BORSA and SECURE 2.0 Mandate for Automatic Enrollment

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Key Points:

• Effective for plan years starting after December 31, 2024.

• New 401(k) and 403(b) plans are required to have automatic enrollment.

• The automatic enrollment feature must comply with an eligible automatic enrollment arrangement (EACA).

• Participants must be enrolled automatically:

– Initially at a rate of a minimum of 3% (maximum 10%).

– Increased annually by 1%, reaching at least 10% (maximum 15%).

• Contributions must be invested in a qualified default investment alternative (QDIA).

Exempt Plans:

• SIMPLE 401(k) plans.

• Plans established before December 29, 2022 (date of document signing, not effective date).

• Governmental or church plans.

• Plans by businesses under 3 years old.

• Plans by employers with 10 or fewer employees.

Most BORSA™ plans adopted after December 29, 2022, will qualify for the exemptions based on the company’s age or size. However, consider the following scenarios with recent BORSA™ clients:

Scenario 1:

A couple establishes a new C-Corp and a BORSA™ to acquire two Home Health Care businesses with over 30 employees in 2023. The C-Corp 3-year exemption applies until 2026. Mandatory automatic enrollment begins on January 1, 2027.

Scenario 2:

DRDA takes over an existing ROBS plan in 2023, which lacks a 401(k) feature (a peculiarity of this competitor). The client adds a 401(k) with a safe harbor 3% non-elective contribution and converts the profit-sharing scheme to a cross-tested formula targeting key employees. Although the plan was established in 2015, adding the 401(k) triggers the requirement for automatic enrollment by January 1, 2025.

Scenario 3:

The owner of a 5-year-old business with 8 employees plans to set up a BORSA™ for capital infusion. The business expects to hire 3 or more employees within a year. According to the rule, automatic enrollment becomes mandatory “not earlier than the date that is one year after the close of the first taxable year with respect to which the employer normally employed more than 10 employees.” If this occurs in 2025, automatic enrollment starts on January 1, 2027.

Although many BORSA™ clients start exempt from mandatory EACA rules, growth and time may necessitate compliance in the future.

- Published in ROBS 401(k), ROBS 401k Provider

Maximizing Retirement Potential: Exploring SECURE 2.0 Roth Match and Non-Elective Contributions

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

The retirement landscape is evolving with the introduction of the SECURE Act 2.0, bringing forth pivotal changes in retirement savings options. Among these enhancements are the broadened horizons of Roth contributions and the introduction of Roth Match and Non-Elective Contributions. In this article, we’ll delve into these progressive strides, elucidating how they can empower individuals to forge a more resilient financial future.

Understanding SECURE 2.0 Roth Match and Non-Elective Contributions:

In addition to the conventional practice of designating salary deferrals as Roth contributions, participants will soon wield the ability to label any employer contribution – whether match or non-elective profit sharing – as Roth. Despite this adjustment, employers will still claim a deduction for the employer contribution. At year-end, participants will receive a 1099R delineating the contribution as a taxable Roth conversion.

Benefits of SECURE 2.0 Roth Contributions:

1. Tax-Free Growth: Roth contributions offer the invaluable benefit of tax-free growth, enabling investment earnings within Roth accounts to accumulate tax-free over time. This translates into considerable tax savings during retirement, as withdrawals from Roth accounts typically remain tax-free.

2. Diversification of Retirement Income: Integrating Roth contributions into retirement savings furnishes individuals with enhanced flexibility in crafting retirement income strategies. By striking a balance between traditional and Roth accounts, retirees can adeptly manage their tax obligations and optimize their retirement income streams.

3. Exemption from RMD Rules: Roth IRA and Roth 401(k) accounts are exempt from the Required Minimum Distribution (RMD) rules, making them an ideal vehicle for wealth transfer to heirs.

Despite the promising prospects, a few obstacles must be addressed before plans can seamlessly adopt this provision. Payroll and recordkeeping systems are currently racing to develop the capabilities to accommodate these new Roth sources, and employers will need to amend their plan documents accordingly.

Conclusion:

SECURE 2.0 Roth Match and Non-Elective Contributions herald a significant leap forward in retirement savings options, offering individuals heightened flexibility, tax efficiency, and savings potential. By embracing these innovative features, both employers and employees can take proactive strides toward fortifying their financial futures. With meticulous planning, informed decision-making, and strategic implementation, SECURE 2.0 Roth contributions can chart the course for a more prosperous retirement journey.

- Published in ROBS 401(k)

BORSA/ ROBS Exit Strategies

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

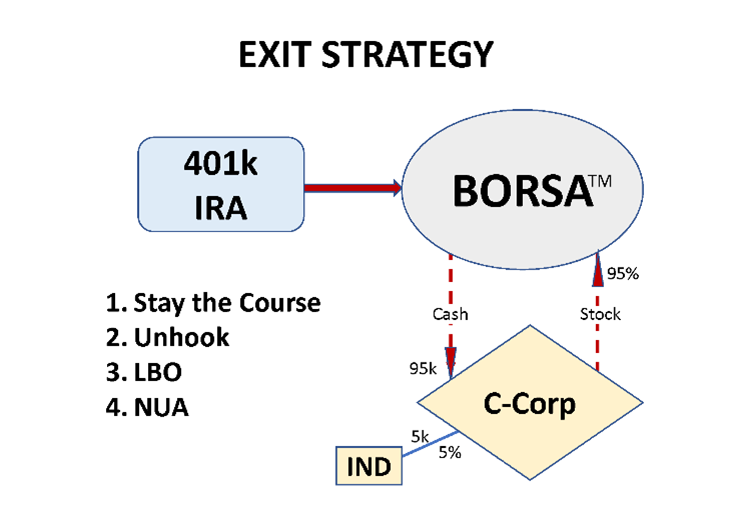

When you enter into any structure, it’s wise to know how to exit it as well. There are essentially four avenues for clients to exit the BORSA structure, each depending on where they aim for the value growth to accumulate.

First, there’s the “Stay the Course” approach, where business owners utilize their retirement savings accounts to invest in their enterprises. By funneling existing retirement funds into the business and reinvesting the accumulated value back into the retirement account, individuals expedite their wealth accumulation, often outstripping stock market investments. For those inclined towards this method, the exit strategy is clear: maintain the current trajectory and stay the course. Funds are introduced into the BORSA plan, invested in the C corporation, utilized to operate and expand the company, and upon selling the company, the proceeds are reinvested into the BORSA plan. Subsequently, the company can be liquidated, the retirement plan closed, and the funds rolled back into an IRA, effectively restoring the initial financial structure. At this point, individuals are poised to enjoy their retirement with a substantial deferred income nest egg.

Alternatively, some individuals view the BORSA as a mere launching pad, using their retirement funds for an initial capital infusion but aiming to replenish the money in their retirement accounts swiftly and grow the business’s value personally outside the plan. We refer to this strategy as the “Unhook“. This entails a nuanced approach—let’s say the company generates $100,000 in profit in the first year. After paying 21% corporate income tax, $79,000 of after-tax profits remain. These profits can be distributed as dividends, with the plan receiving 95% of the dividends and individual shareholders subject to individual taxation on the remaining 5%. Alternatively, employing the Unhook strategy, the $79,000 could be utilized to repurchase some of the company stock owned by the BORSA. When a company buys back shares from shareholders, it’s termed treasury stock, reducing the number of shares outstanding and enhancing the value per share of the remaining outstanding shares. Over time, this method allows the C Corporation to repurchase all stock from the retirement plan, effectively restoring their original retirement account balances and reclaiming complete ownership of the company individually. At this juncture, the option within the retirement plan can be to terminate it or transition into a standard 401(k) plan. The business no longer has the 401(k) as a shareholder and is no longer required to be a C Corporation. Converting to an S Corporation or other structure is now an option. This encompasses the Unhook strategy.

In cases where rapid company growth is anticipated, leveraging a buyout may prove advantageous. By borrowing from banks at the corporate level, funds can be used to repurchase stock from the retirement plan at current valuations. Subsequent profits can then be allocated towards repaying the bank, preserving the frozen stock value from the date of the transaction. This constitutes the third exit option: the Leveraged Buyout.

Finally, the fourth option involves utilizing the Net Unrealized Appreciation (NUA) Strategy. Typically, an entrepreneur who has engaged in the ROBS business financing strategy, built a successful and profitable enterprise, and now wishes to exit the strategy aims to defer or reduce taxation on their company shares. If the company stock is valued at more than what an entrepreneur wants to pay to buy it back, there are provisions in the Internal Revenue Code (IRS) permitting tax deferral and capital gains tax treatment when employing certain exit methods from a ROBS Plan. The primary method used is the Net Unrealized Appreciation (NUA) transaction.

When it comes to the NUA transaction, several conditions must be met. These include the ROBS participant being at least 59.5 years old, all other defined contribution accounts (sponsored by the employer) are also distributed, employer securities are distributed in-kind and in the same tax year, among others. Once these conditions are met, a ROBS participant exit can be initiated. The participant will owe only ordinary income tax in the year of distribution on the original rollover value of the shares, as of the date of the original ROBS transaction. Long-term capital gains tax will be due when the shares are ultimately sold.

In the end, the chosen strategy depends on whether individuals seek to maximize value growth within their retirement accounts, maintain a symbiotic relationship between business investment and retirement funds, or capitalize on rapid company expansion through strategic leveraging. Each approach offers distinct advantages tailored to varying financial objectives.

DRDA is the only ROBS/BORSA provider that is uniquely qualified to help navigate the right strategy for you. If you would like to discuss which option is best for you, please call Bryan Uecker at (281) 954-6004 or email bryan.uecker@drdacpa.com.

- Published in ROBS 401(k)

Using Your 401(k) or IRA to Start a Real Estate Business: A Quick Guide

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Thinking about using your retirement savings to enter the real estate market? Here’s a concise guide on how to leverage your 401(k) or IRA for a real estate operating or property management company.

Why Real Estate?

Real estate is a compelling investment due to its potential for passive income and long-term appreciation. It also provides financial benefits like diversification and tax advantages, including depreciation and deductions.

Can You Use Retirement Funds for Real Estate?

Direct investment in real estate through a traditional 401(k) is not permitted. While self-directed IRAs allow real estate investments, they come with complexities and fees. Direct withdrawals from retirement accounts incur taxes and penalties, reducing your investment capital.

Enter the BORSA: A Tax-Advantaged Solution

BORSA (Business Owners Retirement Savings Account) also called ROBS: (Rollovers for Business Startups) offer a way to use retirement funds without taxes or penalties. Here’s how the BORSA works:

- Start a C Corporation: BORSA requires a C Corp to issue Qualified Employer Securities (QES).

- Start a 401(k): The new C Corp adopts a 401(k) plan.

- Roll Over Funds: Move your retirement funds into the new C Corporation’s 401(k) plan.

- Invest in Real Estate: Use the funds to purchase stock in the C Corp, which then finances your real estate business.

What You Can Start with BORSA

Real Estate Operating Companies (REOCs): Manage and invest in commercial or residential properties.

Property Management Companies: Handle property maintenance and tenant relations for other property owners.

Pros and Cons

Pros:

Diverse Investment: Real estate offers potential for high returns and diversification.

Debt-Free Funding: Avoids debt service and loan complexities.

Cons:

Market Risks: Real estate is affected by local market conditions and economic cycles.

Liquidity Risk: Selling properties can be time-consuming and challenging.

Next Steps

If you’re interested in using BORSA for real estate, consider consulting with a specialist. DRDA can assist with setting up your BORSA, ensuring compliance, and guiding you every step of the way.

- Published in ROBS 401(k)

Understanding the Differences Between DOL and IRS Requirements for Qualified Retirement Plans

By: Bryan Uecker

Navigating the regulatory landscape of qualified retirement plans can be complex for plan sponsors and administrators. The Department of Labor (DOL) and the Internal Revenue Service (IRS) play pivotal roles in overseeing these plans, but they have distinct requirements and regulations. Understanding the differences between the two can help plan sponsors ensure compliance and effectively manage their retirement plans.

DOL Requirements:

The DOL primarily focuses on enforcing the Employee Retirement Income Security Act (ERISA), which sets standards for the operation and administration of retirement plans. Some key DOL requirements for qualified plans include:

1. Reporting and Disclosure: The DOL mandates that plan sponsors provide participants with various disclosures, such as the Summary Plan Description (SPD) and Summary of Material Modifications (SMM). These documents inform participants about their rights, benefits, and obligations under the plan.

2. Fiduciary Responsibilities: Plan fiduciaries have a duty to act prudently and solely in the interest of plan participants and beneficiaries. The DOL oversees fiduciary conduct, ensuring that fiduciaries fulfill their obligations and avoid conflicts of interest.

3. Vesting and Participation: The DOL sets rules regarding vesting schedules and eligibility criteria for plan participation. These regulations aim to protect participants’ rights to their accrued benefits and ensure equitable access to retirement savings opportunities.

IRS Requirements:

While the DOL focuses on ERISA compliance, the IRS administers the tax laws related to qualified retirement plans. Key IRS requirements for these plans include:

1. Plan Qualification: To receive favorable tax treatment, retirement plans must meet specific qualification requirements outlined in the Internal Revenue Code (IRC). These requirements cover various aspects of plan design, such as contribution limits, distribution rules, and nondiscrimination testing.

2. Plan Documentation: The IRS requires plan sponsors to maintain up-to-date plan documents that reflect the terms and conditions of the retirement plan. These documents must comply with IRS regulations and be available for review by plan participants and government agencies.

3. Tax Reporting: Plan sponsors are responsible for filing annual tax returns and informational forms with the IRS, reporting contributions, distributions, and other plan-related activities. Compliance with IRS reporting requirements ensures that the plan maintains its tax-qualified status.

Comparison:

While both the DOL and IRS regulate qualified retirement plans, they have distinct areas of focus and enforcement authority. The DOL emphasizes participant protection, fiduciary oversight, and transparency through disclosure requirements. In contrast, the IRS focuses on tax qualification, plan documentation, and compliance with tax laws to maintain the plan’s favorable tax status.

Conclusion:

Understanding the differences between DOL and IRS requirements is essential for plan sponsors and administrators tasked with managing qualified retirement plans. By adhering to both sets of regulations, sponsors can ensure compliance, protect participants’ interests, and maintain the tax-qualified status of their plans. Staying informed about evolving regulations from both agencies is key to successfully navigating the complex landscape of retirement plan administration.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business

Selling Your BORSA Business

By: Bryan Uecker

When a seller has a BORSA™ (Business Owners Retirement Savings Account), also known as ROBS, and is considering selling their business, the decision between an asset sale and a stock sale involves additional considerations due to the BORSA/ROBS structure. Here’s a comparison of the two approaches in this context:

Asset Sale

1. Definition: In an asset sale, the buyer acquires specific assets and liabilities of the business rather than the entity itself. This includes tangible assets (like equipment and inventory) and intangible assets (like trademarks and customer lists).

2. Tax Implications: For the Seller: The business entity may face double taxation. First, the entity is taxed on the gain from the sale of assets at the corporate tax rate. Then, any remaining sale proceeds are distributed to shareholders according to their ownership percentage and taxed accordingly. For the Buyer: The buyer benefits from a step-up in the basis of the acquired assets, which allows for depreciation or amortization based on the purchase price, potentially reducing future tax liabilities.

3. Complexity: Asset sales require detailed purchase price allocation among various assets and involve complex tax considerations.

4. Liability: The buyer assumes only the liabilities specifically agreed upon in the sale. This reduces the risk of inheriting unknown or contingent liabilities.

5. BORSA/ROBS Considerations: The C-Corp will have to estimate its federal and state tax bill, pay the estimated taxes, pay its final expenses, dissolve, and lastly, any remaining cash gets distributed to the stockholders according to ownership percentage. So, if the 401(k) owns 95% of the company, 95% will go to the 401 (k). The double taxation kicks in when the seller eventually takes retirement distributions taxed as ordinary income. The 5% going to the individual is taxed using capital gains rates.

Stock Sale

1. Definition: In a stock sale, the buyer acquires the company’s shares, gaining ownership of the entire entity, including all its assets and liabilities.

2. Tax Implications: Selling stock can be advantageous for the seller. 95% goes to the 401(k) plan with no tax due until the seller takes retirement distributions. The personal stock portion will be taxed using capital gains treatment, potentially resulting in a lower tax rate on the proceeds. For the Buyer, the buyer assumes the company’s existing tax basis in its assets and takes on all of the business’s liabilities, which may include unknown or contingent liabilities.

3. Complexity: Stock sales tend to be less complex from a transactional standpoint than asset sales, as the focus is on transferring ownership rather than valuing and transferring individual assets.

4. Liability: The buyer inherits all the company’s liabilities, known or unknown, which can be a significant risk factor.

5. BORSA/ROBS Considerations: If the seller’s BORSA plan holds stock in the company, the plan will sell its shares for cash as part of the stock sale. The account can then be rolled into an IRA or other retirement plan vehicle and won’t be taxed until withdrawn. The portion owned outside the plan will be taxed using capital gains rates.

Conclusion

The BORSA™/ROBS structure affects both asset and stock sales of a business. The choice between the two will depend on various factors, including tax considerations, liability issues, licensing issues, and the specific goals of both the seller and the buyer. DRDA is uniquely positioned to help you navigate these complex transactions and ensure compliance with tax, Department of Labor, banking and regulatory requirements so you keep more of what you have earned from growing your business.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business

Comparing Self-Directed IRAs vs. BORSA/ROBS

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

Self-directed IRAs and BORSA/ROBS (Rollovers for Business Start-ups) offer distinct approaches to investing in businesses:

Business Involvement

BORSA/ROBS: Requires active participation in business operations, including receiving a salary if deemed reasonable. Structured through a C corporation, which is the sponsor of the retirement plan.

Self-directed IRAs: Passive investment vehicles where IRA owners cannot engage in business management or take salaries. Doing so could violate IRS rules on prohibited transactions.

Tax Considerations

BORSA/ROBS: Subject to regular corporate taxes; UBIT (Unrelated Business Income Tax) does not apply since the C corporation is taxable.

Self-directed IRAs: Income from business activities may trigger UBIT if unrelated to the IRA’s tax-exempt purpose.

Loan Guarantees

BORSA/ROBS: Allows funds to be used as a down payment for business loans, including SBA loans.

Self-directed IRAs: Cannot guarantee loans, maintaining separation between IRA assets and personal liabilities.

Ownership Flexibility

BORSA/ROBS: Enables up to 100% ownership of the business, providing full control.

Self-directed IRAs: Direct ownership risks violating IRA rules if exceeding certain ownership thresholds, jeopardizing tax benefits.

Conclusion: Self-directed IRAs are ideal for passive investors seeking hands-off involvement, while ROBS empowers owners with direct control and tax advantages through a C corporation setup.

- Published in ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business