Do You Need a Formal Valuation for Your BORSA/ROBS Plan? Here’s What Business Owners Should Know

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Introduction

If you’re using a Business Owners Retirement Savings Account (BORSA) or Rollover as Business Startup (ROBS) to fund your business dreams, you’ve probably wondered about valuation requirements. As a business owner, understanding when and how to value your BORSA/ROBS plan assets isn’t just about checking a box—it’s about protecting your investment and staying compliant with IRS regulations. Let’s break down everything you need to know about BORSA/ROBS plan valuations in plain English.

Why Valuations Matter in Your BORSA/ROBS Plan

Think of your BORSA/ROBS plan valuation like a regular health check-up for your business. It’s essential because:

- It helps ensure your retirement funds are being managed properly

- It keeps you compliant with IRS regulations

- It protects you from potential penalties and prohibited transactions

- It provides crucial information for making business decisions

When Do You Need a Formal Valuation?

The Simple Answer: It Depends on Your Activity

Not every BORSA/ROBS plan needs a formal valuation with an independent appraiser every year. Here’s when you might be able to use a less formal approach:

- You’re running a single-participant plan

- Your plan hasn’t made any contributions during the year

- You haven’t processed any distributions

- There haven’t been any investment changes

- You haven’t conducted any transactions involving employer securities

When to Get Formal

However, certain situations definitely call for a more formal valuation approach:

- During Major Transactions

- When making contributions to the plan

- When processing distributions

- During transactions involving employer securities

- For Complex Assets

- When dealing with hard-to-value assets

- If you’re planning significant business changes

- When the IRS might request additional documentation

Real-World Implications

The IRS has found that many BORSA/ROBS arrangements face challenges within their first three years. One common pitfall? Improper valuations. To avoid becoming a cautionary tale, consider these best practices:

Best Practices for BORSA/ROBS Valuations

- Annual Review

- Schedule regular valuations

- Document your valuation method

- Keep detailed records

- Professional Support

- Consider working with valuation experts

- Consult with BORSA/ROBS specialists

- Maintain relationships with financial advisors

- Documentation Requirements

- Keep detailed records of all valuations

- Maintain proof of your methodology

- Store copies of all relevant paperwork

Common Questions from Business Owners

“How accurate does my valuation need to be?”

Your valuation needs to reflect the true fair market value of your business assets. This isn’t about guesswork—it’s about using legitimate, defensible methods.

“What happens if I get it wrong?”

Incorrect valuations can lead to:

- IRS penalties

- Compliance issues

- Potential plan disqualification

- Tax complications

Tips for Success

- Stay Organized

- Keep a calendar of valuation deadlines

- Maintain clear documentation

- Track all business changes that might affect valuations

- Plan Ahead

- Budget for professional valuations when needed

- Consider timing of major business decisions

- Think about future exit strategies

Conclusion

While BORSA/ROBS plan valuations might seem daunting, they don’t have to be. The key is understanding when you need a formal valuation and when a less formal approach will suffice. Remember, the goal is to protect your investment while staying compliant with IRS requirements.

Take Action

- Review your BORSA/ROBS plan’s current valuation status

- Schedule any needed valuations

- Consult with professionals if you’re unsure

- Document your valuation process

Remember, your BORSA/ROBS plan is more than just a funding mechanism—it’s a crucial part of your business and retirement strategy. Treating valuations with the attention they deserve will help ensure your long-term success.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Social Security: Current Status and Challenges

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Social Security remains a critical topic of discussion due to ongoing concerns about its solvency and future. Recent expert panels have examined the program’s state and potential improvements.

Public Support and Confidence

Research by the National Institute on Retirement Security (NIRS) shows strong public support for Social Security, with many considering it a crucial government program. However, confidence in benefit delivery varies, with older generations generally more confident than younger ones.

Key Challenges

Gopi Shah Goda of the Brookings Institution outlined four main challenges:

- Financial shortfalls

- Program rigidity

- Inadequate coverage of elderly financial risks

- Persistent poverty among survivors

Proposed Solutions

Experts suggest reforming rather than replacing Social Security. Recommendations include:

- Increased funding through dedicated tax flows

- Indexing benefits to longevity

- Expanding private retirement plans

- Establishing a commission for thorough examination

Broader Implications

Discussions also touched on whether Social Security should primarily serve as income replacement or an anti-poverty safety net. Consensus remains on its critical role in retirement security for most Americans.

Moving forward, addressing these challenges while preserving Social Security’s core mission will require thoughtful, bipartisan efforts.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Understanding Cycle 3 Restatements for Defined Benefit (DB) Plans

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Defined Benefit (DB) Plans are an essential component of retirement planning, offering predictable income streams for participants. However, staying compliant with government regulations is critical for plan sponsors. One of the key compliance requirements is the periodic restatement of plan documents to reflect legislative and regulatory changes. We’re currently in the Cycle 3 Restatement period for DB Plans, and plan sponsors should ensure they meet the deadlines and requirements to remain compliant.

What Are Cycle Restatements?

Cycle restatements are part of the IRS’s pre-approved plan document program. Every few years, the IRS requires plan sponsors of retirement plans—such as Defined Contribution (DC) and Defined Benefit (DB) Plans—to restate their plan documents. These restatements incorporate recent legislative and regulatory updates to ensure the plan operates in compliance with current laws.

For DB Plans, the current restatement period, known as Cycle 3, opened August 1, 2023 and will close on March 31, 2025. Plan sponsors must adopt the updated Cycle 3 document within this window.

What’s New in Cycle 3 Restatements for DB Plans?

Cycle 3 restatements incorporate a variety of regulatory and legislative updates enacted since the last restatement cycle. Some key updates include:

- SECURE Act

The Setting Every Community Up for Retirement Enhancement (SECURE) Act introduced provisions to expand access to retirement savings and increase flexibility. Employers must ensure their DB Plans reflect these changes, such as updated rules for required minimum distributions (RMDs). - Bipartisan Budget Act of 2018

This legislation introduced changes to hardship withdrawals and other plan operations that may need to be reflected in the updated document. - Other IRS Guidance

Recent IRS procedures and notices have clarified certain operational requirements for DB Plans, which should now be incorporated into the Cycle 3 restatements.

Why Are Restatements Important?

Plan restatements aren’t just a bureaucratic requirement—they’re essential for maintaining the tax-qualified status of your DB Plan. A failure to restate the plan document by the deadline can result in significant penalties, including the potential loss of tax benefits for both the employer and plan participants. Regular updates also help ensure the plan is operating as intended and providing the intended benefits.

If you have questions about Cycle 3 restatements or need assistance navigating the process, don’t hesitate to reach out to DRDA as your TPA . Compliance may seem complex, but with proper guidance, it’s entirely manageable!

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Pros and Cons of Emergency Accounts Inside a 401(k) Plan (SECURE 2.0)

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Under the SECURE 2.0 Act, a new feature allows employees to access emergency savings within their 401(k) plans. This is designed to provide workers with more flexibility to cover unexpected expenses without needing to resort to high-interest loans or credit cards. Here’s a breakdown of the potential benefits and drawbacks of incorporating emergency savings accounts inside a 401(k) plan:

Pros:

- Accessibility for Employees:

- Emergency Fund Access: Employees can set aside up to $2,500 in an emergency savings account within their 401(k). This provides a quick and easy way to access emergency funds without having to worry about depleting personal savings or taking on high-interest debt.

- Early Withdrawals without Penalty: If structured correctly, employees may withdraw emergency funds without incurring the 10% early withdrawal penalty (though income tax may still apply).

2. Tax-Advantaged Growth:

- Tax-Deferred Contributions: Contributions to the emergency savings account within the 401(k) plan grow tax-deferred. This can be an attractive option for employees, as the funds will accumulate without being subject to annual income taxes.

- Potential for Employer Contributions: Employers may be able to match emergency savings contributions, further boosting employees’ savings potential.

3. Encouragement of Savings:

- Automatic Payroll Deductions: Employees may be able to set up automatic contributions directly from their paychecks. This can help establish the habit of saving for unexpected expenses, even if it’s just a small amount each pay period.

- Financial Security: Access to emergency savings in a 401(k) plan gives employees peace of mind, knowing that they have a built-in safety net to deal with unforeseen financial burdens.

4. Enhanced Retirement Contributions:

- Employees may contribute to their emergency savings and retirement savings simultaneously, allowing for the long-term benefits of retirement planning while addressing short-term liquidity needs.

Cons:

- Limited Emergency Fund Access:

- Withdrawals Are Still Subject to Income Tax: While the penalty is waived, emergency fund withdrawals are still subject to income tax, which may reduce the amount of the funds employees actually receive.

- Limits on Withdrawals: Withdrawals from the emergency savings account are restricted to specific qualifying circumstances. Employees may not have the same flexibility as they would with a regular savings account, and not all emergencies may qualify.

2. Reduced Contributions to Retirement Fund:

- Emergency Savings Could Impact Retirement Contributions: If employees are putting funds into their emergency account within the 401(k), it may reduce their ability to maximize contributions to their retirement savings. This could impact long-term financial planning for retirement.

- Potential for Missed Investment Growth: While the funds in emergency savings are protected from market volatility, they may also miss out on the higher returns associated with more aggressive investments in the main portion of the 401(k) plan.

3. Complexity and Administration:

- Additional Administration for Employers: Employers will need to track both regular 401(k) contributions and emergency savings contributions. This adds another layer of complexity to plan administration and may require additional time and resources.

- Employee Confusion: Employees may be confused about how their emergency savings are structured within their 401(k) and how this fits into their overall retirement planning strategy. Clear communication and guidance from employers will be necessary to avoid confusion.

4. Potential for Overuse:

- Overreliance on Emergency Savings: Employees might be tempted to use emergency funds more frequently, draining the emergency savings account. This can reduce the funds available for true emergencies, potentially leaving employees without the necessary resources when they need them the most.

5. Impact on Future Withdrawals:

- Tax Implications: Since the emergency savings are inside the 401(k), any withdrawals from this account will still count toward the total 401(k) balance, potentially increasing the taxable amount when the employee retires or takes distributions.

Conclusion:

The inclusion of emergency savings accounts within a 401(k) plan under SECURE 2.0 offers significant benefits, particularly in providing employees with an accessible, tax-advantaged way to manage unexpected expenses. However, it also comes with challenges related to tax implications, withdrawal restrictions, and the potential for reduced retirement savings growth.

Employers and employees must carefully weigh the pros and cons, ensuring they balance short-term financial flexibility with long-term retirement planning goals. With proper structure and communication, emergency accounts within 401(k) plans can be an excellent tool for enhancing financial security and preparedness.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Year-End 401(k) Housekeeping: Set Your Retirement Savings Up for Success

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

2024 end year to Happy New Year 2025 with Doctor, heart shape and coins stack. Money for Healthcare cost, Money Saving, Health Insurance, Medical, Donation and Financial concept

As the year winds down, it’s a great time to take stock of your financial progress and prepare for the year ahead. Your 401(k) plan is one of the most powerful tools for building long-term wealth, so don’t overlook the opportunity to give it some year-end attention. A few simple housekeeping steps now can help ensure your retirement savings are on track and working as hard as you are.

Here are three essential tasks every 401(k) participant should complete before the new year:

- Increase Your Contribution Rate by At Least 1%

Small, consistent increases to your deferral rate can make a huge difference in your retirement savings over time. If your plan doesn’t have auto-escalation, it’s up to you to manually increase your contributions.

• Why It Matters: A 1% increase may seem small, but over time, compounded growth can turn modest contributions into significant savings.

• How to Do It: Log into your 401(k) account, find the contribution section, and raise your deferral rate. Even better, if you’ve received a raise or bonus, consider increasing your contributions by more than 1% to fully capture the benefits of your income growth.

Pro Tip: If your plan offers a match up to a certain percentage, make sure you’re contributing at that level to get the full match – it’s free money! - Set Up Auto Rebalance

Market fluctuations can throw your portfolio out of alignment with your intended investment strategy. Auto-rebalancing automatically adjusts your holdings to maintain your chosen asset allocation, ensuring your investments stay on track.

• Why It Matters: Over time, certain investments may outperform others, causing your portfolio to drift from your risk tolerance or retirement goals. Rebalancing helps reduce risk and maintain diversification.

• How to Do It: Most 401(k) plans allow you to enable auto-rebalancing online. You can typically choose the frequency (quarterly, semi-annually, or annually). Select a schedule that works for you and let the system handle the adjustments.

Pro Tip: Rebalancing doesn’t involve selling or withdrawing funds—it’s simply reallocating your existing investments. It assures that you are always selling high and buying low. - Update Your Beneficiary Information

Life changes, such as marriage, divorce, or the birth of a child, can impact who you want to inherit your 401(k) assets. Failing to update your beneficiary designations can lead to unintended outcomes.

• Why It Matters: Beneficiary designations override your will or trust, meaning the person listed on your 401(k) account will receive the funds, regardless of other legal documents.

• How to Do It: Log into your account, locate the beneficiary section, and ensure your information is up to date. If your marital status has changed this year, updating your beneficiary designation is especially important.

Pro Tip: Include a contingent (backup) beneficiary to ensure your wishes are honored even if the primary beneficiary is unavailable.

Bonus: Review Your Overall Retirement Strategy

While you’re tidying up your 401(k), take a moment to ensure your broader retirement plan aligns with your long-term goals:

• Check Your Savings Progress: Are you on track to meet your retirement savings goals? Consider increasing contributions if you’re behind.

• Review Investment Performance: Look at your portfolio’s performance and make sure your investments are still aligned with your risk tolerance and time horizon.

• Understand Plan Features: Take advantage of features like catch-up contributions (if you’re over 50) or Roth 401(k) options for tax diversification.

Start the New Year Financially Strong

A little year-end attention to your 401(k) plan can go a long way toward securing your financial future. By increasing your contributions, setting up auto-rebalance, and updating your beneficiary information, you’ll enter the new year with confidence and a well-tended retirement plan. Take 30 minutes today to complete these tasks—you’ll thank yourself later!

- Published in ROBS 401(k), ROBS 401k Provider

Starting a Business Later in Life

By James Barrera

Before moving forward put together a business plan. It’s not necessary to expend a lot of time on this document, as long as you can clearly state your intended strategy and clearly define the scope of your intended sales, marketing, and financing efforts.

Starting a business at any age can be a daunting experience, but doing so after age 50 offers its own challenges and opportunities. The risk factor is as high as it is for a business owner of any age. On the other hand, you have a depth of experience and knowledge that is not present in most budding 25-year entrepreneurs.

If you are considering a startup of some kind in your fifties or later be sure you can answer the following questions.

Are you prepared?

This is no time to jump into the marketplace just to see what happens. If you think you have a great business idea then test it against a thorough market analysis. You need to know who your potential competitors and customers are, but even more critically, if there’s likely to be a genuine demand for your product or service.

Before moving forward put together a business plan. It’s not necessary to expend a lot of time on this document, as long as you can clearly state your intended strategy and clearly define the scope of your intended sales, marketing, and financing efforts.

Do you have passion?

For business owners aged 50 and older, there is no getting around a simple fact: you’re just not as young as you used to be. Starting a business requires the stamina to put in many long hours upfront. Not everyone can meet the physical demands of hard work and lack of sleep. You must have passion for this new business. Making money cannot be your sole motivator – since you may not see profits in the early stages.

Have you looked at the costs?

You are going to need start up funds. Whether you put up your hard dollars, obtain a loan for financing, or tap into your retirement funds tax and penalty free you need to find an accountant experienced in new business ventures to realistically assess the likely startup costs. The plus side here is that by age 50 or greater many have managed to put away a substantial amount of money in their 401k/IRA accounts. DRDA’s self-directed 401k program – the BORSA Plan – would give you access to these funds without tax or penalty erosion.

How can you build on your experience?

Starting a business later in life gives you the unique opportunity to draw on a lifetime of experience. By now you have a much better sense of your strengths and weaknesses. Chances are you have also accumulated a network of contact who can help you along the way, either directly or through referrals to people who can help you.

Are you considering business ownership at age 50+? One of our Business Consultants would be happy to offer you a free initial consultation. Give us a call at 281-488-2022.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Guide to Dissolving a Corporation in Texas

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

For many business owners, there may come a time when operating a corporation no longer aligns with their financial or strategic objectives. Whether due to business restructuring, financial challenges, or other factors, following the correct dissolution procedures is essential to avoid legal and financial consequences. At DRDA, LLC, we can help you navigate the complex steps involved in dissolving your corporation.

What is Corporation Dissolution?

Corporation dissolution refers to the formal process of ending a corporation’s legal existence. Dissolution may occur voluntarily, through a decision by the shareholders or board of directors, or involuntarily, by court order in cases of fraud, mismanagement, or failure to comply with state requirements.

In Texas, the Texas Business Organizations Code (BOC) outlines the process for corporation dissolution and termination. By following these guidelines, corporations can avoid liabilities related to unresolved debts and ensure a structured wind-down of business activities.

Steps to Dissolve a Corporation in Texas

Dissolving a corporation in Texas involves several steps and compliance with state laws and regulations. Although specific steps may vary depending on your corporation’s unique circumstances, the general process includes the following:

- Initiate the Dissolution Process

Once you decide to close the corporation, hold a board of directors meeting to formally approve the decision. Two main options exist to begin voluntary dissolution:

– Board of Directors Resolution: Secure a resolution from the board of directors approving the dissolution, and document it in the corporate records.

– Unanimous Shareholder Approval: If required by corporate bylaws, gain unanimous approval from shareholders, either through a vote or written consent. For small businesses, shareholders often also serve as directors, making this step more straightforward. Document this approval in the corporate . - File Articles of Dissolution

Once approval is secured, prepare and file Articles of Dissolution with the Texas Secretary of State to officially notify the state of the corporation’s dissolution. Information required includes the corporation’s name, dissolution date, and a statement affirming that debts and obligations have been addressed. - Conduct the Wind-Up Process

After filing for dissolution, your corporation remains active solely to wrap up its business affairs. During this process, the corporation must:

• Cease business operations except for those necessary for final transactions

• Notify creditors

• Liquidate assets

• Settle outstanding legal matters

• Pay debts, taxes, and liabilities

• Distribute any remaining assets to shareholders - Obtain Tax Clearance

Before completing the dissolution, you must obtain tax clearance from the Texas Comptroller of Public Accounts. This includes paying any outstanding state taxes, filing all required tax returns, and securing a Tax Clearance Letter from the Comptroller’s office. - Notify Creditors

Provide written notice of the dissolution to all known creditors, allowing them a specified timeframe to submit claims against the corporation. - Cancel Business Registrations

Cancel any business registrations, licenses, or permits held by the corporation with state or local authorities to prevent future fees or reporting obligations. - File Final Tax Returns

Complete and file final federal and state tax returns, reporting the corporation’s termination and any capital gains or losses, to ensure compliance with tax obligations.

Following these steps can streamline the dissolution process and help prevent issues. If you’re ready to dissolve your corporation, reach out to the team at DRDA, LLC for expert guidance and support through each phase of the process.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business

IRS Updates: 2025 Contribution and Benefit Limits Released in Notice 2024-80

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

The IRS has announced the 2025 contribution and benefit limits in Notice 2024-80, released on November 1.

Key Contribution Limits for 2025:

- 401(k), 403(b), 457, and Thrift Savings Plans: The standard contribution limit for these plans increases to $23,500, up from $23,000 in 2024.

- Catch-Up Contributions for Ages 50 and Over: The catch-up contribution limit remains at $7,500, allowing individuals aged 50 and older to contribute up to $31,000 across 401(k), 403(b), most 457 plans, and the Thrift Savings Plan.

- Special Catch-Up Contributions for Ages 60 to 63: SECURE 2.0 introduced an additional catch-up provision for individuals ages 60 through 63. In 2025, this special catch-up amount is $11,250 for 401(k), 403(b), and most 457 plans, allowing for a total contribution limit of up to $34,750 for these participants.

- Defined Benefit and Contribution Plans (IRC Section 415): The annual benefit limit for defined benefit plans rises to $280,000 (up from $275,000), and the limit for defined contribution (DC) plans increases to $70,000 (up from $69,000).

Other Key Adjustments:

- Annual Compensation Limits: The maximum compensation considered for qualified plans is now $350,000 (up from $345,000).

- Top-Heavy Plan Key Employee Definition: Limit increased to $230,000 (up from $220,000).

- Highly Compensated Employee Definition: Raised to $160,000 from $155,000.

These 2025 updates, including special catch-up contributions for ages 60-63, provide increased flexibility and savings opportunities for retirement planning.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Are You Ready to Be the Boss?

By James Barrera

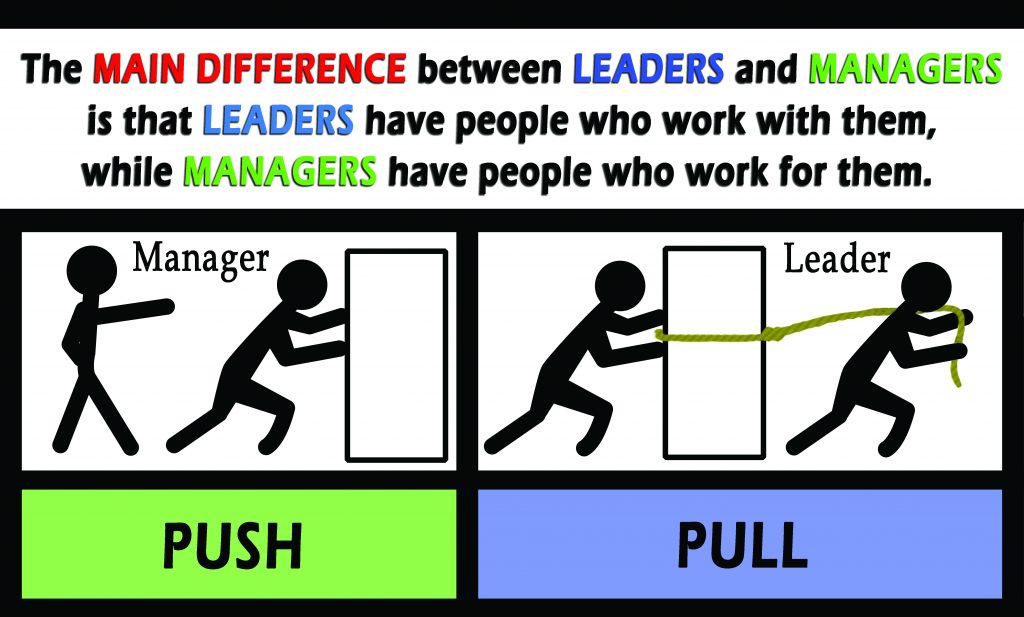

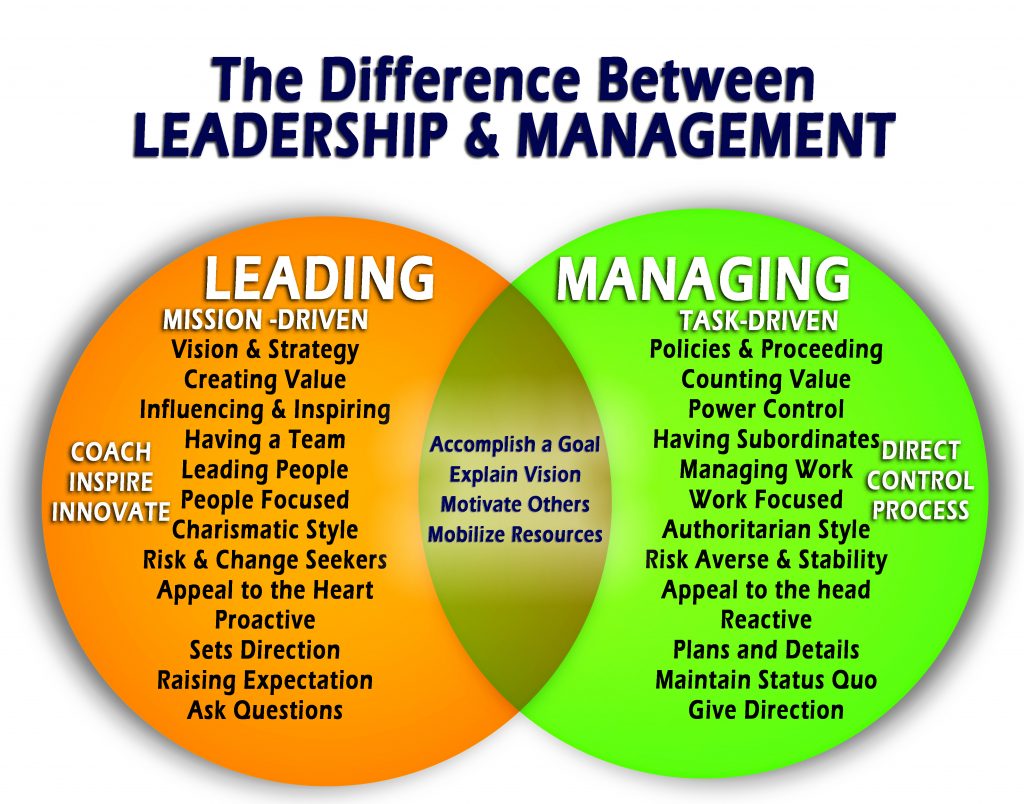

Which are you – Manager, Leader or Both?

In an ever-increasing competitive workplace, how we show up matters. If you want to get ahead, you must show up as a leader – not only a manager. The difference between leadership vs management is big, and the distinction between the two matters. Not every manager is a leader, and not every leader is a manager, the ability to balance both is a feat many of us aspire to achievement.

A successful business owner needs to be both a strong leader and manager to get their team on board to follow them towards their vision of success. Leadership is about getting people to understand and believe in your vision and to work with you to achieve your goals while managing is more about administering and making sure the day-to-day things are happening as they should.

What Is Management?

Managers make the business world go around. When goals and objectives are set, managers are the implementers. They get things done. Management requires planning, organizing and controlling the various aspects of projects and the related outcomes. Managers are process oriented. They rely on other people, primarily subordinates, to complete tasks and move projects along. Managers delegate set deadlines and evaluate work product. They also course-correct when needed.

What is Leadership?

Management is an essential skill required to perform effectively. It is also a foundational skill that can evolve into leadership. But leadership is a combination of personal qualities that inspire others to follow. A leader is not a power of authority, but a process of social influence which maximizes the efforts of others toward the achievement of a greater good.

What is true leadership? Many times, when you come across the word leader you see the word follower aligned in some way. Leadership is not about attracting others to follow. This conveys a sense of power, authority, and control that might serve well in the short term by getting others to fall into line through conformity, but it doesn’t create the conditions necessary for sustaining change.

Great leaders don’t tell people what to do, but instead drive them to where they need to be. There is no agenda to create a group of followers or disciples. True leaders know that their success is intimately tied to the project and its results. The path to achieve a goal is predicated on how effective the team responds and interacts with each other and the leader. It is a team approach where each person in the organization knows that he or she has an important role to play. Leadership is all about action not position or title.

Some of the best leaders never had a title. What they did have was the tenacity to act on a bold vision for change to improve outcomes and increase performance. These people may be overlooked because they don’t possess the necessary title that is used to describe a leader in a traditional sense. A Leader, from the perspective of society is not a virtue associated by a title, such as manager, director, supervisor, but more by character, presence and action.

The fact that we are surrounded by these people each day both physically and virtually. They are colleagues, mentors, and staff who have all acted to initiate meaningful change in their teams and work environment. These people don’t just talk the talk, but they walk the walk. They lead by example in what might be the most impactful way possible – Leading by Example. These true leaders do not expect others to do what they are not willing to do. The best part is that these unsung heroes do not need a title to make a difference. They also don’t need a title to be a force of change.

If you look on the internet you will find thousands of articles depicting traits and styles of what makes a good leader. For most of us we have identified what traits are important by evaluating our current supervisors and determining what differentiates them from being a good leader. In retrospect we tend to place ourselves in their shoes and begin envisioning how we would do things differently. Our impressions distinguish what attributes we place value on to determine what makes a good leader.

The best leaders work to improve themselves Continuously and do the following on a consistent basis:

Learn

Learning is the work. Great leaders take professional growth seriously as they know there is no perfection in any position, just daily improvement. Leaders make the time to learn and get better daily. They also make their learning visible to inspire others to follow suit. Leaders who love their work are always learning.

Empower

A key element of effective leadership is to empower others to take risks, remove the fear of failure, and grant autonomy to innovate. People that are empowered find greater value in the work they are engaged in. Empowerment leads to respect and trust, which builds powerful relationships where everyone is focused on attaining specified goals.

Adapt

Everything can change in a heartbeat. As such, leaders must embrace a sense of flexibility and openness to change accordingly in certain cases. The ability to adapt to an array of situations, challenges, and pressures are pivotal to accomplish goals. Success in life is intimately intertwined into an organism’s ability to adapt in order to survive. As leaders adapt, they evolve into better leaders.

Delegate

A leader knows the importance of communication and trust. The decisiveness to delegate certain tasks and responsibilities is paramount for team-esteem. It builds confidence in others in their ability as co-leaders of an organization even if they don’t have a fancy title. It also allows leaders to apply more focus to areas of greater importance.

Engage

In the sharing economy there might not be anything more important than information. Leaders understand this fact and develop strategies to authentically engage their clients through multi-dimensional communications, by taking control of public relations, and developing a positive brand presence. Increased engagement results by meeting prospects where they are at, encouraging two-way communications, and becoming the liaison of the brand.

Reflect

It is quite difficult to find a great leader who does not reflect daily on his or her work. Reflection in a digital world can take many forms and results in greater transparency. It is not how one chooses to reflect, but an emphasis to integrate this process consistently that defines a great leader.

Serve

It’s not just what you say, but more importantly what you do. The most effective leaders work constantly to meet the needs of others while building them up in the process. They make it clear that it is not about them. Serving others taps into one’s heart and soul. It is in the moment of service to others that true leaders rise up in esteem, prestige, and industry.

You are in Control

The perception of the term leader is evolving, and it begins with you regardless of your position. As an aspiring leader, setting high standards requires that you develop a strategic and compelling vision for who you want to be and what you want to achieve. It is that vision that will provide you with the drive and perseverance to attain your leadership goals. Herein lies the first key in transforming your world into a better place. Never underestimate the power that you have. You are part of the solution!

Are you interested in learning more about DRDA’s ROBS structure, the BORSA™ Plan? Contact Bryan Uecker by sending an email (bryan.uecker@drdacpa.com) today for a free consultation.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

BORSA and SECURE 2.0 Mandate for Automatic Enrollment

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Key Points:

• Effective for plan years starting after December 31, 2024.

• New 401(k) and 403(b) plans are required to have automatic enrollment.

• The automatic enrollment feature must comply with an eligible automatic enrollment arrangement (EACA).

• Participants must be enrolled automatically:

– Initially at a rate of a minimum of 3% (maximum 10%).

– Increased annually by 1%, reaching at least 10% (maximum 15%).

• Contributions must be invested in a qualified default investment alternative (QDIA).

Exempt Plans:

• SIMPLE 401(k) plans.

• Plans established before December 29, 2022 (date of document signing, not effective date).

• Governmental or church plans.

• Plans by businesses under 3 years old.

• Plans by employers with 10 or fewer employees.

Most BORSA™ plans adopted after December 29, 2022, will qualify for the exemptions based on the company’s age or size. However, consider the following scenarios with recent BORSA™ clients:

Scenario 1:

A couple establishes a new C-Corp and a BORSA™ to acquire two Home Health Care businesses with over 30 employees in 2023. The C-Corp 3-year exemption applies until 2026. Mandatory automatic enrollment begins on January 1, 2027.

Scenario 2:

DRDA takes over an existing ROBS plan in 2023, which lacks a 401(k) feature (a peculiarity of this competitor). The client adds a 401(k) with a safe harbor 3% non-elective contribution and converts the profit-sharing scheme to a cross-tested formula targeting key employees. Although the plan was established in 2015, adding the 401(k) triggers the requirement for automatic enrollment by January 1, 2025.

Scenario 3:

The owner of a 5-year-old business with 8 employees plans to set up a BORSA™ for capital infusion. The business expects to hire 3 or more employees within a year. According to the rule, automatic enrollment becomes mandatory “not earlier than the date that is one year after the close of the first taxable year with respect to which the employer normally employed more than 10 employees.” If this occurs in 2025, automatic enrollment starts on January 1, 2027.

Although many BORSA™ clients start exempt from mandatory EACA rules, growth and time may necessitate compliance in the future.

- Published in ROBS 401(k), ROBS 401k Provider