the training and ongoing support you receive from a franchisor. They can help with managing the day-to-day business, from hiring and training employees to overseeing the finances. Franchisors can help you learn to run a business rather than doing it on your own, which can lead to mistakes that affect your business’s bottom line – whether through the cost of time, money or both.

Costs, fees and contracts

Depending on the system, startup costs for a franchise can be steep. Many franchise owners find it necessary to secure financing to purchase their business. In addition, most franchisors require franchisees to pay ongoing royalty and/or advertising fees. The fees are attributed to training, support and marketing, of which a certain percentage of your profits will be allocated to the franchisor. Finally, when you buy a franchise, you sign an agreement that locks you in for a specified amount of time, anywhere from 5 to 30 years. Breaking a franchise agreement can be difficult and costly.

Financing

Owning any new business, start-up costs can be high and require infusions of capital if they encounter hardship. A business needs a good business plan, healthy cash flow, and solid financing to succeed. Most franchisees will have to apply for a business loan at some point, such as a loan backed by the SBA (Small Business Administration). But bank loans and SBA loans are still not easy to get even for franchise businesses, and the application and approval process can be prohibitively long for a lot of franchisees in need of quick capital. Some franchisors offer their own financing programs, but the practice is far from widespread, so you can’t necessarily depend on funding from your franchise brand.

For these reasons, many prospective business owners are turning to alternative funding for better financing options. DRDA BORSA™ Plan, a self-directed 401(k) plan which allows an individual access to their qualifying retirement funds TAX and PENALTY FREE to be used as equity for a business start-up, acquisition, or as capital for an existing business. The Plan offers a much faster time to funding than traditional bank loans, often receiving funds in your account within 30 days of initiating the plan. The Funds then can be used as a down payment for an SBA loan.

Autonomy

Buying into a franchise system requires you to run your business as dictated by the franchisor with little leeway for business decisions, including the look and feel, purchasing equipment and overall operating procedures. You may control your franchise unit’s culture and who you hire and fire, but you still must follow a prescribed set of guidelines.

To maintain uniformity and ensure future success within a franchise system, franchisors can be very diligent about enforcing policies and procedures. The franchise system they created is their most valuable asset. If following and adhering to a prescribed set of operating instructions to run your business is not something you are envisioning, then franchising may not be the path for you.

Purchasing power

Having brand-name backing allows you to benefit from the collective buying power of the franchise when it comes to purchasing equipment and supplies. This can be critical for finding the right supplier and negotiating deals. Franchisors can also help you with determining what equipment you need, the right size and the supplies you’ll need.

At the same time, a franchisor’s requirement for you to purchase equipment and inventory only from approved suppliers will limit what you can purchase as well as your ability to purchase something at a discounted price from another dealer.

Challenges & Advantages

There are many advantages to investing in a franchise, as there are advantages in starting your own business. Widely recognized benefits to buying a franchise include a ready-made business operation. A franchise comes with a built-in business formula including products, services, even employee uniforms and well-established brand recognition. Depending on the franchise, the franchisor company may offer support in training and financial planning, or even with approved suppliers. Whether this is a formula for success is no guarantee.

Business owners, by definition, may not have any ongoing costs to an investor in the form of a percentage of sales or revenue, but they do have to expense their marketing, training, processes, and systems in place. Thich can equate to the same percentage range of 4% to 8% royalty fees required by the franchisee. Other equivalents would be location control or creativity with an owned business. Territories are defined by the Franchisor and approved based on area and region of similar brands within the geographical distance. The business owner must conduct market research and competitive analysis in order to establish a consensus of where to locate, and how to promote their brand. Other factors that affect all businesses, such as poor location or management, are also possibilities.

Franchise or Startup

As a franchisee, you will be signing a long-term contract with your franchisor and creating a relationship through which you will need each other to succeed. It’s critical you do your research and ensure your core values and goals align with those of the franchisor.

If you don’t want to carry on somebody else’s idea for a business, with a host of regulations, procedures, systems in place and rules you must follow as part of your agreement, you can start your own. While founding your own company has plenty of potential rewards, both monetary and personal, it is also at greater risk. When you start your own business, you are on your own, and much is unknown. Will the product sell? Will customers like it? Will I make enough money to survive?

If you choose to build your own business, then you won’t be as constrained by the franchisor/franchisee relationship, but you also will not receive the support you may need down the road. If your business is going to survive, you alone will have to make that happen. To turn your dream into a reality, you can expect to work long, hard hours with no support or expert training. If you try this on your own without any experience, the deck is stacked against you. If this sounds like too big a burden to bear, the franchise route may be a better choice.

People purchase a franchise because the model often works. It offers careful entrepreneurs a stable, tested model for running a successful business. It also requires them to operate on someone else’s business model. For those with a big idea and a solid understanding of how to run a business, launching your own startup presents an opportunity for personal and financial freedom.

So, startup or franchise? As you can tell the decision is very dependent on the professional and personal experience you want to gain through this next venture. There are merits and perils with each, but at the end of the day, only you can make the right choice for yourself.

Are you interested in learning more about DRDA’s ROBS structure, the BORSA™ Plan? Give Bryan Uecker a call today at 281-954-6004 for a free consultation.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Tax

Harnessing the Advantages of the ROBS / BORSA Structure.

PART I: C-CORP

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

ROBS (Rollover as Business Start-up) or BORSA™ (Business Owners Retirement Savings Account) structures are exclusively compatible with C-Corps. This is because only C-Corps permit a 401(k) profit-sharing plan to serve as a shareholder. Upon discovering this exception, some prospective clients may feel disappointed, as the C-Corp often carries a stigma of “double taxation”. Historically viewed as “the entity choice of last resort” due to potential for double taxation resulting from corporate-level taxes and subsequent taxation upon distribution or liquidation. The good news is that C corporations present unique tax advantages that S corporations and partnerships cannot replicate.

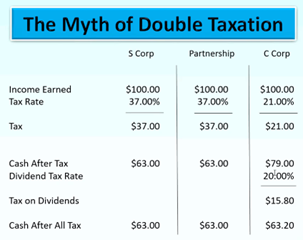

To debunk the stigma of “double taxation” right up front, a helpful chart compares the corporate tax and dividend tax to profits through a pass-through entity at a personal tax rate of 37%:

So the issue is not how many times you are taxed……but rather how much tax you pay.

Now that we have cleared up the myth, here are ten benefits of a C-Corp:

1. Lowering Overall Tax Burden: C Corps can achieve significant tax savings thanks to a single flat corporate tax rate of 21%. By proactively managing dividends and salaries, business owners can optimize their tax burden, generally resulting in lower overall taxes than pass-through entities.

2. Flexible Fiscal Year: C Corps can choose their fiscal year, unlike LLCs and S Corps. This allows for better timing of income recognition and expense deductions, enabling shareholders to further minimize their tax burden.

3. Retaining Earnings for Growth: C Corps can reinvest profits within the company at a lower tax cost. Unlike S Corps, where profits are passed through to shareholders and taxed regardless of distribution, C Corps can retain earnings to fuel future expansion without immediate tax consequences.

4. Deducting Salaries and Bonuses: Shareholders of C Corps can receive salaries and bonuses, which are deductible expenses for the corporation. Businesses can optimize tax efficiency and mitigate double taxation concerns by structuring compensation packages appropriately.

5. Tax Write-offs for Fringe Benefits: C Corps can deduct 100% of medical premiums and other fringe benefits provided to employees. This includes health, long-term care, and retirement plan contributions, offering substantial tax savings opportunities for the corporation and its employees.

6. Charitable Contributions Deduction: C Corps can deduct charitable donations as business expenses, subject to certain limitations. This benefits worthy causes and provides tax advantages for the corporation, with the option to carry over excess contributions to future tax years.

7. Gaines: C Corps are taxed at a flat 21% on short-term and long-term gains so you no long have to carry economic risk to get to a lower tax bracket. You sell you capital asset when it is best for you. C Corps can carry forward capital and operating losses indefinitely to offset future profits. This flexibility allows businesses to smooth out tax liabilities over time, particularly during growth or economic downturns.

8. Fewer Ownership Restrictions: Unlike S Corps, which have strict ownership rules, C Corps can have unlimited shareholders, issue multiple classes of stock and be owned by anyone or anything. This flexibility facilitates equity financing and business expansion without the constraints imposed by S Corp regulations.

9. Favorable Treatment for Passive Investors: Passive investors in C Corps benefit from the inability to pass losses through to individual tax returns. Unlike S Corps, where active participation is required to claim losses, passive investors can still enjoy tax advantages without direct involvement in management.

10. Unique Financing Opportunities: Registering as a C Corp opens doors to diverse financing options, including public offerings and innovative strategies like 401(k) business financing, such as ROBS or BORSA™ plans. These financing avenues give businesses access to capital while minimizing debt obligations, offering a valuable alternative to traditional lending sources.

With over four decades of experience, DRDA, LLC has focused on supporting entrepreneurs in initiating, expanding, and selling their businesses. Leveraging our proficiency in accounting, business consulting, and retirement plan design, we harness the advantages of the ROBS/BORSA™ structure to benefit our clients throughout the operation of their business and at their succession transition or exit of their business, not just at formation.

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

- Published in Business Lending, ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Delving into Required Minimum Distributions (RMDs) for 401(k) Plans: Understand the New Rules

By Bryan Uecker, QPA, QPFC, AIF, AIFA

A Required Minimum Distribution (RMD) is the mandated withdrawal amount from certain retirement accounts on an annual basis after reaching a specific age. These rules were established by the government to prevent retirement accounts from being used solely for estate planning purposes to transfer wealth to beneficiaries upon the account holder’s death. It’s crucial for participants in 401(k) plans to grasp these regulations as failure to comply with RMD requirements can lead to tax penalties imposed by the IRS.

Understanding the “Required” Aspect of RMDs:

An RMD must be distributed from your 401(k) account each year once you reach a designated age. However, if you’re still employed when you reach this age, your plan might allow you to postpone RMDs until retirement.

RMD Age or Retirement:

The age for commencing RMDs is determined by your birth year:

– Born before July 1, 1949: RMD age is 70 ½

– Born after June 30, 1949, and before January 1, 1951: RMD age is 72

– Born in 1951 through 1959: RMD age is 73

– Born after 1959: RMD age is 75

However, you might be able to defer your initial RMD beyond this age if you’re still employed by the plan sponsor and don’t own more than 5% of the business. Owners with more than 5% ownership must start RMDs at the designated age.

RMD Deadline:

Typically, you must receive the RMD by December 31 of the relevant year. However, the first RMD can be delayed until April 1 of the following year if it’s the later of reaching RMD age or retiring (if allowed by the plan and you’re not a 5% owner).

RMDs Upon Death:

Regardless of whether you’ve reached RMD age, distributions must be made from your 401(k) account upon your death. Beneficiaries usually have ten years to withdraw the full amount, though some, like spouses or minor children, might be eligible for extended payment periods.

RMDs with BORSA®:

For many BORSA® clients, employer securities make up the bulk of their 401(k) balance. The corporation can repurchase shares to cover the RMD, or the participant can opt for an “in-kind” distribution in employer securities equivalent to the RMD’s fair market value. The participant is subject to ordinary income tax on the in-kind distribution and holds the stock personally.

RMDs and Roth 401(k) Accounts:

Starting with the 2024 RMDs, Roth 401(k) accounts are not subjected to the same RMD rules. Prior to 2024, Roth 401(k) accounts followed the same rules but were non-taxable.

By Bryan Uecker, QPA, QPFC, AIF, AIFA

- Published in ROBS 401(k), ROBS 401k Provider, Small Business