Harnessing the Advantages of the ROBS / BORSA Structure.

PART I: C-CORP

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

ROBS (Rollover as Business Start-up) or BORSA™ (Business Owners Retirement Savings Account) structures are exclusively compatible with C-Corps. This is because only C-Corps permit a 401(k) profit-sharing plan to serve as a shareholder. Upon discovering this exception, some prospective clients may feel disappointed, as the C-Corp often carries a stigma of “double taxation”. Historically viewed as “the entity choice of last resort” due to potential for double taxation resulting from corporate-level taxes and subsequent taxation upon distribution or liquidation. The good news is that C corporations present unique tax advantages that S corporations and partnerships cannot replicate.

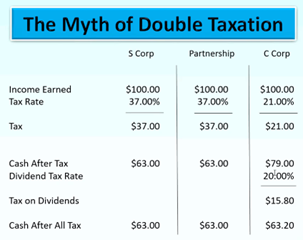

To debunk the stigma of “double taxation” right up front, a helpful chart compares the corporate tax and dividend tax to profits through a pass-through entity at a personal tax rate of 37%:

So the issue is not how many times you are taxed……but rather how much tax you pay.

Now that we have cleared up the myth, here are ten benefits of a C-Corp:

1. Lowering Overall Tax Burden: C Corps can achieve significant tax savings thanks to a single flat corporate tax rate of 21%. By proactively managing dividends and salaries, business owners can optimize their tax burden, generally resulting in lower overall taxes than pass-through entities.

2. Flexible Fiscal Year: C Corps can choose their fiscal year, unlike LLCs and S Corps. This allows for better timing of income recognition and expense deductions, enabling shareholders to further minimize their tax burden.

3. Retaining Earnings for Growth: C Corps can reinvest profits within the company at a lower tax cost. Unlike S Corps, where profits are passed through to shareholders and taxed regardless of distribution, C Corps can retain earnings to fuel future expansion without immediate tax consequences.

4. Deducting Salaries and Bonuses: Shareholders of C Corps can receive salaries and bonuses, which are deductible expenses for the corporation. Businesses can optimize tax efficiency and mitigate double taxation concerns by structuring compensation packages appropriately.

5. Tax Write-offs for Fringe Benefits: C Corps can deduct 100% of medical premiums and other fringe benefits provided to employees. This includes health, long-term care, and retirement plan contributions, offering substantial tax savings opportunities for the corporation and its employees.

6. Charitable Contributions Deduction: C Corps can deduct charitable donations as business expenses, subject to certain limitations. This benefits worthy causes and provides tax advantages for the corporation, with the option to carry over excess contributions to future tax years.

7. Gaines: C Corps are taxed at a flat 21% on short-term and long-term gains so you no long have to carry economic risk to get to a lower tax bracket. You sell you capital asset when it is best for you. C Corps can carry forward capital and operating losses indefinitely to offset future profits. This flexibility allows businesses to smooth out tax liabilities over time, particularly during growth or economic downturns.

8. Fewer Ownership Restrictions: Unlike S Corps, which have strict ownership rules, C Corps can have unlimited shareholders, issue multiple classes of stock and be owned by anyone or anything. This flexibility facilitates equity financing and business expansion without the constraints imposed by S Corp regulations.

9. Favorable Treatment for Passive Investors: Passive investors in C Corps benefit from the inability to pass losses through to individual tax returns. Unlike S Corps, where active participation is required to claim losses, passive investors can still enjoy tax advantages without direct involvement in management.

10. Unique Financing Opportunities: Registering as a C Corp opens doors to diverse financing options, including public offerings and innovative strategies like 401(k) business financing, such as ROBS or BORSA™ plans. These financing avenues give businesses access to capital while minimizing debt obligations, offering a valuable alternative to traditional lending sources.

With over four decades of experience, DRDA, LLC has focused on supporting entrepreneurs in initiating, expanding, and selling their businesses. Leveraging our proficiency in accounting, business consulting, and retirement plan design, we harness the advantages of the ROBS/BORSA™ structure to benefit our clients throughout the operation of their business and at their succession transition or exit of their business, not just at formation.

By: Bryan Uecker, QPA, QPFC, AIF, AIFA

- Published in Business Lending, ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business