Discovering Financial Excellence: Why DRDA’s Tailored Solutions Stand Out

By: Eva Jiang, M.B.A., M.S.

Looking for financial services that exceed expectations? Look no further than DRDA. Our comprehensive range of services encompasses tax planning and compliance, audit, accounting, bookkeeping, QuickBooks, 401(k) plan, Third Party Administration, BORSA® implementation, Operation and Exit, Profit and Cash Flow Optimization (P+CFO®), and Business Value Acceleration.

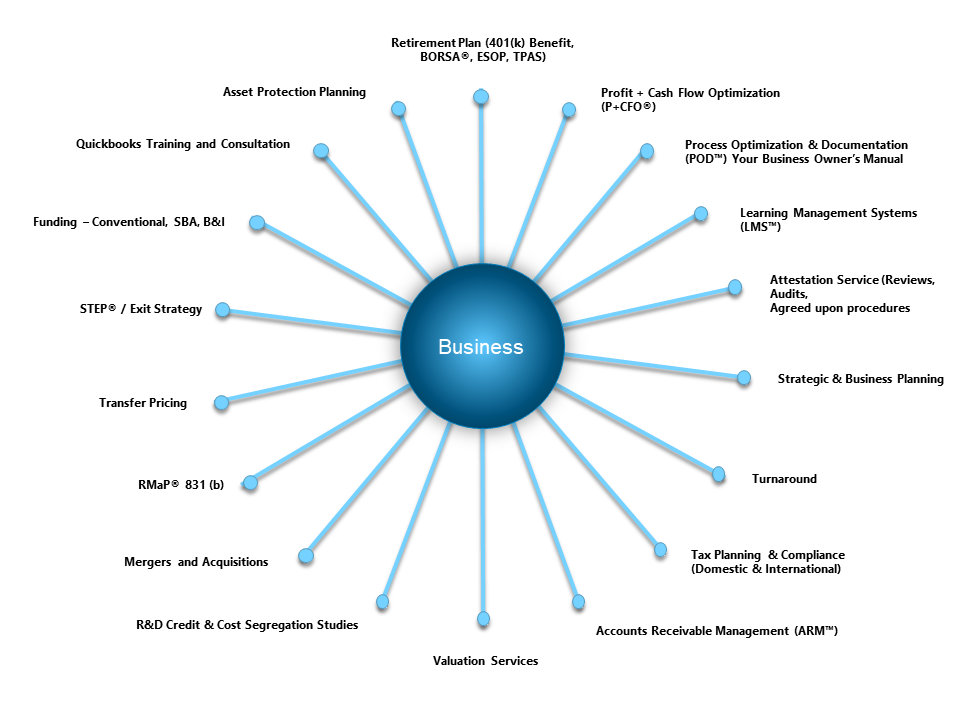

DRDA Wheel of Services

Because of our commitment to professionalism and uniqueness, we offer several trademarked services, including RMaP, BORSA, STEP, P+CFO, ARM, POD and LMS. At DRDA, we pride ourselves on our ability to make a difference in our clients lives. These trademarked services represent our dedication to providing cutting-edge solutions that are tailored to the needs of each client.

When you choose DRDA, you’re not just getting cookie-cutter solutions. Our team understands that every business is unique, which is why we take the time to truly understand your individual needs. We believe in open communication and collaboration across departments, ensuring that your experience with us is seamless and efficient.

Our tax services cover everything from planning and compliance to resolution, helping you navigate complex tax laws to minimize liabilities and maximize savings.

Our accounting services are tailored to your specific needs, providing accurate and reliable financial reporting. From auditing, assurance and financial statement preparation to budgeting and forecasting, our team helps you understand and trust your business information systems.

Our bookkeeping services ensure that your financial records are organized and up-to-date, allowing you to focus on what you do best – running your business. And if you use QuickBooks, our consultants can optimize your software usage, from setup and customization to training and ongoing support.

In addition to traditional services, our business advisory team offers strategic guidance to drive growth and profitability. Whether you need help with TPAS (Third-Party Administrative Services), retirement plan, BORSA® implementation (ROBS), business planning, performance analysis, or risk management, we’ve got you covered.

At DRDA, we don’t believe in a one-size-fits-all approach. DRDA Business Solutions are tailor-made for your business, saving you time and money while ensuring maximum efficiency and effectiveness.

Of the more than 46,000 CPA firms in the United States, DRDA has been recognized as one of the Top 500 CPA Firms in the United states by Inside Public Accounting, DRDA is ready to serve you. Visit our website at www.drdacpa.com to learn more about how we can help you and your business succeed and thrive.

By: Eva Jiang, M.B.A., M.S.

- Published in P+CFO™, ROBS 401(k), ROBS 401k Provider, Small Business, Starting a Business, Tax