BORSA/ ROBS Exit Strategies

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

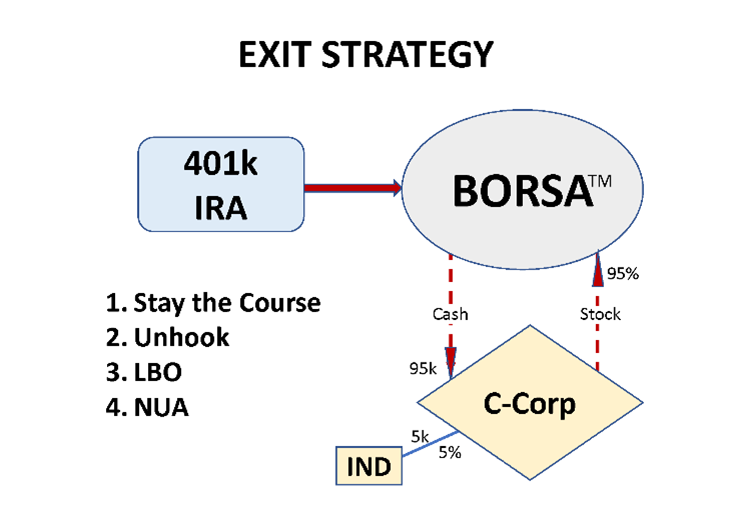

When you enter into any structure, it’s wise to know how to exit it as well. There are essentially four avenues for clients to exit the BORSA structure, each depending on where they aim for the value growth to accumulate.

First, there’s the “Stay the Course” approach, where business owners utilize their retirement savings accounts to invest in their enterprises. By funneling existing retirement funds into the business and reinvesting the accumulated value back into the retirement account, individuals expedite their wealth accumulation, often outstripping stock market investments. For those inclined towards this method, the exit strategy is clear: maintain the current trajectory and stay the course. Funds are introduced into the BORSA plan, invested in the C corporation, utilized to operate and expand the company, and upon selling the company, the proceeds are reinvested into the BORSA plan. Subsequently, the company can be liquidated, the retirement plan closed, and the funds rolled back into an IRA, effectively restoring the initial financial structure. At this point, individuals are poised to enjoy their retirement with a substantial deferred income nest egg.

Alternatively, some individuals view the BORSA as a mere launching pad, using their retirement funds for an initial capital infusion but aiming to replenish the money in their retirement accounts swiftly and grow the business’s value personally outside the plan. We refer to this strategy as the “Unhook“. This entails a nuanced approach—let’s say the company generates $100,000 in profit in the first year. After paying 21% corporate income tax, $79,000 of after-tax profits remain. These profits can be distributed as dividends, with the plan receiving 95% of the dividends and individual shareholders subject to individual taxation on the remaining 5%. Alternatively, employing the Unhook strategy, the $79,000 could be utilized to repurchase some of the company stock owned by the BORSA. When a company buys back shares from shareholders, it’s termed treasury stock, reducing the number of shares outstanding and enhancing the value per share of the remaining outstanding shares. Over time, this method allows the C Corporation to repurchase all stock from the retirement plan, effectively restoring their original retirement account balances and reclaiming complete ownership of the company individually. At this juncture, the option within the retirement plan can be to terminate it or transition into a standard 401(k) plan. The business no longer has the 401(k) as a shareholder and is no longer required to be a C Corporation. Converting to an S Corporation or other structure is now an option. This encompasses the Unhook strategy.

In cases where rapid company growth is anticipated, leveraging a buyout may prove advantageous. By borrowing from banks at the corporate level, funds can be used to repurchase stock from the retirement plan at current valuations. Subsequent profits can then be allocated towards repaying the bank, preserving the frozen stock value from the date of the transaction. This constitutes the third exit option: the Leveraged Buyout.

Finally, the fourth option involves utilizing the Net Unrealized Appreciation (NUA) Strategy. Typically, an entrepreneur who has engaged in the ROBS business financing strategy, built a successful and profitable enterprise, and now wishes to exit the strategy aims to defer or reduce taxation on their company shares. If the company stock is valued at more than what an entrepreneur wants to pay to buy it back, there are provisions in the Internal Revenue Code (IRS) permitting tax deferral and capital gains tax treatment when employing certain exit methods from a ROBS Plan. The primary method used is the Net Unrealized Appreciation (NUA) transaction.

When it comes to the NUA transaction, several conditions must be met. These include the ROBS participant being at least 59.5 years old, all other defined contribution accounts (sponsored by the employer) are also distributed, employer securities are distributed in-kind and in the same tax year, among others. Once these conditions are met, a ROBS participant exit can be initiated. The participant will owe only ordinary income tax in the year of distribution on the original rollover value of the shares, as of the date of the original ROBS transaction. Long-term capital gains tax will be due when the shares are ultimately sold.

In the end, the chosen strategy depends on whether individuals seek to maximize value growth within their retirement accounts, maintain a symbiotic relationship between business investment and retirement funds, or capitalize on rapid company expansion through strategic leveraging. Each approach offers distinct advantages tailored to varying financial objectives.

DRDA is the only ROBS/BORSA provider that is uniquely qualified to help navigate the right strategy for you. If you would like to discuss which option is best for you, please call Bryan Uecker at (281) 954-6004 or email bryan.uecker@drdacpa.com.

- Published in ROBS 401(k)

Using Your 401(k) or IRA to Start a Real Estate Business: A Quick Guide

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Thinking about using your retirement savings to enter the real estate market? Here’s a concise guide on how to leverage your 401(k) or IRA for a real estate operating or property management company.

Why Real Estate?

Real estate is a compelling investment due to its potential for passive income and long-term appreciation. It also provides financial benefits like diversification and tax advantages, including depreciation and deductions.

Can You Use Retirement Funds for Real Estate?

Direct investment in real estate through a traditional 401(k) is not permitted. While self-directed IRAs allow real estate investments, they come with complexities and fees. Direct withdrawals from retirement accounts incur taxes and penalties, reducing your investment capital.

Enter the BORSA: A Tax-Advantaged Solution

BORSA (Business Owners Retirement Savings Account) also called ROBS: (Rollovers for Business Startups) offer a way to use retirement funds without taxes or penalties. Here’s how the BORSA works:

- Start a C Corporation: BORSA requires a C Corp to issue Qualified Employer Securities (QES).

- Start a 401(k): The new C Corp adopts a 401(k) plan.

- Roll Over Funds: Move your retirement funds into the new C Corporation’s 401(k) plan.

- Invest in Real Estate: Use the funds to purchase stock in the C Corp, which then finances your real estate business.

What You Can Start with BORSA

Real Estate Operating Companies (REOCs): Manage and invest in commercial or residential properties.

Property Management Companies: Handle property maintenance and tenant relations for other property owners.

Pros and Cons

Pros:

Diverse Investment: Real estate offers potential for high returns and diversification.

Debt-Free Funding: Avoids debt service and loan complexities.

Cons:

Market Risks: Real estate is affected by local market conditions and economic cycles.

Liquidity Risk: Selling properties can be time-consuming and challenging.

Next Steps

If you’re interested in using BORSA for real estate, consider consulting with a specialist. DRDA can assist with setting up your BORSA, ensuring compliance, and guiding you every step of the way.

- Published in ROBS 401(k)